Your First time home buyer missouri bad credit images are ready. First time home buyer missouri bad credit are a topic that is being searched for and liked by netizens now. You can Download the First time home buyer missouri bad credit files here. Find and Download all free photos and vectors.

If you’re looking for first time home buyer missouri bad credit images information related to the first time home buyer missouri bad credit topic, you have come to the ideal site. Our site always provides you with hints for viewing the maximum quality video and image content, please kindly search and locate more informative video articles and images that match your interests.

First Time Home Buyer Missouri Bad Credit. Your credit score is just one of the many factors that mortgage lenders scrutinize when determining whether you’re eligible for a home loan. Specifically, you may still be eligible if your closing took place on or before september 30, 2010. First time home loans for poor credit: Now you can get introduced to lenders that.

Credit Scores By State Credit Repair Services Credit Repair Credit Score From pinterest.com

Credit Scores By State Credit Repair Services Credit Repair Credit Score From pinterest.com

Fha rates near 50 year low! Many times people sell a home giving them their down payment, but of course that would not be true for a first time home buyer. First time home loans for poor credit: Your credit score is just one of the many factors that mortgage lenders scrutinize when determining whether you’re eligible for a home loan. In some cases, there are credit score requirements and income and purchase price limits. Ad no secured deposit required.

First, low down payment requirements of only 3.5% of the purchase price.

First, low down payment requirements of only 3.5% of the purchase price. If you have any kind of credit issues whatsoever and want to buy a home, credit karma can be a godsend. Low down payment is a big plus. Qualified veterans include any veterans who have served on active duty, though they must apply for financing within 25 years of. Ad no secured deposit required. Now you can get introduced to lenders that.

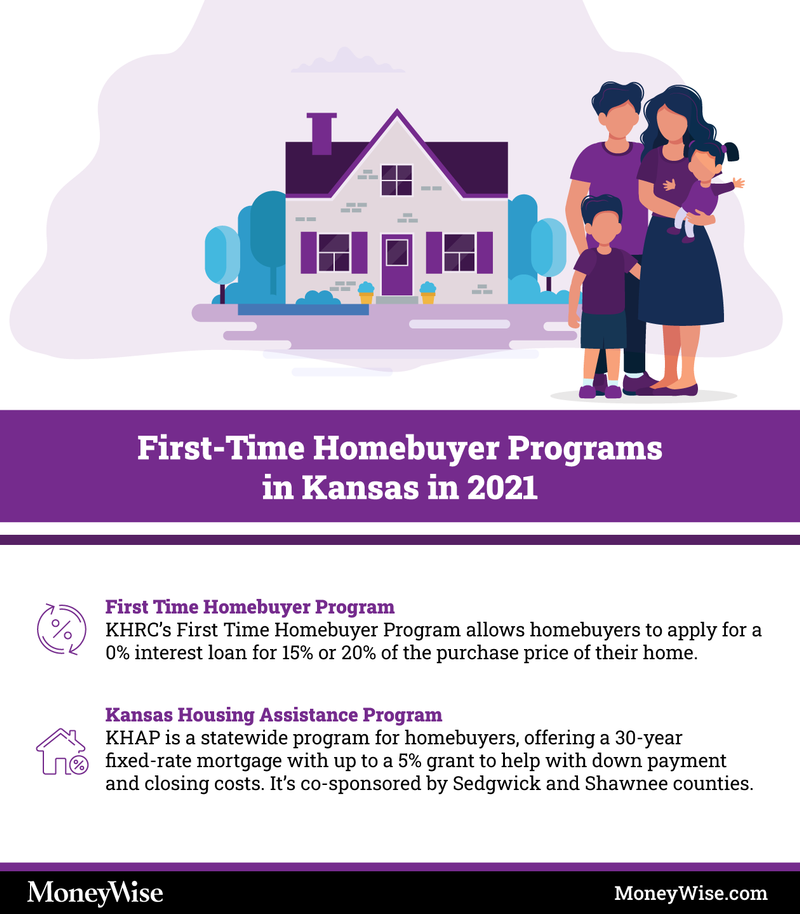

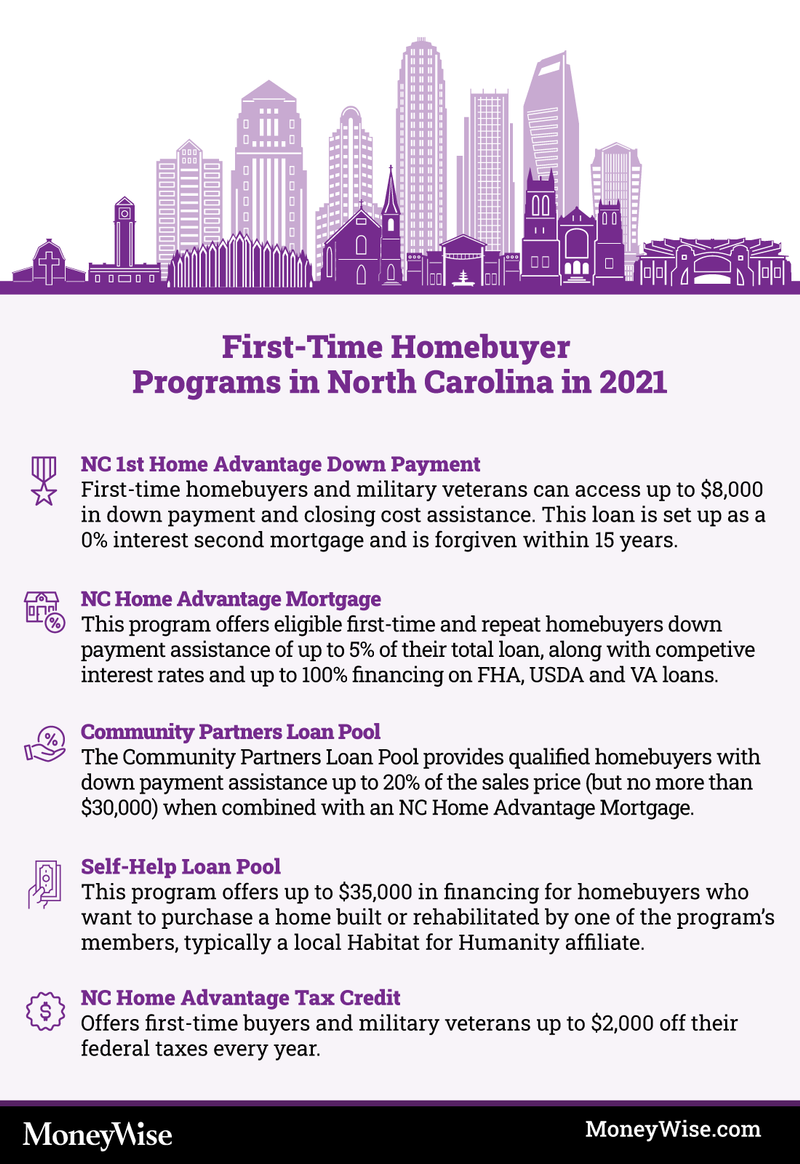

Source: moneywise.com

Source: moneywise.com

Yes, the federal housing administration still allows first time home buyers with poor credit scores as low as 500 to get approved. However, people who purchased homes before 2010 can still benefit from the tax credit initiative. Qualified veterans include any veterans who have served on active duty, though they must apply for financing within 25 years of. In some cases, there are credit score requirements and income and purchase price limits. Low down payment is a big plus.

Source: pinterest.com

Source: pinterest.com

In some cases, there are credit score requirements and income and purchase price limits. Second, fha loans, called the bad credit home loan for years, allows for lower credit scores than do conventional loan programs. Complimentary mastercard identity theft resolution services for new accounts Your credit score is just one of the many factors that mortgage lenders scrutinize when determining whether you’re eligible for a home loan. However, people who purchased homes before 2010 can still benefit from the tax credit initiative.

Source: pinterest.com

Source: pinterest.com

A “bad” credit score falls somewhere between 300 and 579 on the fico credit scoring scale. The program ended in 2010. New house buying applicants must be able to show the underwriter compensating factors for them to justify making a loan to a first time home buyer with a checkered history. Complimentary mastercard identity theft resolution services for new accounts Yes, the federal housing administration still allows first time home buyers with poor credit scores as low as 500 to get approved.

Source: id.pinterest.com

Source: id.pinterest.com

Another incredibly useful financial tool when buying a home for the first time is credit karma. We may approve when others won�t. Borrowers need just a 3% down payment. Complimentary mastercard identity theft resolution services for new accounts However, people who purchased homes before 2010 can still benefit from the tax credit initiative.

Source: forbes.com

Source: forbes.com

Low down payment is a big plus. However, people who purchased homes before 2010 can still benefit from the tax credit initiative. We may approve when others won�t. First time home loans for poor credit: Ad no secured deposit required.

Source: moneywise.com

Source: moneywise.com

Yes, the federal housing administration still allows first time home buyers with poor credit scores as low as 500 to get approved. Second, fha loans, called the bad credit home loan for years, allows for lower credit scores than do conventional loan programs. Many times people sell a home giving them their down payment, but of course that would not be true for a first time home buyer. Ad no secured deposit required. Borrowers need just a 3% down payment.

Source: pinterest.com

Source: pinterest.com

Second, fha loans, called the bad credit home loan for years, allows for lower credit scores than do conventional loan programs. Specifically, you may still be eligible if your closing took place on or before september 30, 2010. The program ended in 2010. Qualified veterans include any veterans who have served on active duty, though they must apply for financing within 25 years of. Ad no secured deposit required.

Source: pinterest.com

Source: pinterest.com

Your credit score is just one of the many factors that mortgage lenders scrutinize when determining whether you’re eligible for a home loan. Low down payment is a big plus. Another incredibly useful financial tool when buying a home for the first time is credit karma. Second, fha loans, called the bad credit home loan for years, allows for lower credit scores than do conventional loan programs. Specifically, you may still be eligible if your closing took place on or before september 30, 2010.

Source: homebuyer.com

Source: homebuyer.com

Low down payment is a big plus. Ad no secured deposit required. Now you can get introduced to lenders that. In some cases, there are credit score requirements and income and purchase price limits. Your credit score is just one of the many factors that mortgage lenders scrutinize when determining whether you’re eligible for a home loan.

Source: pinterest.com

Source: pinterest.com

However, people who purchased homes before 2010 can still benefit from the tax credit initiative. Now you can get introduced to lenders that. Second, fha loans, called the bad credit home loan for years, allows for lower credit scores than do conventional loan programs. New house buying applicants must be able to show the underwriter compensating factors for them to justify making a loan to a first time home buyer with a checkered history. The program ended in 2010.

Source: fha.com

Source: fha.com

Another incredibly useful financial tool when buying a home for the first time is credit karma. Each lender may have additional guidelines and requirements. For over a decade, we have managed a network of lenders and banks that offer unique opportunities for people with good and bad credit. Fha rates near 50 year low! Borrowers need just a 3% down payment.

Source: thetexasmortgagepros.com

Source: thetexasmortgagepros.com

However, people who purchased homes before 2010 can still benefit from the tax credit initiative. Another incredibly useful financial tool when buying a home for the first time is credit karma. We may approve when others won�t. Income cannot exceed 100% of the area median income (ami). Low down payment is a big plus.

Source: moneywise.com

Source: moneywise.com

Many times people sell a home giving them their down payment, but of course that would not be true for a first time home buyer. We may approve when others won�t. Borrowers need just a 3% down payment. First, low down payment requirements of only 3.5% of the purchase price. Many times people sell a home giving them their down payment, but of course that would not be true for a first time home buyer.

Source: cz.pinterest.com

Source: cz.pinterest.com

Complimentary mastercard identity theft resolution services for new accounts Low down payment is a big plus. However, people who purchased homes before 2010 can still benefit from the tax credit initiative. Borrowers need just a 3% down payment. The program ended in 2010.

Source: pinterest.com

Source: pinterest.com

First time home loans for poor credit: Borrowers need just a 3% down payment. Yes, the federal housing administration still allows first time home buyers with poor credit scores as low as 500 to get approved. Specifically, you may still be eligible if your closing took place on or before september 30, 2010. Your credit score is just one of the many factors that mortgage lenders scrutinize when determining whether you’re eligible for a home loan.

Source: pinterest.com

Source: pinterest.com

Yes, the federal housing administration still allows first time home buyers with poor credit scores as low as 500 to get approved. Complimentary mastercard identity theft resolution services for new accounts Yes, the federal housing administration still allows first time home buyers with poor credit scores as low as 500 to get approved. If you have any kind of credit issues whatsoever and want to buy a home, credit karma can be a godsend. The program ended in 2010.

Source: in.pinterest.com

Source: in.pinterest.com

If you have any kind of credit issues whatsoever and want to buy a home, credit karma can be a godsend. For over a decade, we have managed a network of lenders and banks that offer unique opportunities for people with good and bad credit. Low down payment is a big plus. Another incredibly useful financial tool when buying a home for the first time is credit karma. Yes, the federal housing administration still allows first time home buyers with poor credit scores as low as 500 to get approved.

Source: pinterest.com

Source: pinterest.com

Another incredibly useful financial tool when buying a home for the first time is credit karma. A “bad” credit score falls somewhere between 300 and 579 on the fico credit scoring scale. However, people who purchased homes before 2010 can still benefit from the tax credit initiative. Low down payment is a big plus. New house buying applicants must be able to show the underwriter compensating factors for them to justify making a loan to a first time home buyer with a checkered history.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title first time home buyer missouri bad credit by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.