Your First time home buyer loans missouri bad credit images are available. First time home buyer loans missouri bad credit are a topic that is being searched for and liked by netizens today. You can Download the First time home buyer loans missouri bad credit files here. Get all royalty-free photos.

If you’re looking for first time home buyer loans missouri bad credit pictures information linked to the first time home buyer loans missouri bad credit interest, you have come to the right site. Our site frequently gives you hints for downloading the maximum quality video and image content, please kindly surf and find more informative video content and graphics that fit your interests.

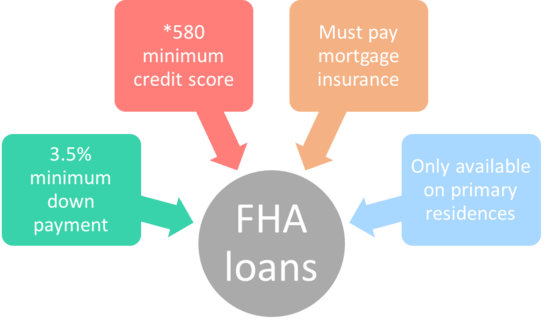

First Time Home Buyer Loans Missouri Bad Credit. Getting an fha loan in missouri in 2020 usually requires a credit score of 580 or higher, proof of employment for two years, and total monthly debts that are less than or equal to 43 percent of your total income. Some of these loan options are but not limited to: (if you have 680 or better, you might get even better pricing.) A “bad” credit score falls somewhere between 300 and 579 on the fico credit scoring scale.

Tips For First-time Home Buyers What You Must Know Before You Buy From thetruthaboutmortgage.com

Tips For First-time Home Buyers What You Must Know Before You Buy From thetruthaboutmortgage.com

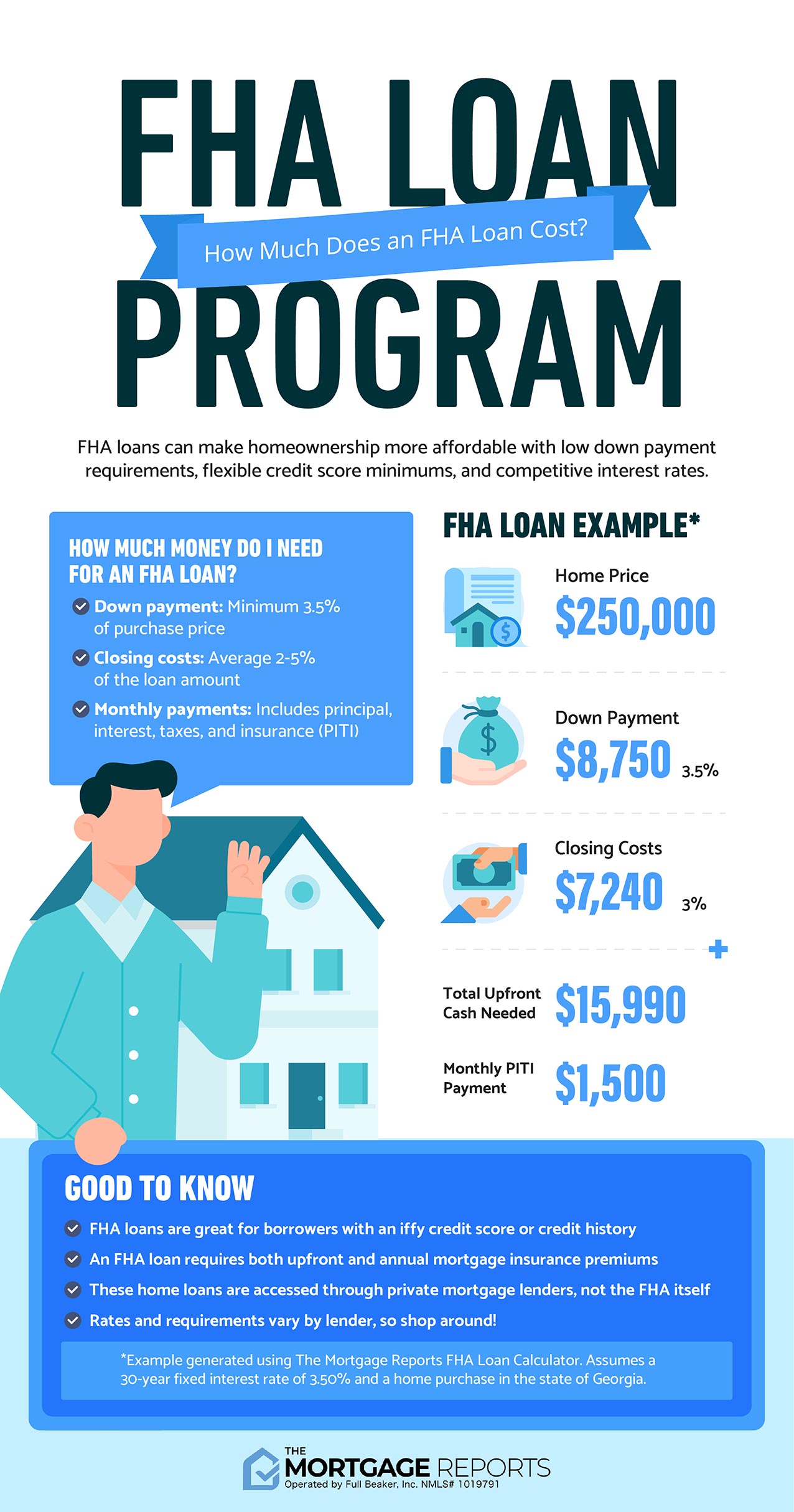

Charles county to find the perfect home, quickly and painlessly as possible. First time home buyer programs in st. To apply, please contact a certified lender or start the process now online. First, low down payment requirements of only 3.5% of the purchase price. Home loans for bad credit. Usda also charges an upfront funding fee of 1% of the loan amount.

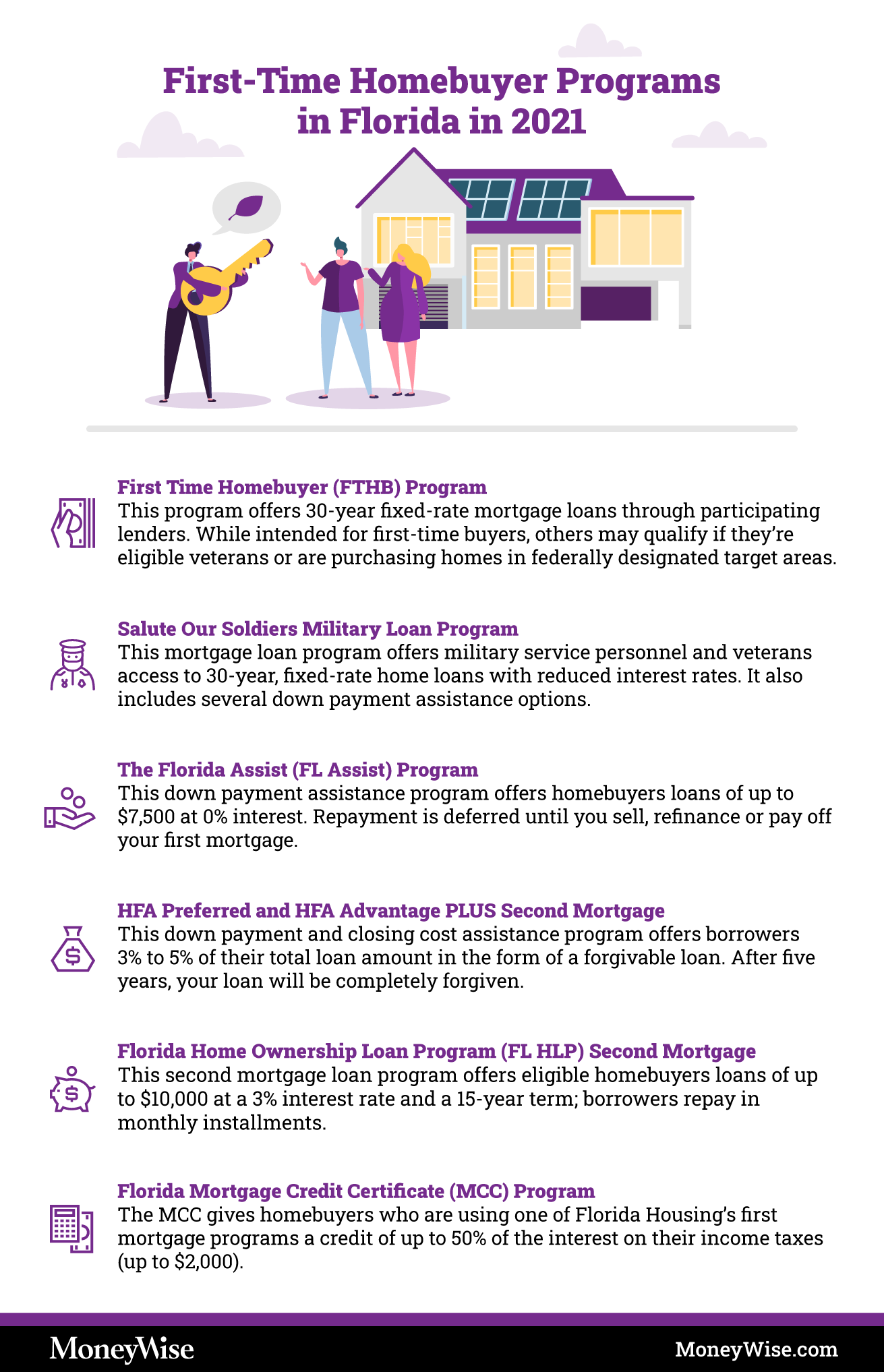

The state offers three main programs with options that provide multiple avenues of assistance to buyers.

You may view the primary fha loan requirements for missouri below. Yes, the federal housing administration still allows first time home buyers with poor credit scores as low as 500 to get approved. The federal housing administration offers home loans to first time home buyers with bad credit, no credit and yes good credit. Mdhc loans, home possible, fannie mae home ready and city of columbia grant money. Many times people sell a home giving them their down payment, but of course that would not be true for a first time home buyer. First time home loans for poor credit:

Source: nerdwallet.com

Source: nerdwallet.com

Charles county & throughout missouri. Find out more about gift funds allowed with down payments with first time home buying loans insured by the fha First time home buyer programs in st. First time home buyer programs. Fast approvals and quick funding.

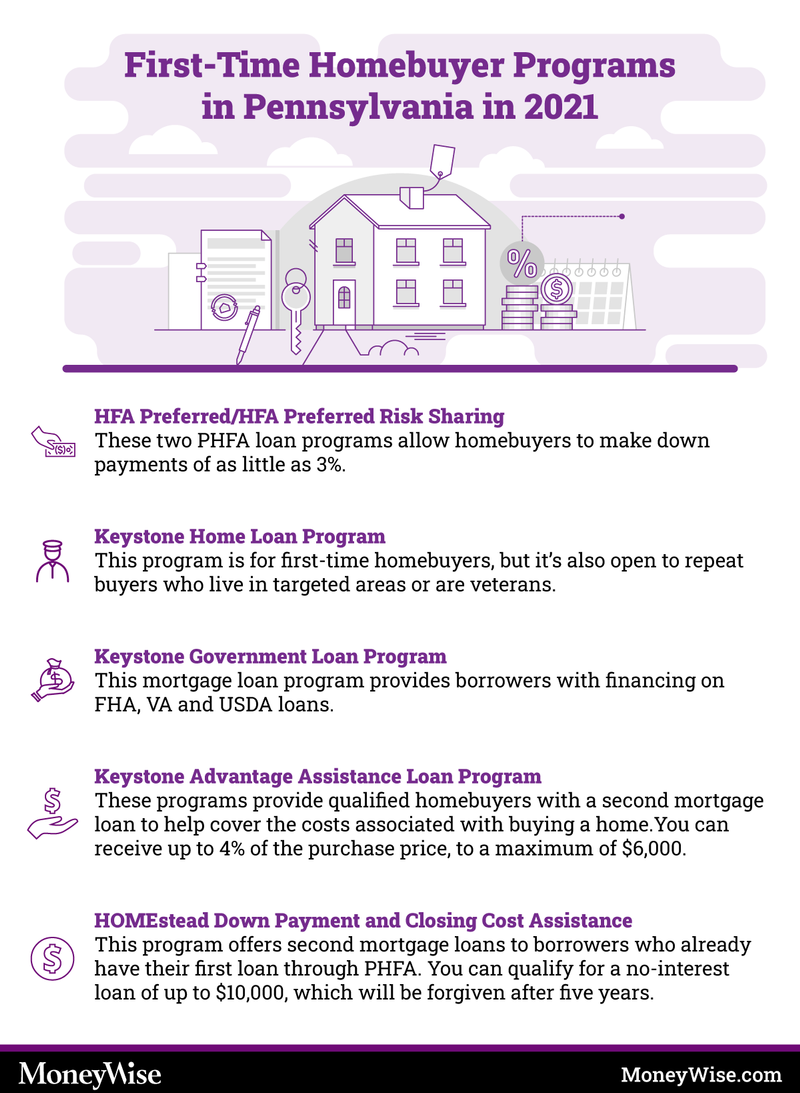

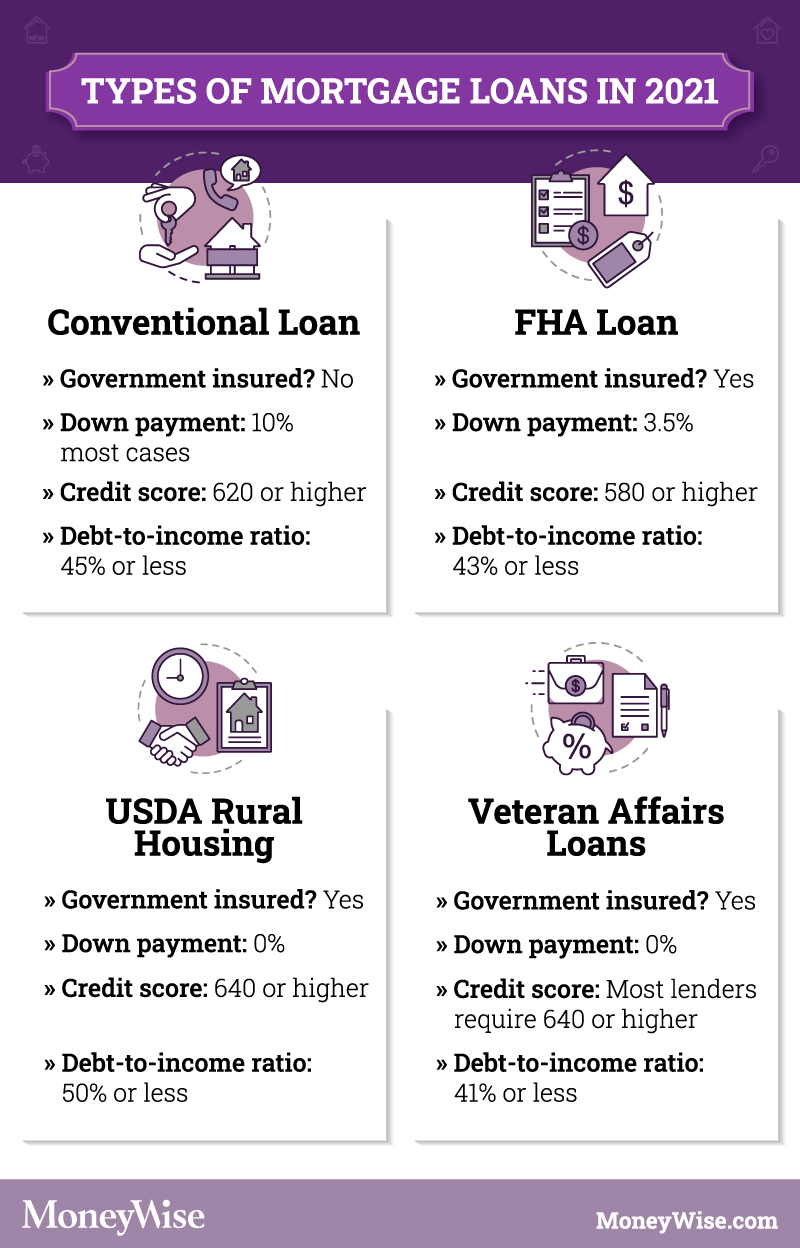

Source: moneywise.com

Source: moneywise.com

Income cannot exceed 100% of the area median income (ami). Many times people sell a home giving them their down payment, but of course that would not be true for a first time home buyer. Usda also charges an upfront funding fee of 1% of the loan amount. First time home loans for poor credit: First time buyer programs available.

Source: pinterest.com

Source: pinterest.com

Charles county to find the perfect home, quickly and painlessly as possible. However, lenders can set their own requirements, and if you do your research you may find. First time home loans for poor credit: First time home buyer programs. Usda charges an annual service fee of.35% of the total loan amount, which is paid monthly.

Source: pinterest.com

Source: pinterest.com

Usda charges an annual service fee of.35% of the total loan amount, which is paid monthly. First time home loans for poor credit: Home loans for bad credit. A “bad” credit score falls somewhere between 300 and 579 on the fico credit scoring scale. Since 2001, the helpful folks at hometown equity mortgage have guided friends and neighbors in st.

Source: id.pinterest.com

Source: id.pinterest.com

Many times people sell a home giving them their down payment, but of course that would not be true for a first time home buyer. Getting an fha loan in missouri in 2020 usually requires a credit score of 580 or higher, proof of employment for two years, and total monthly debts that are less than or equal to 43 percent of your total income. Second, fha loans, called the bad credit home loan for years, allows for lower credit scores than do conventional loan programs. Each individual fha approved lender may have some of their own loan requirements in addition to these. First time home buyer programs.

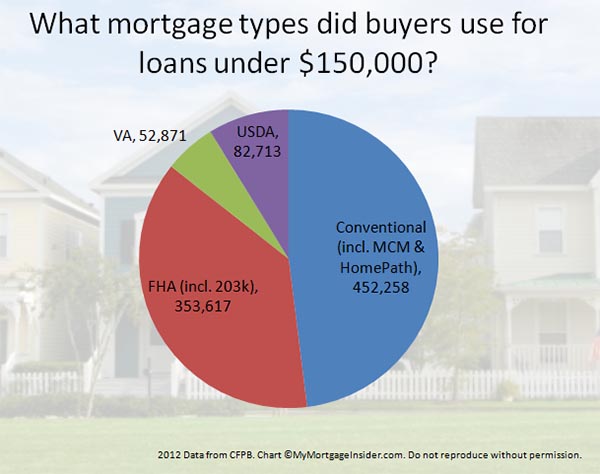

Source: mymortgageinsider.com

Source: mymortgageinsider.com

Rated 4.8 /5 based on 28 reviews. Income cannot exceed 100% of the area median income (ami). Mdhc loans, home possible, fannie mae home ready and city of columbia grant money. Usa mortgage goes above and beyond to bring as many as of first time home buyer loans and programs to its clients and referral partners. Folks with limited cash for down payment, and a credit score of 620 or up.

Source: pinterest.com

Source: pinterest.com

Types of first place loans. Some of these loan options are but not limited to: However, lenders can set their own requirements, and if you do your research you may find. Fast approvals and quick funding. To apply, please contact a certified lender or start the process now online.

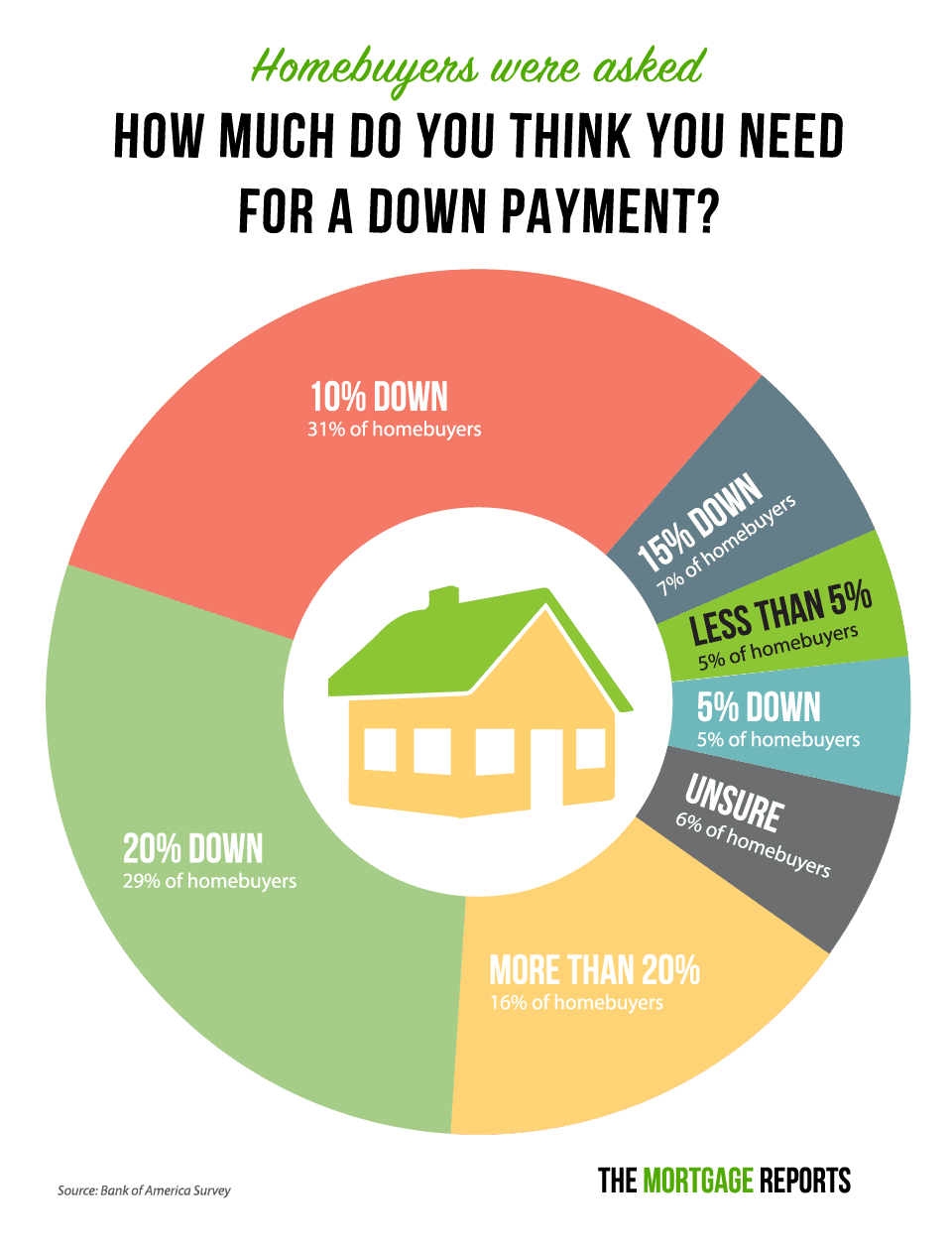

Source: themortgagereports.com

Source: themortgagereports.com

A “bad” credit score falls somewhere between 300 and 579 on the fico credit scoring scale. Your credit score is just one of the many factors that mortgage lenders scrutinize when determining whether you’re eligible for. Mdhc loans, home possible, fannie mae home ready and city of columbia grant money. Folks with limited cash for down payment, and a credit score of 620 or up. However, we work with a few lenders that will.

Source: moneywise.com

Source: moneywise.com

Fha rates near 50 year low! Charles county & throughout missouri. 2021 missouri fha loan requirements. Since 2001, the helpful folks at hometown equity mortgage have guided friends and neighbors in st. First time home buyer programs.

Source: mymortgageinsider.com

Source: mymortgageinsider.com

Speak with a real estate representative regarding. Getting an fha loan in missouri in 2020 usually requires a credit score of 580 or higher, proof of employment for two years, and total monthly debts that are less than or equal to 43 percent of your total income. New house buying applicants must be able to show the underwriter compensating factors for them to justify making a loan to a first time home buyer with a checkered history. Mdhc loans, home possible, fannie mae home ready and city of columbia grant money. Each individual fha approved lender may have some of their own loan requirements in addition to these.

Source: ar.pinterest.com

Source: ar.pinterest.com

Some of these loan options are but not limited to: Usa mortgage goes above and beyond to bring as many as of first time home buyer loans and programs to its clients and referral partners. Mdhc loans, home possible, fannie mae home ready and city of columbia grant money. You may view the primary fha loan requirements for missouri below. To apply, please contact a certified lender or start the process now online.

Source: fr.pinterest.com

Source: fr.pinterest.com

A “bad” credit score falls somewhere between 300 and 579 on the fico credit scoring scale. Borrowers need just a 3% down payment. Yes, the federal housing administration still allows first time home buyers with poor credit scores as low as 500 to get approved. Qualified veterans include any veterans who have served on active duty, though they must apply for financing within 25 years of the date they left active duty. However, the loans are administered and facilitated by private lenders that the mhdc certifies.

Source: pinterest.com

Source: pinterest.com

Since 2001, the helpful folks at hometown equity mortgage have guided friends and neighbors in st. Borrowers need just a 3% down payment. Speak with a real estate representative regarding. Fha rates near 50 year low! Find out more about gift funds allowed with down payments with first time home buying loans insured by the fha

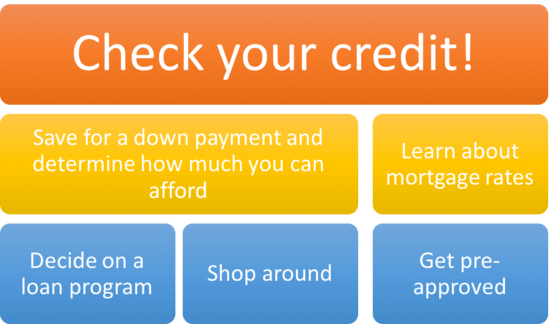

Source: thetruthaboutmortgage.com

Source: thetruthaboutmortgage.com

Yes, the federal housing administration still allows first time home buyers with poor credit scores as low as 500 to get approved. To apply, please contact a certified lender or start the process now online. Charles county & throughout missouri. Fast approvals and quick funding. Usda charges an annual service fee of.35% of the total loan amount, which is paid monthly.

Source: thetruthaboutmortgage.com

Source: thetruthaboutmortgage.com

Fha rates near 50 year low! A buyer with a roommate, boarder, or other supplemental rental income; Types of first place loans. New house buying applicants must be able to show the underwriter compensating factors for them to justify making a loan to a first time home buyer with a checkered history. They come with lower interest rates, but the biggest benefit is a low down payment requirement.

Source: fhalenders.com

Source: fhalenders.com

Here are tips you can use for taking out home equity loans, despite your fair or poor credit rating: Usda also charges an upfront funding fee of 1% of the loan amount. Usa mortgage has received a lot of recognition for being a great choice for. Income cannot exceed 100% of the area median income (ami). 2021 missouri fha loan requirements.

Source: moneywise.com

Source: moneywise.com

Usda home loans can be used for the purchase of a primary residence. Usda home loans can be used for the purchase of a primary residence. First time home buyer programs. Requirements for an fha loan in missouri. Folks with limited cash for down payment, and a credit score of 620 or up.

Source: themortgagereports.com

Source: themortgagereports.com

However, we work with a few lenders that will. New house buying applicants must be able to show the underwriter compensating factors for them to justify making a loan to a first time home buyer with a checkered history. Borrowers need just a 3% down payment. First, low down payment requirements of only 3.5% of the purchase price. However, lenders can set their own requirements, and if you do your research you may find.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title first time home buyer loans missouri bad credit by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.