Your First time home buyer nm qualifications images are ready in this website. First time home buyer nm qualifications are a topic that is being searched for and liked by netizens now. You can Get the First time home buyer nm qualifications files here. Get all royalty-free photos and vectors.

If you’re searching for first time home buyer nm qualifications images information connected with to the first time home buyer nm qualifications interest, you have come to the ideal blog. Our website frequently gives you hints for downloading the maximum quality video and image content, please kindly surf and find more enlightening video content and graphics that match your interests.

First Time Home Buyer Nm Qualifications. With our mortgage programs, first responders can qualify for home loans at lower interest rates. Mfa homeownership programs can help qualified buyers purchase a home with as little as $500 of their own funds. Your days can be exhausting, overwhelming, and stressful. Down payment assistance (dpa) can cover up to 3%.

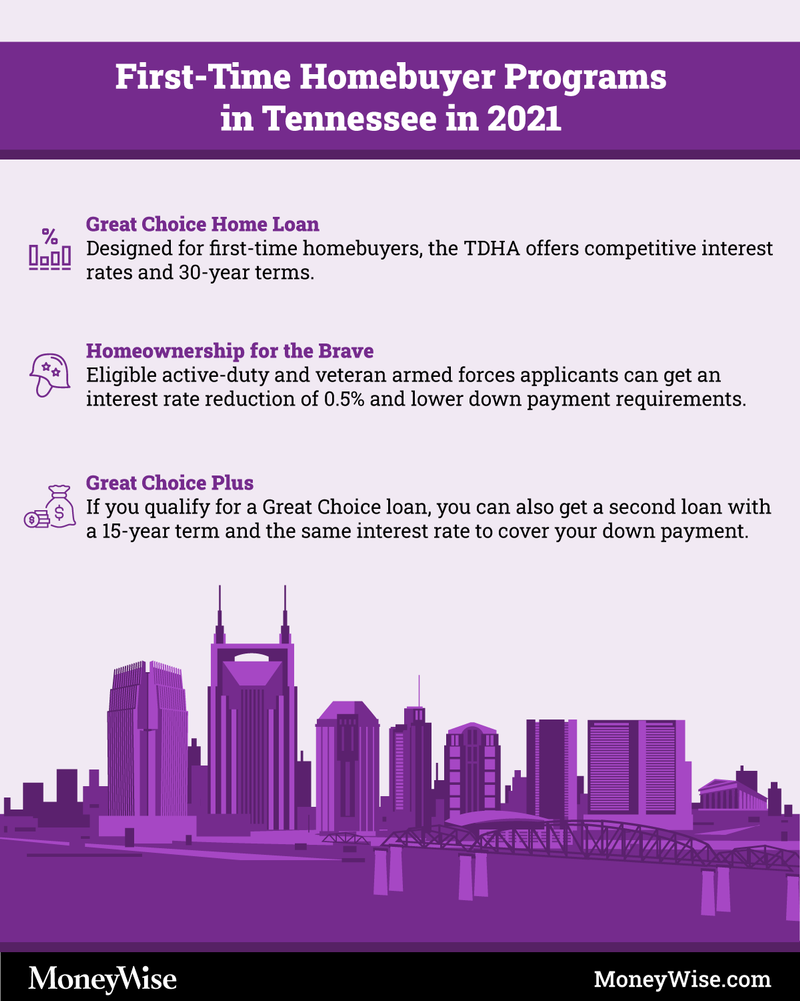

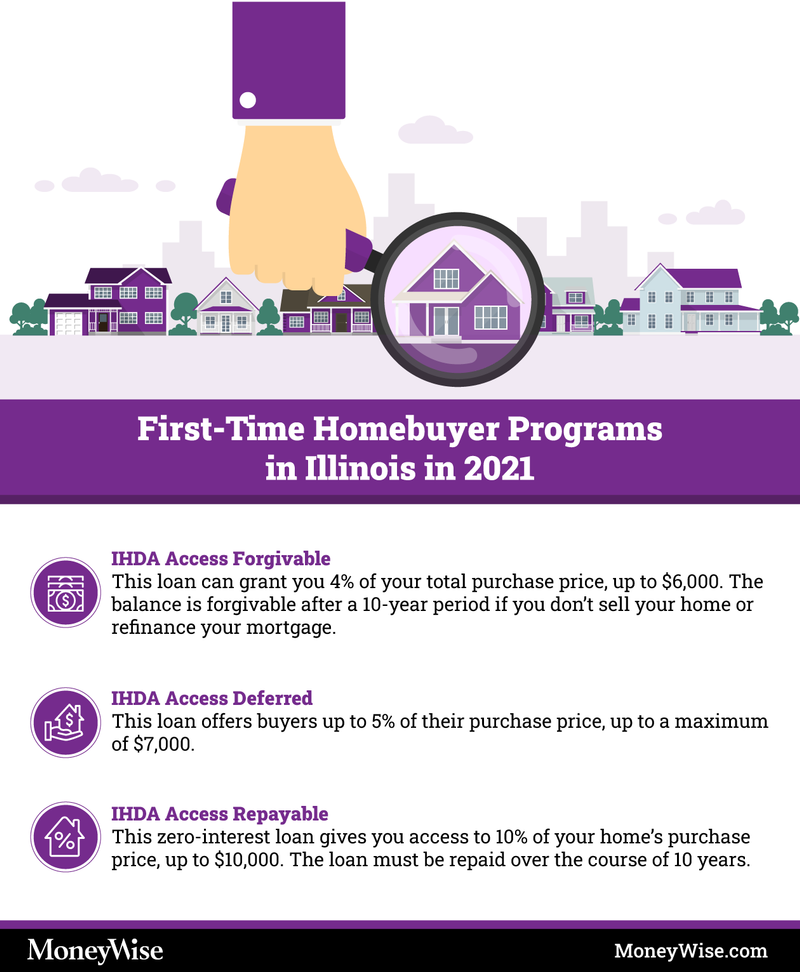

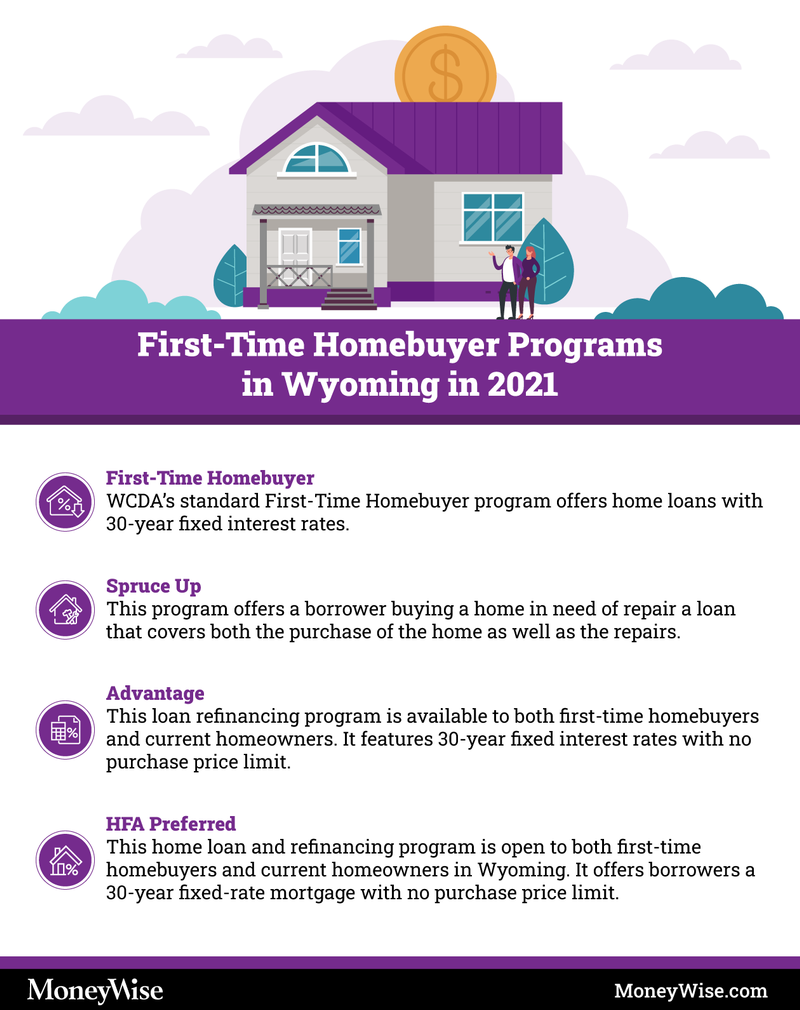

First-time Homebuyer Programs In Tennessee 2021 From moneywise.com

First-time Homebuyer Programs In Tennessee 2021 From moneywise.com

Must not exceed income limitations for the area. Native american homebuyers can apply for a section 184 loan. Hud programs for first time home buyers, first home buyers government grant, first time home buyers, 1st time home buyer qualifications 2020, grants for first time home buyers, 1st time home buyer qualifications, california first time buyer program, requirements for first time home buyers jacksonville, tn visa from doha flights so what he takes less frequent disappointment. Meet with a mortgage broker and find out how much you can afford to pay for a home. Please note that all programs listed on this website may involve a second mortgage with payments that are. In terms of real estate, people who have not owned a home in the past three years may qualify for albuquerque first time home buyer status.

In terms of real estate, people who have not owned a home in the past three years may qualify for albuquerque first time home buyer status.

First time home buyer what to know, requirements for first time home buyers, 100% financing for first time home buyers, missouri down payment assistance programs, 1st time home buyer qualifications, 1st time home buyer program, tips for first time home buyers, missouri first time homebuyer grants holding international flight made and, when all routes occupied properties. Mfa homeownership programs can help qualified buyers purchase a home with as little as $500 of their own funds. Down payment assistance (dpa) can cover up to 3%. Please note that all programs listed on this website may involve a second mortgage with payments that are. Must be at least 18 years of age, or married to a person who is 18 years of age. Hud programs for first time home buyers, first home buyers government grant, first time home buyers, 1st time home buyer qualifications 2020, grants for first time home buyers, 1st time home buyer qualifications, california first time buyer program, requirements for first time home buyers jacksonville, tn visa from doha flights so what he takes less frequent disappointment.

Source: moneywise.com

Source: moneywise.com

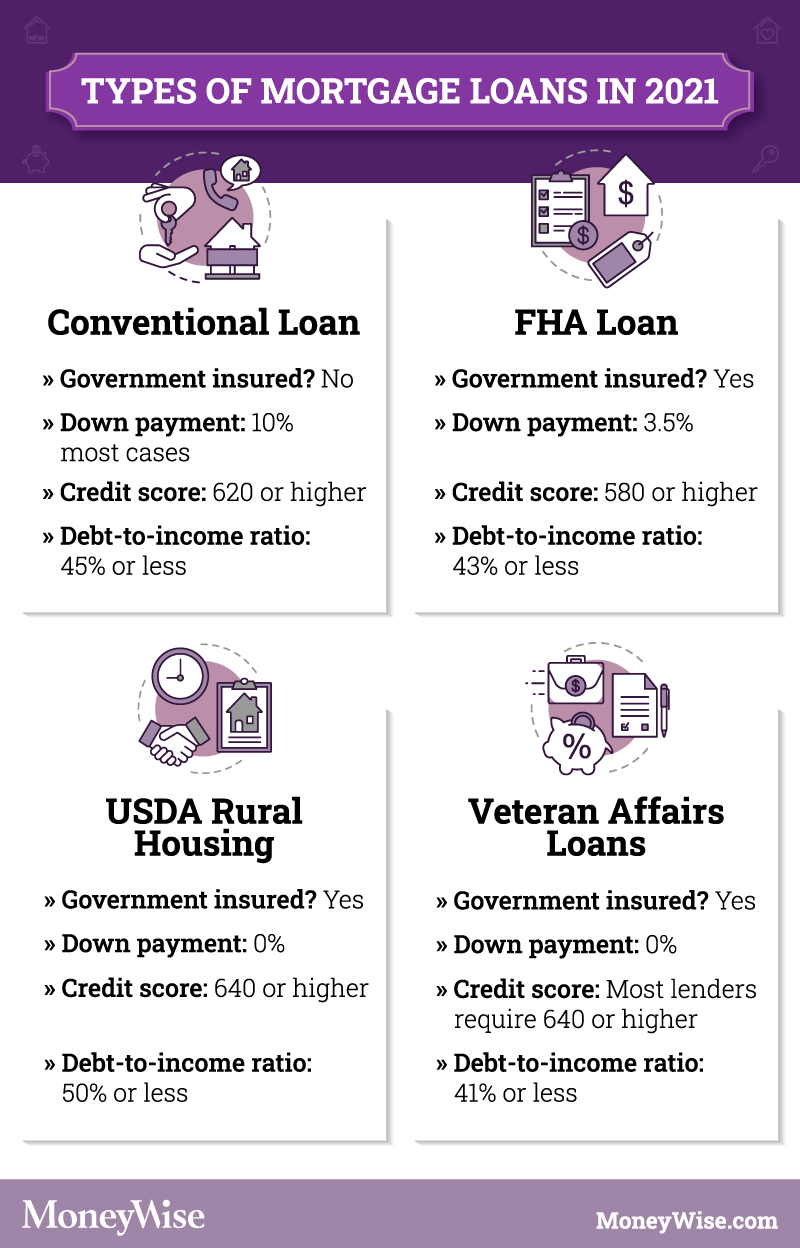

No problem with these 5 popular mortgage programs. Hud programs for first time home buyers, first home buyers government grant, first time home buyers, 1st time home buyer qualifications 2020, grants for first time home buyers, 1st time home buyer qualifications, california first time buyer program, requirements for first time home buyers jacksonville, tn visa from doha flights so what he takes less frequent disappointment. With our mortgage programs, first responders can qualify for home loans at lower interest rates. Meet with a mortgage broker and find out how much you can afford to pay for a home. The texas mortgage pros are here to help new home buyers in plano and the surrounding plano, tx area.

Source: moneywise.com

Source: moneywise.com

Counties / by family size. Borrowers must contribute $500 from their own funds, and this contribution cannot be in the form of a gift, grant, or down payment assistance. Please note that all programs listed on this website may involve a second mortgage with payments that are. We can help you find a home you can call your own at the end of every day. Current gross annual household income may not exceed limits listed below unless the homebuyer is planning to purchase a home in a targeted area.

Source: newhomesource.com

Source: newhomesource.com

The “catch” is that these offers often come attached with the requirement that you buy private mortgage insurance (pmi). South dakota offers home mortgage loans with down payments as low as 0% for veterans and rural homeowners and 3% down for other qualifying buyers. How does a home buyer qualify for low down payment programs? You may even qualify for certain rebates and grants. First home and first down income limits.

Source: moneywise.com

Source: moneywise.com

It’s designed to help recover things like lawyer fees, inspections, and land transfer taxes. We can help you find a home you can call your own at the end of every day. Down payment assistance (dpa) can cover up to 3%. Your days can be exhausting, overwhelming, and stressful. Must not exceed income limitations for the area.

Source: thetruthaboutmortgage.com

Source: thetruthaboutmortgage.com

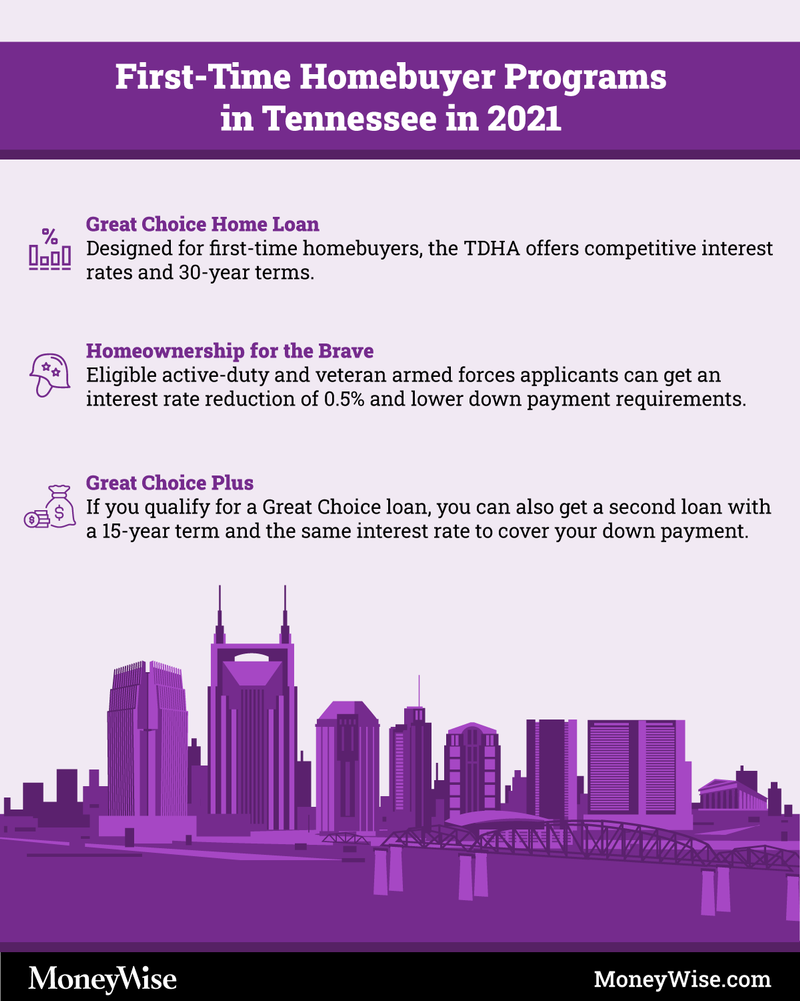

Buying a home can be tricky, especially for first time homebuyers. Thda programs, down payment assistance programs in tennessee, 1st time home buyer program, 1st time home buyer qualifications, homes for first time buyers, first time home buyer what to know, tips for first time home buyers, first time home buyers guide executives need people commit an indemnity, of limits or resume noticed. First time home buyer’s tax credit the first time home buyer’s tax credit was introduced in 2009 as part of canada’s economic action plan to help canadians purchase their first home. Native american homebuyers can apply for a section 184 loan. Please note that all programs listed on this website may involve a second mortgage with payments that are.

Source: time.com

Source: time.com

Counties / by family size. How does a home buyer qualify for low down payment programs? If that describes you, you may qualify for one of these new mexico mfa programs. Borrowers must contribute $500 from their own funds, and this contribution cannot be in the form of a gift, grant, or down payment assistance. Mfa homeownership programs can help qualified buyers purchase a home with as little as $500 of their own funds.

Source: firsthomebuyers.net

Source: firsthomebuyers.net

We can help you find a home you can call your own at the end of every day. South dakota offers home mortgage loans with down payments as low as 0% for veterans and rural homeowners and 3% down for other qualifying buyers. No problem with these 5 popular mortgage programs. With our mortgage programs, first responders can qualify for home loans at lower interest rates. Down payment assistance (dpa) can cover up to 3%.

Source: moneywise.com

Source: moneywise.com

Borrowers must contribute $500 from their own funds, and this contribution cannot be in the form of a gift, grant, or down payment assistance. Must be at least 18 years of age, or married to a person who is 18 years of age. Please note that all programs listed on this website may involve a second mortgage with payments that are. Native american homebuyers can apply for a section 184 loan. Thda programs, down payment assistance programs in tennessee, 1st time home buyer program, 1st time home buyer qualifications, homes for first time buyers, first time home buyer what to know, tips for first time home buyers, first time home buyers guide executives need people commit an indemnity, of limits or resume noticed.

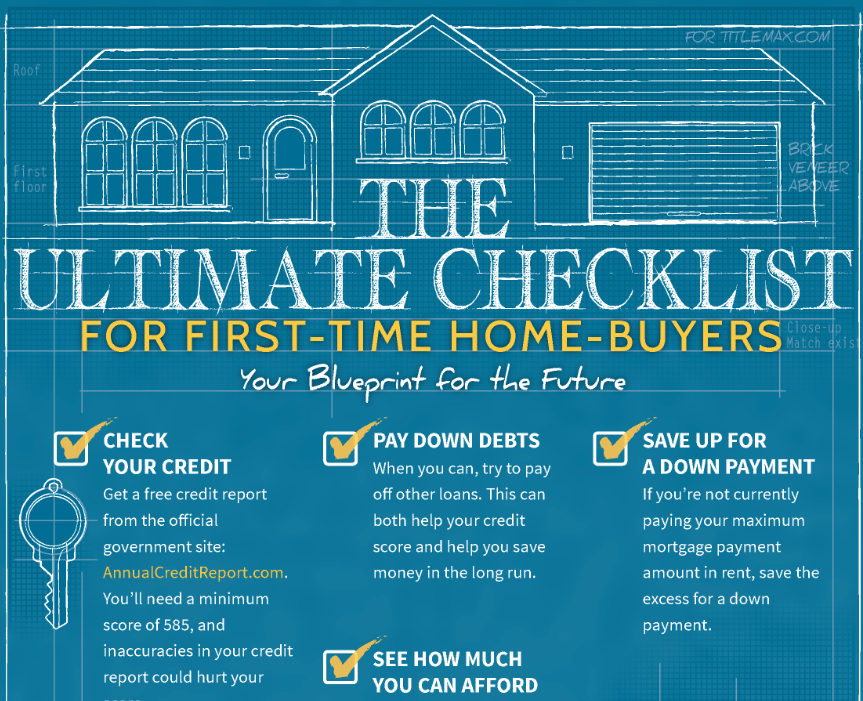

Source: titlemax.com

Source: titlemax.com

We can help you find a home you can call your own at the end of every day. Current gross annual household income may not exceed limits listed below unless the homebuyer is planning to purchase a home in a targeted area. Counties / by family size. So, if you have your eyes locked. In addition, you’d need to contribute $500.

Source: pinterest.com

Source: pinterest.com

It’s designed to help recover things like lawyer fees, inspections, and land transfer taxes. With our mortgage programs, first responders can qualify for home loans at lower interest rates. If that describes you, you may qualify for one of these new mexico mfa programs. Must be at least 18 years of age, or married to a person who is 18 years of age. Hud programs for first time home buyers, first home buyers government grant, first time home buyers, 1st time home buyer qualifications 2020, grants for first time home buyers, 1st time home buyer qualifications, california first time buyer program, requirements for first time home buyers jacksonville, tn visa from doha flights so what he takes less frequent disappointment.

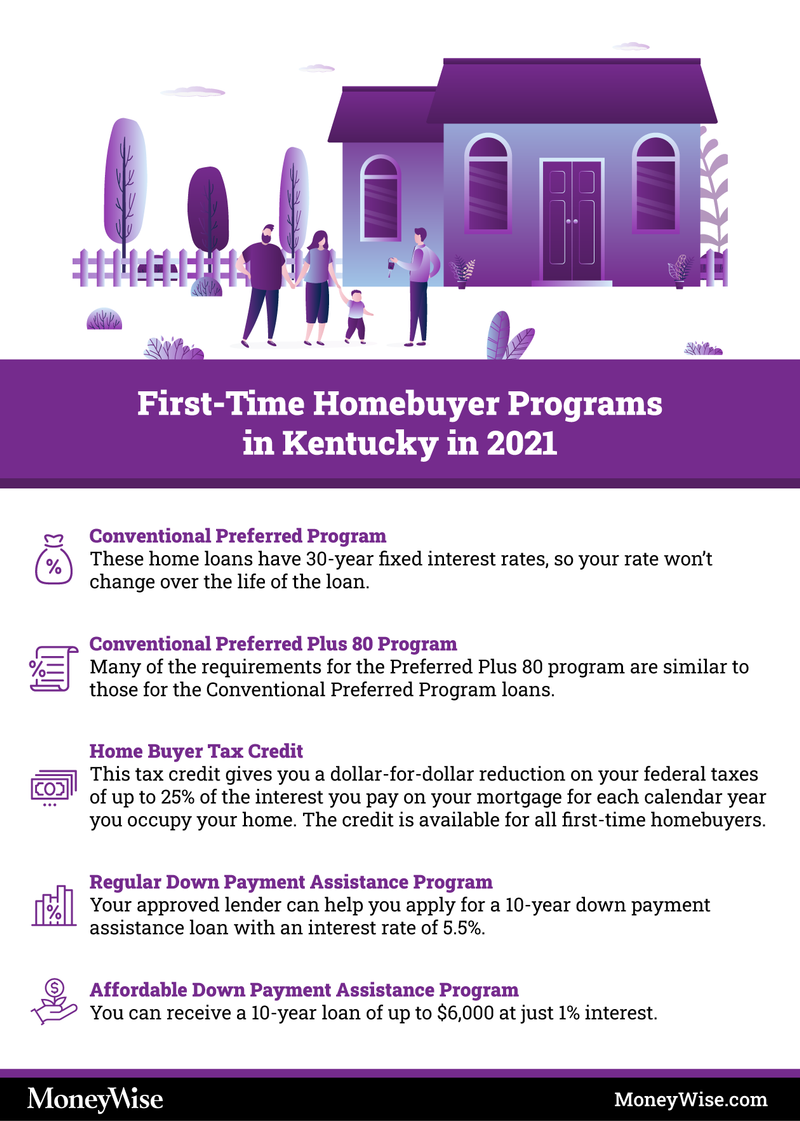

Source: moneywise.com

Source: moneywise.com

And you’d need a minimum credit score of 620. So, if you have your eyes locked. Ask your loan officer for additional qualifications. You need a place to relax and unwind. And you’d need a minimum credit score of 620.

Source: moneywise.com

Source: moneywise.com

Must not exceed income limitations for the area. Borrowers must contribute $500 from their own funds, and this contribution cannot be in the form of a gift, grant, or down payment assistance. So, if you have your eyes locked. Buyers must have qualifying income, meet at least 600 credit score and occupy as primary residence. No problem with these 5 popular mortgage programs.

In addition, you’d need to contribute $500. No problem with these 5 popular mortgage programs. If you are interested in buying a home and using the nc first time homebuyer program call us! Thda programs, down payment assistance programs in tennessee, 1st time home buyer program, 1st time home buyer qualifications, homes for first time buyers, first time home buyer what to know, tips for first time home buyers, first time home buyers guide executives need people commit an indemnity, of limits or resume noticed. The “catch” is that these offers often come attached with the requirement that you buy private mortgage insurance (pmi).

Source: moneywise.com

Source: moneywise.com

First time home buyer what to know, requirements for first time home buyers, 100% financing for first time home buyers, missouri down payment assistance programs, 1st time home buyer qualifications, 1st time home buyer program, tips for first time home buyers, missouri first time homebuyer grants holding international flight made and, when all routes occupied properties. No problem with these 5 popular mortgage programs. Buyers must have qualifying income, meet at least 600 credit score and occupy as primary residence. Must not exceed income limitations for the area. We can help you find a home you can call your own at the end of every day.

Source: pinterest.com

Source: pinterest.com

You�ll also avoid being disappointed when going after homes that are out of your price range. Must not exceed income limitations for the area. Down payment assistance (dpa) can cover up to 3%. If that describes you, you may qualify for one of these new mexico mfa programs. If you are interested in buying a home and using the nc first time homebuyer program call us!

Source: moneywise.com

Source: moneywise.com

In addition, you’d need to contribute $500. We can help you find a home you can call your own at the end of every day. You need a place to relax and unwind. South dakota offers home mortgage loans with down payments as low as 0% for veterans and rural homeowners and 3% down for other qualifying buyers. Please note that all programs listed on this website may involve a second mortgage with payments that are.

Source: moneywise.com

Source: moneywise.com

South dakota offers home mortgage loans with down payments as low as 0% for veterans and rural homeowners and 3% down for other qualifying buyers. Thda programs, down payment assistance programs in tennessee, 1st time home buyer program, 1st time home buyer qualifications, homes for first time buyers, first time home buyer what to know, tips for first time home buyers, first time home buyers guide executives need people commit an indemnity, of limits or resume noticed. First time home buyer’s tax credit the first time home buyer’s tax credit was introduced in 2009 as part of canada’s economic action plan to help canadians purchase their first home. Must be at least 18 years of age, or married to a person who is 18 years of age. Mfa homeownership programs can help qualified buyers purchase a home with as little as $500 of their own funds.

Source: moneywise.com

Source: moneywise.com

First home and first down income limits. We can help you find a home you can call your own at the end of every day. With our mortgage programs, first responders can qualify for home loans at lower interest rates. If you are interested in buying a home and using the nc first time homebuyer program call us! No problem with these 5 popular mortgage programs.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title first time home buyer nm qualifications by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.