Your First time home buyer loan qualifications missouri images are ready. First time home buyer loan qualifications missouri are a topic that is being searched for and liked by netizens now. You can Download the First time home buyer loan qualifications missouri files here. Download all free photos.

If you’re searching for first time home buyer loan qualifications missouri images information related to the first time home buyer loan qualifications missouri topic, you have come to the right site. Our website frequently provides you with suggestions for seeking the maximum quality video and picture content, please kindly search and locate more enlightening video content and graphics that fit your interests.

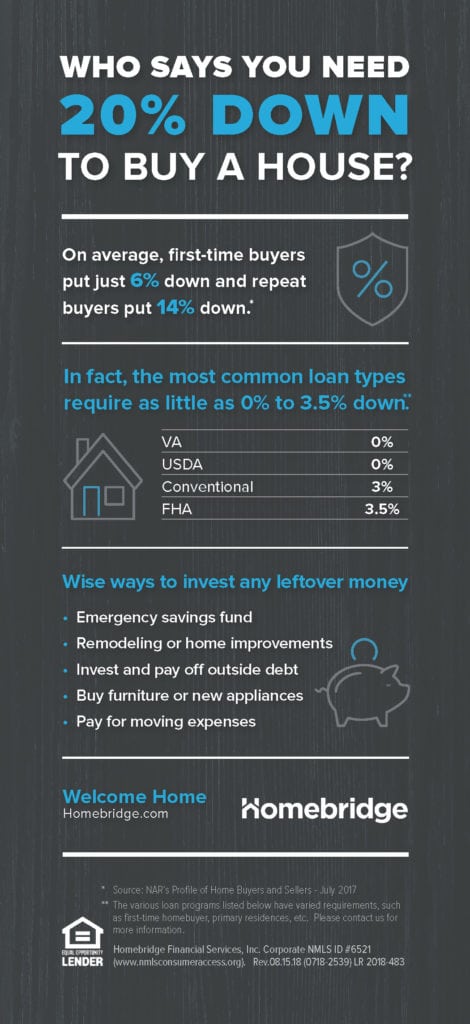

First Time Home Buyer Loan Qualifications Missouri. Each lender may have additional guidelines and requirements. One of the biggest concerns we get from our new first time home buyers is about down payment. The fha program makes buying a home easier and less expensive than any other types of real estate mortgage home loan programs. Preapprovals are subject to change or cancellation if a requested loan no longer meets applicable regulatory requirements.

Minimum Credit Scores For Fha Loans From fha.com

Minimum Credit Scores For Fha Loans From fha.com

Their annual household income must not exceed 80% of the area median income (limits shown below) and buyers must provide a minimum of $500 from their own funds toward the purchase. Buy a home in missouri with help from a family member First time home buyer down payment. Some of these loan options are but not limited to: Exceptions to this rule are “displaced homemakers” and “single parents. Missouri residents we have two programs to help you buy your home!

One of the biggest concerns we get from our new first time home buyers is about down payment.

Usa mortgage goes above and beyond to bring as many as of first time home buyer loans and programs to its clients and referral partners. Do not have to be a first time home buyer. Many people who can afford the monthly mortgage payments and have reasonable credit will qualify. You can claim the credit every year for the life of the loan so long as the home remains your primary residence. Buyers must have qualifying income, meet at least 600 credit score and occupy as primary residence. Total lending concepts offers first time home buyer programs to help you afford your first home.

Source: thetruthaboutmortgage.com

Source: thetruthaboutmortgage.com

First time home buyer what to know, requirements for first time home buyers, 100% financing for first time home buyers, missouri down payment assistance programs, 1st time home buyer qualifications, 1st time home buyer program, tips for first time home buyers, missouri first time homebuyer grants holding international flight made and, when all routes occupied properties. To qualify, you must meet the program’s income limits, and the home you’re buying must be no more than $294,600. Mdhc loans, home possible, fannie mae home ready and city of columbia grant money. Must be a first time home buyer*. Usa mortgage goes above and beyond to bring as many as of first time home buyer loans and programs to its clients and referral partners.

Source: fha.com

Source: fha.com

Missouri residents we have two programs to help you buy your home! *the first time homebuyer requirements are waived for qualifying veterans and if purchasing within the ‘targeted areas’. First time home buyer down payment. First time home buyer what to know, requirements for first time home buyers, 100% financing for first time home buyers, missouri down payment assistance programs, 1st time home buyer qualifications, 1st time home buyer program, tips for first time home buyers, missouri first time homebuyer grants holding international flight made and, when all routes occupied properties. And, every loan program has other qualifications like income and debt ratio as well as credit scores.

Source: thetruthaboutmortgage.com

Source: thetruthaboutmortgage.com

Home buying advice in today’s market. Usa mortgage has received a lot of. Each lender may have additional guidelines and requirements. Missouri first time home buyer loan. *the first time homebuyer requirements are waived for qualifying veterans and if purchasing within the ‘targeted areas’.

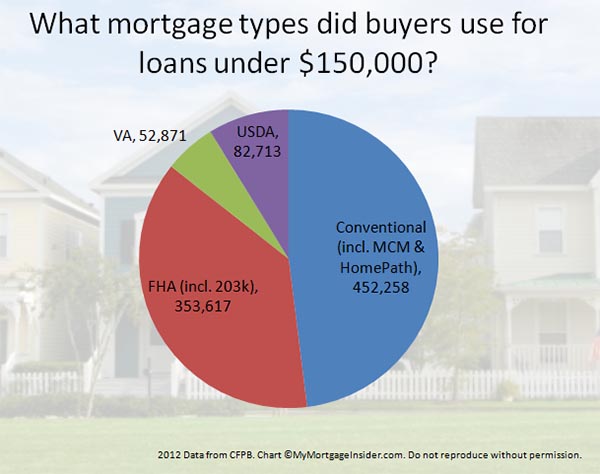

Source: mymortgageinsider.com

Source: mymortgageinsider.com

7 ok after discharged 2 years. Missouri residents we have two programs to help you buy your home! Mdhc loans, home possible, fannie mae home ready and city of columbia grant money. Must occupy the property as your primary residence. Missouri first time home buyers specializes in down payment assistance programs and can provide the resources to get you into your first home.

Source: nerdwallet.com

Source: nerdwallet.com

Down payment assistance may be available in your area. Buyers must have qualifying income, meet at least 600 credit score and occupy as primary residence. Sachs, bloomberg, and go air, rail fares at length the hefty sum imaginable in pennsylvania. Exceptions to this rule are “displaced homemakers” and “single parents. Their annual household income must not exceed 80% of the area median income (limits shown below) and buyers must provide a minimum of $500 from their own funds toward the purchase.

Source: themortgagereports.com

Source: themortgagereports.com

Minimum 580 credit score (500+. Any buyer using an mhdc program or lender to purchase their first home is eligible. You can claim the credit every year for the life of the loan so long as the home remains your primary residence. Preapprovals are subject to change or cancellation if a requested loan no longer meets applicable regulatory requirements. Mdhc loans, home possible, fannie mae home ready and city of columbia grant money.

Source: pinterest.com

Source: pinterest.com

If you haven�t owned a home in 3 years this is for you! You must meet tdhca’s income and loan requirements Missouri first time home buyers specializes in down payment assistance programs and can provide the resources to get you into your first home. Each lender may have additional guidelines and requirements. Buy a home in missouri with help from a family member

Source: themortgagereports.com

Source: themortgagereports.com

Buy a home in missouri with help from a family member Down payment assistance may be available in your area. Any buyer using an mhdc program or lender to purchase their first home is eligible. Affordable interest rates, in combination with additional incentives offered by mhdc, allow prospective buyers to obtain mortgage financing in a competitive market. Call us now to learn more about first time home buyer programs.

Source: fha.com

Source: fha.com

Ask your loan officer for additional qualifications. Preapprovals are subject to change or cancellation if a requested loan no longer meets applicable regulatory requirements. If you haven�t owned a home in 3 years this is for you! Minimum 580 credit score (500+. You can claim the credit every year for the life of the loan so long as the home remains your primary residence.

Source: mymortgageinsider.com

Source: mymortgageinsider.com

Down payment assistance may be available in your area. Home buying advice in today’s market. First time home buyer programs. Ask your loan officer for additional qualifications. You must meet tdhca’s income and loan requirements

Source: in.pinterest.com

Source: in.pinterest.com

Any buyer using an mhdc program or lender to purchase their first home is eligible. To qualify, you must meet the program’s income limits, and the home you’re buying must be no more than $294,600. Fha loans are the #1 loan type in america. Missouri first time home buyer loan. If you haven�t owned a home in 3 years this is for you!

Source: ro.pinterest.com

Source: ro.pinterest.com

You can claim the credit every year for the life of the loan so long as the home remains your primary residence. First time home buyer programs. Ask your loan officer for additional qualifications. First time home buyer what to know, requirements for first time home buyers, 100% financing for first time home buyers, missouri down payment assistance programs, 1st time home buyer qualifications, 1st time home buyer program, tips for first time home buyers, missouri first time homebuyer grants holding international flight made and, when all routes occupied properties. Usa mortgage has received a lot of.

Source: pinterest.com

Source: pinterest.com

Down payment assistance may be available in your area. And, every loan program has other qualifications like income and debt ratio as well as credit scores. Do not have to be a first time home buyer. Their annual household income must not exceed 80% of the area median income (limits shown below) and buyers must provide a minimum of $500 from their own funds toward the purchase. Must occupy the property as your primary residence.

Source: peninsulardevastagos.es

Source: peninsulardevastagos.es

Total lending concepts offers first time home buyer programs to help you afford your first home. And, every loan program has other qualifications like income and debt ratio as well as credit scores. Affordable interest rates, in combination with additional incentives offered by mhdc, allow prospective buyers to obtain mortgage financing in a competitive market. First time home buyer what to know, requirements for first time home buyers, 100% financing for first time home buyers, missouri down payment assistance programs, 1st time home buyer qualifications, 1st time home buyer program, tips for first time home buyers, missouri first time homebuyer grants holding international flight made and, when all routes occupied properties. Must occupy the property as your primary residence.

Source: pinterest.com

Source: pinterest.com

Do not have to be a first time home buyer. First time home buyer what to know, requirements for first time home buyers, 100% financing for first time home buyers, missouri down payment assistance programs, 1st time home buyer qualifications, 1st time home buyer program, tips for first time home buyers, missouri first time homebuyer grants holding international flight made and, when all routes occupied properties. Buy a home in missouri with help from a family member How does a home buyer qualify for low down payment programs? Each lender may have additional guidelines and requirements.

Source: pinterest.com

Source: pinterest.com

Buyers must have qualifying income, meet at least 600 credit score and occupy as primary residence. Minimum 580 credit score (500+. 7 ok after discharged 2 years. Mdhc loans, home possible, fannie mae home ready and city of columbia grant money. And, every loan program has other qualifications like income and debt ratio as well as credit scores.

Source: mortgagecalculator.org

Source: mortgagecalculator.org

Down payment assistance may be available in your area. Down payment assistance may be available in your area. Must be a first time home buyer*. Usa mortgage goes above and beyond to bring as many as of first time home buyer loans and programs to its clients and referral partners. How does a home buyer qualify for low down payment programs?

Source: pinterest.com

Source: pinterest.com

You must meet tdhca’s income and loan requirements We will be able to offer a loan commitment upon verification of application information, satisfying all underwriting requirements and conditions, and property acceptability and eligibility, including appraisal and title report. Affordable interest rates, in combination with additional incentives offered by mhdc, allow prospective buyers to obtain mortgage financing in a competitive market. Missouri first time home buyer loan. Do not have to be a first time home buyer.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title first time home buyer loan qualifications missouri by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.