Your First time home buyer wv credit score images are ready in this website. First time home buyer wv credit score are a topic that is being searched for and liked by netizens today. You can Download the First time home buyer wv credit score files here. Download all free photos.

If you’re searching for first time home buyer wv credit score pictures information related to the first time home buyer wv credit score keyword, you have come to the ideal site. Our website frequently provides you with hints for viewing the highest quality video and picture content, please kindly hunt and locate more enlightening video content and images that fit your interests.

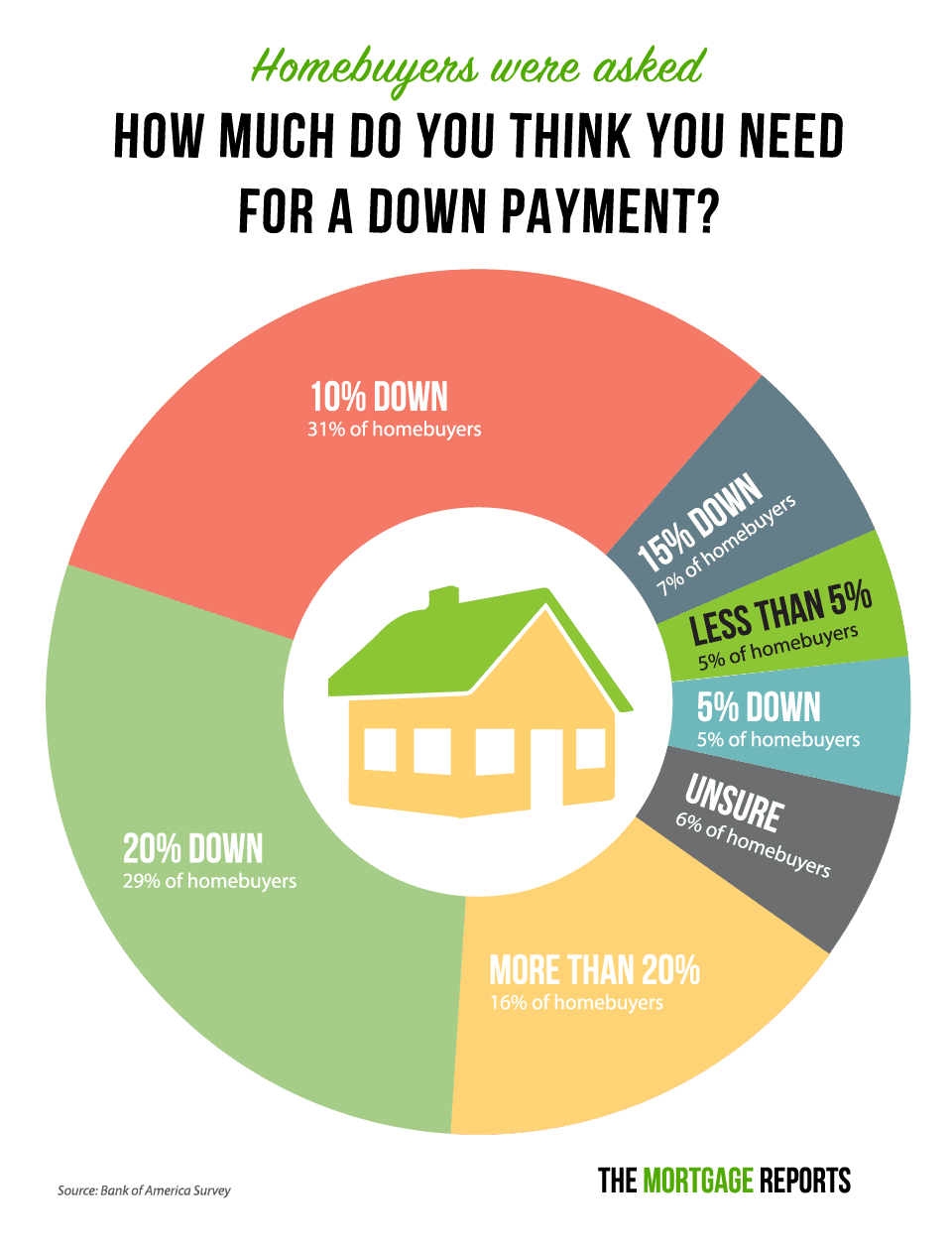

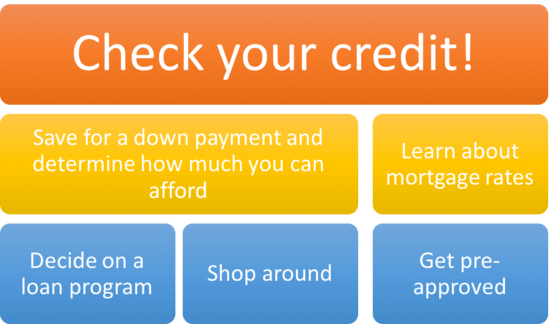

First Time Home Buyer Wv Credit Score. Home loans start with low convetional 3% and fha 3.5% down payment. On a $300,000 home, that comes out to an $18,000 down payment. Conventional loans are the most common. I would work on improving your credit a bit more.

Free Printable Checklist For 1st Time Home Buyers 17 Critical Steps First Home Checklist Home Buying Checklist Buying First Home From pinterest.com

Free Printable Checklist For 1st Time Home Buyers 17 Critical Steps First Home Checklist Home Buying Checklist Buying First Home From pinterest.com

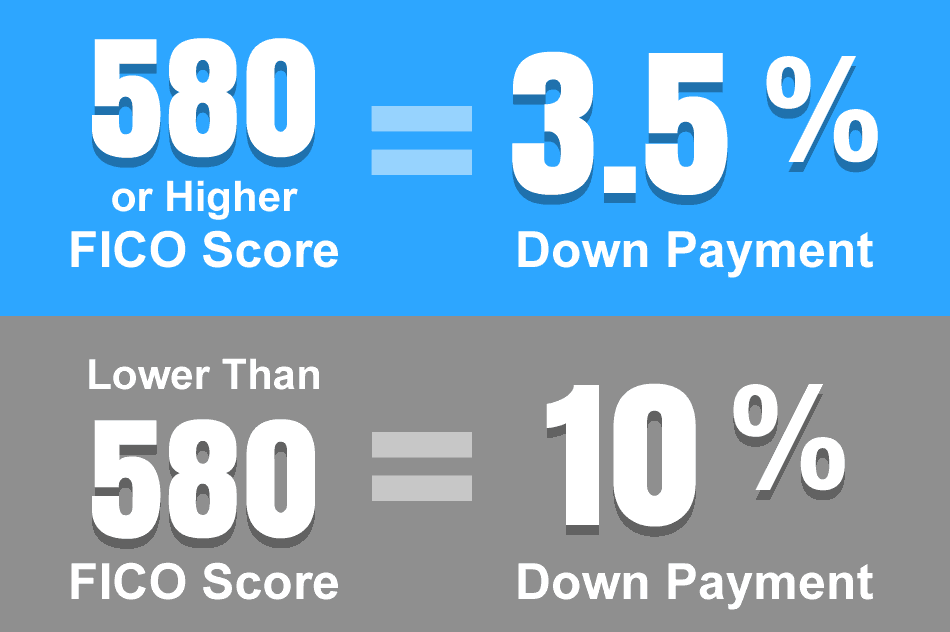

640 minimum credit score for conventional loan; Rent or buy a home; The federal housing administration allows down payments as. Not eligible for fha financing; It would depend on your down payment. Second, mortgage lenders are bound by specific rules which determine what credit scores you need to buy a house, and those rules vary by your loan type.

Not eligible for fha financing;

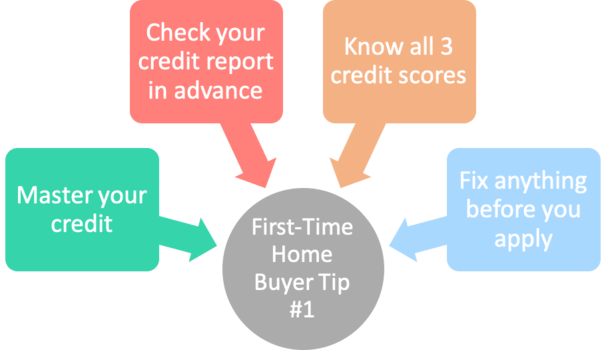

With the score at 520 you may be looking at 20% down. Many people who can afford the monthly mortgage payments and have reasonable credit will qualify. First time home buyers with bad credit; First time home buyers in west virginia can position themselves for a better mortgage rate through improved credit scores, even when it comes to refinancing down the road. New house buying applicants must be able to show the underwriter compensating factors for them to justify making a loan to a first time home buyer with a checkered history. But that number could drop closer to fha’s published minimums because of the new policy.

Source: fha.com

Source: fha.com

This promotion is valid on new applications submitted between 04/01/21 and 09/30/2021. Second, mortgage lenders are bound by specific rules which determine what credit scores you need to buy a house, and those rules vary by your loan type. Not eligible for fha financing; Rent or buy a home; Click here to see if your credit score is high enough to buy a home (dec 3rd, 2021)

Source: ro.pinterest.com

Source: ro.pinterest.com

Yes, the federal housing administration still allows first time home buyers with poor credit scores as low as 500 to get approved. An income at or below the program’s current limits. Fha bad credit mortgage and credit repair; Many people who can afford the monthly mortgage payments and have reasonable credit will qualify. First time home buyers with bad credit;

Source: membersccu.org

Source: membersccu.org

Fha loans are the #1 loan type in america. Conventional vs fha home loans; Home owners association and fees; Fha loans are backed by the government and designed to help home buyers with limited upfront funds receive financing. Yes, the federal housing administration still allows first time home buyers with poor credit scores as low as 500 to get approved.

Source: themortgagereports.com

Source: themortgagereports.com

But that number could drop closer to fha’s published minimums because of the new policy. Upfront (1.75% loan amount) and monthly Yes, the federal housing administration still allows first time home buyers with poor credit scores as low as 500 to get approved. Homebuyers with less than perfect credit scores can use fha loan options. With the score at 520 you may be looking at 20% down.

Source: pinterest.com

Source: pinterest.com

1 virginia credit union is offering a $500 discount on closing costs on new mortgage loans subject to qualification and credit approval. Homebuyers with less than perfect credit scores can use fha loan options. Click here to see if your credit score is high enough to buy a home (dec 3rd, 2021) Fha loans are the #1 loan type in america. They require a 3% down payment.

Source: pinterest.com

Source: pinterest.com

Some of the eligibility requirements include: The federal housing administration allows down payments as. First time home buyers in west virginia can position themselves for a better mortgage rate through improved credit scores, even when it comes to refinancing down the road. The west virginia housing development fund, a state agency, offers affordable mortgage loans to finance the purchase of a home through its homeownership and movin’ up programs.to participate, homebuyers must live in west virginia and plan on buying a home in the state. Whether you’re looking to purchase or refinance, we got you!

Source: bankrate.com

Source: bankrate.com

It would depend on your down payment. Must put 10% down, but still eligible; Down payment assistance may be available in your area. An income at or below the program’s current limits. This promotion is valid on new applications submitted between 04/01/21 and 09/30/2021.

Source: pinterest.com

Source: pinterest.com

660 minimum credit score for conventional no mortgage insurance loan; But that number could drop closer to fha’s published minimums because of the new policy. Whether you’re looking to purchase or refinance, we got you! You will also have to pay for private mortgage insurance (pmi) to protect the lender in case you default on the loan. Conventional vs fha home loans;

Source: pinterest.com

Source: pinterest.com

The federal housing administration allows down payments as. The west virginia housing development fund, a state agency, offers affordable mortgage loans to finance the purchase of a home through its homeownership and movin’ up programs.to participate, homebuyers must live in west virginia and plan on buying a home in the state. 660 minimum credit score for conventional no mortgage insurance loan; Click here to see if your credit score is high enough to buy a home (dec 3rd, 2021) Second, mortgage lenders are bound by specific rules which determine what credit scores you need to buy a house, and those rules vary by your loan type.

Source: thetruthaboutmortgage.com

Source: thetruthaboutmortgage.com

If you’re a first time home buyer without a lot to put down, a west virginia fha loan may accommodate you. Fha bad credit mortgage and credit repair; First time home loans for poor credit: They require a 3% down payment. This promotion is valid on new applications submitted between 04/01/21 and 09/30/2021.

Source: firsthomebuyers.net

Source: firsthomebuyers.net

Whether you’re looking to purchase or refinance, we got you! This promotion is valid on new applications submitted between 04/01/21 and 09/30/2021. An income at or below the program’s current limits. Not eligible for fha financing; First time home loans for poor credit:

Source: thetruthaboutmortgage.com

Source: thetruthaboutmortgage.com

You will also have to pay for private mortgage insurance (pmi) to protect the lender in case you default on the loan. Homebuyers with less than perfect credit scores can use fha loan options. An income at or below the program’s current limits. Yes, the federal housing administration still allows first time home buyers with poor credit scores as low as 500 to get approved. 1 virginia credit union is offering a $500 discount on closing costs on new mortgage loans subject to qualification and credit approval.

Source: movoto.com

Source: movoto.com

It would depend on your down payment. Fha bad credit mortgage and credit repair; First time home buyers with bad credit; The west virginia housing development fund, a state agency, offers affordable mortgage loans to finance the purchase of a home through its homeownership and movin’ up programs.to participate, homebuyers must live in west virginia and plan on buying a home in the state. With the score at 520 you may be looking at 20% down.

Source: pinterest.com

Source: pinterest.com

The federal housing administration allows down payments as. Not eligible for fha financing; On a $300,000 home, that comes out to an $18,000 down payment. Home owners association and fees; New house buying applicants must be able to show the underwriter compensating factors for them to justify making a loan to a first time home buyer with a checkered history.

Source: pinterest.com

Source: pinterest.com

Upfront (1.75% loan amount) and monthly Yes, the federal housing administration still allows first time home buyers with poor credit scores as low as 500 to get approved. You will also have to pay for private mortgage insurance (pmi) to protect the lender in case you default on the loan. Conventional vs fha home loans; Must put 10% down, but still eligible;

Source: pinterest.com

Source: pinterest.com

Down payment assistance may be available in your area. A minimum credit score of 620. But that number could drop closer to fha’s published minimums because of the new policy. You will also have to pay for private mortgage insurance (pmi) to protect the lender in case you default on the loan. Fha loans are the #1 loan type in america.

Source: ar.pinterest.com

Source: ar.pinterest.com

Homebuyers with less than perfect credit scores can use fha loan options. The west virginia housing development fund, a state agency, offers affordable mortgage loans to finance the purchase of a home through its homeownership and movin’ up programs.to participate, homebuyers must live in west virginia and plan on buying a home in the state. This promotion is valid on new applications submitted between 04/01/21 and 09/30/2021. Not eligible for fha financing; First time buyers & more

Source: wvhdf.com

Source: wvhdf.com

640 minimum credit score for conventional loan; The federal housing administration allows down payments as. An income at or below the program’s current limits. Some of the eligibility requirements include: Not eligible for fha financing;

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title first time home buyer wv credit score by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.