Your First time home buyer wv no down payment images are available. First time home buyer wv no down payment are a topic that is being searched for and liked by netizens now. You can Find and Download the First time home buyer wv no down payment files here. Get all free photos and vectors.

If you’re looking for first time home buyer wv no down payment images information connected with to the first time home buyer wv no down payment interest, you have visit the right site. Our website always provides you with hints for viewing the maximum quality video and image content, please kindly surf and find more enlightening video articles and graphics that fit your interests.

First Time Home Buyer Wv No Down Payment. National level home buyer grants are rare. First time home buyer no down payment. There are pros and cons to no or low down payments. Can i take advantage of down payment/closing cost assistance?

Tips For First-time Home Buyers What You Must Know Before You Buy From thetruthaboutmortgage.com

Tips For First-time Home Buyers What You Must Know Before You Buy From thetruthaboutmortgage.com

Any property being purchased must be located in the state of west virginia, and must serve as the buyer’s primary residence. Minimum annual household income of 80% of the median income in your area 2. Down payment/closing cost assistance program in some cases you may qualify for a down payment/closing cost assistance program loan. If you want to buy your first home, the 20% down payment might seem like a goal that�s out of reach. Can i take advantage of down payment/closing cost assistance? Find your down payment option.

Be the owner of your first home with low down payment.

There are pros and cons to no or low down payments. Down payment and closing cost assistance loans are available in conjunction with the homeownership and movin’ up programs to reduce the amount of upfront money needed to purchase a home. My home buyer programs first time buyers. If you have a credit score of 580 with 3.5 down payments, you are eligible to this. This no down payment mortgage option requires a home buyer education course and mortgage insurance through va, fha, usda, or private insurers, but has no location restrictions, so popular areas. Local first time home buyer grants.

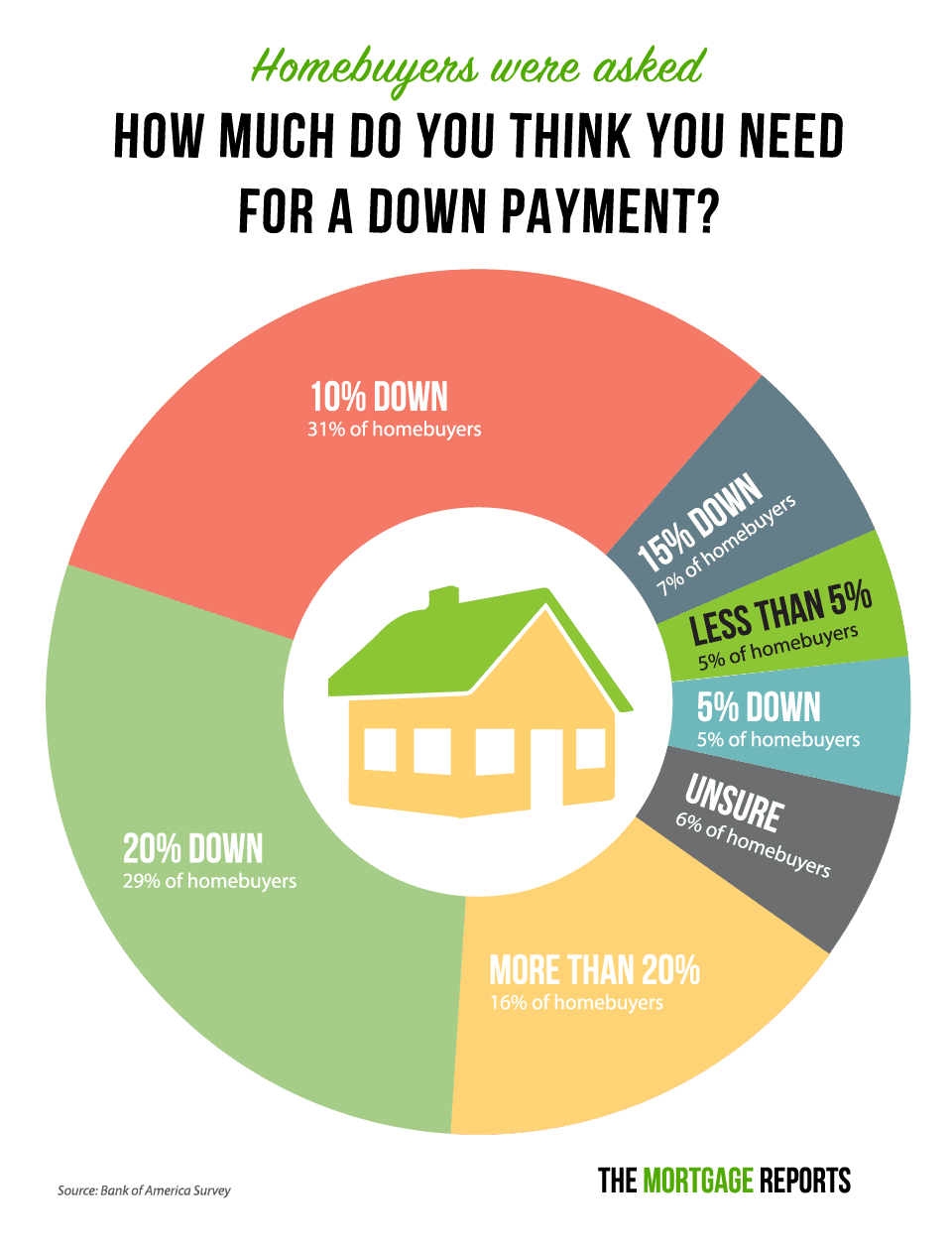

Source: themortgagereports.com

Source: themortgagereports.com

Down payment assistance programs and/or grants were researched by the team at fha.com. National level home buyer grants are rare. Up to 100% of the purchase price of the home can be financed. Find your down payment option. On a $250,000 home purchase, that would be just $15,000.

Source: consolidatedcredit.org

Source: consolidatedcredit.org

Most first time home buying grants assess a few necessary things. Minimum annual household income of 80% of the median income in your area 2. In some cases, the loan can be paired with down payment and closing cost assistance. Little to no down payment. Can i take advantage of down payment/closing cost assistance?

Source: dashhomeloans.com

Source: dashhomeloans.com

First time home buyer…no down payment First time home buyer loans with zero down: Many people are unaware there are grant programs (free money) to assist with these costs, as well as special financing for qualified buyers, including veterans, native americans, and those with disabilities. No private mortgage insurance requirements. National level home buyer grants are rare.

Source: thetruthaboutmortgage.com

Source: thetruthaboutmortgage.com

To participate, homebuyers must live in west virginia and plan on buying a home in the state. On a $250,000 home purchase, that would be just $15,000. If you want to buy your first home, the 20% down payment might seem like a goal that�s out of reach. Down payment/closing cost assistance program in some cases you may qualify for a down payment/closing cost assistance program loan. Most first time home buying grants assess a few necessary things.

Source: wvhdf.com

Source: wvhdf.com

Many people are unaware there are grant programs (free money) to assist with these costs, as well as special financing for qualified buyers, including veterans, native americans, and those with disabilities. First time home buyer no down payment thoughts. Any property being purchased must be located in the state of west virginia, and must serve as the buyer’s primary residence. Down payment assistance programs and/or grants were researched by the team at fha.com. My home buyer programs first time buyers.

Source: time.com

Source: time.com

If you have a credit score of 580 with 3.5 down payments, you are eligible to this. This no down payment mortgage option requires a home buyer education course and mortgage insurance through va, fha, usda, or private insurers, but has no location restrictions, so popular areas. National level home buyer grants are rare. In some cases, the loan can be paired with down payment and closing cost assistance. Any property being purchased must be located in the state of west virginia, and must serve as the buyer’s primary residence.

Source: wvhdf.com

Source: wvhdf.com

If you want to buy your first home, the 20% down payment might seem like a goal that�s out of reach. My home buyer programs first time buyers. National level home buyer grants are rare. Find your down payment option. Buy a home sooner than you imagined with as little as 3% down on mortgages up to $510,400.

Source: firsttimehomebuyer.com

Source: firsttimehomebuyer.com

Down payment and closing cost assistance loans are available in conjunction with the homeownership and movin’ up programs to reduce the amount of upfront money needed to purchase a home. National level home buyer grants are rare. Minimum annual household income of 80% of the median income in your area 2. Down payment assistance programs and/or grants were researched by the team at fha.com. The west virginia housing development fund offers affordable mortgage loans to finance the purchase of a home or offers help to most homeowners if they choose to refinance.

Source: vhda.com

Source: vhda.com

Any property being purchased must be located in the state of west virginia, and must serve as the buyer’s primary residence. First time home buyer…no down payment First time home buyer no down payment thoughts. If you want to buy your first home, the 20% down payment might seem like a goal that�s out of reach. Find your down payment option.

Source: gr.pinterest.com

Source: gr.pinterest.com

The options are listed below: Down payment assistance programs and/or grants were researched by the team at fha.com. On a $250,000 home purchase, that would be just $15,000. This no down payment mortgage option requires a home buyer education course and mortgage insurance through va, fha, usda, or private insurers, but has no location restrictions, so popular areas. Local first time home buyer grants.

Source: pinterest.com

Source: pinterest.com

Buy a home sooner than you imagined with as little as 3% down on mortgages up to $510,400. No private mortgage insurance requirements. Down payment/closing cost assistance program in some cases you may qualify for a down payment/closing cost assistance program loan. My home buyer programs first time buyers. Any property being purchased must be located in the state of west virginia, and must serve as the buyer’s primary residence.

Source: changeinc.org

Source: changeinc.org

Many people are unaware there are grant programs (free money) to assist with these costs, as well as special financing for qualified buyers, including veterans, native americans, and those with disabilities. Be the owner of your first home with low down payment. That’s one of the major benefits of this program. Down payment and closing cost assistance loans are available in conjunction with the homeownership and movin’ up programs to reduce the amount of upfront money needed to purchase a home. The west virginia housing development fund, a state agency, offers affordable mortgage loans to finance the purchase of a home through its homeownership and movin’ up programs.

Source: wvhdf.com

Source: wvhdf.com

The options are listed below: The west virginia housing development fund, a state agency, offers affordable mortgage loans to finance the purchase of a home through its homeownership and movin’ up programs. First time home buyer no down payment thoughts. On a $250,000 home purchase, that would be just $15,000. Down payment assistance programs and/or grants were researched by the team at fha.com.

Source: thetruthaboutmortgage.com

Source: thetruthaboutmortgage.com

Buy a home sooner than you imagined with as little as 3% down on mortgages up to $510,400. Most first time home buying grants assess a few necessary things. In some cases, the loan can be paired with down payment and closing cost assistance. On a $250,000 home purchase, that would be just $15,000. Can i take advantage of down payment/closing cost assistance?

Source: themortgagereports.com

Source: themortgagereports.com

Down payment/closing cost assistance program in some cases you may qualify for a down payment/closing cost assistance program loan. Buy a home sooner than you imagined with as little as 3% down on mortgages up to $510,400. Minimum annual household income of 80% of the median income in your area 2. Down payment/closing cost assistance program in some cases you may qualify for a down payment/closing cost assistance program loan. National level home buyer grants are rare.

Source: membersccu.org

Source: membersccu.org

If you have a credit score of 580 with 3.5 down payments, you are eligible to this. The west virginia housing development fund, a state agency, offers affordable mortgage loans to finance the purchase of a home through its homeownership and movin’ up programs. Can i take advantage of down payment/closing cost assistance? National level home buyer grants are rare. There are pros and cons to no or low down payments.

Source: bankrate.com

Source: bankrate.com

These programs made available from both state and federal sources allow for first time home buyer no down payment assistance. Minimum credit score of 620. The west virginia housing development fund, a state agency, offers affordable mortgage loans to finance the purchase of a home through its homeownership and movin’ up programs. First time home buyer loans with zero down: On a $250,000 home purchase, that would be just $15,000.

Source: pinterest.com

Source: pinterest.com

The west virginia housing development fund offers affordable mortgage loans to finance the purchase of a home or offers help to most homeowners if they choose to refinance. Can i take advantage of down payment/closing cost assistance? Find your down payment option. First time home buyer no down payment thoughts. Down payment/closing cost assistance program in some cases you may qualify for a down payment/closing cost assistance program loan.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title first time home buyer wv no down payment by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.