Your First time home buyer nh bad credit images are available in this site. First time home buyer nh bad credit are a topic that is being searched for and liked by netizens today. You can Find and Download the First time home buyer nh bad credit files here. Download all royalty-free photos.

If you’re looking for first time home buyer nh bad credit pictures information linked to the first time home buyer nh bad credit keyword, you have pay a visit to the right blog. Our website frequently gives you hints for refferencing the highest quality video and image content, please kindly search and find more enlightening video content and graphics that fit your interests.

First Time Home Buyer Nh Bad Credit. If you qualify for the program, you may be eligible for either a full or partial exemption from the tax. A credit score of at least 620 is. Fha loans and hud homes. The texas state affordable housing corporation (tsahc) is a nonprofit organization that was created by the texas legislature to help texans achieve their dream of homeownership.

Nh Home Buyer Tax Credit Home Start Homebuyer Tax Credit Hanover Nh Real Estate Lebanon Nh Real Estate Upper Valley Homes From hs-re.com

Nh Home Buyer Tax Credit Home Start Homebuyer Tax Credit Hanover Nh Real Estate Lebanon Nh Real Estate Upper Valley Homes From hs-re.com

Your best chance of buying a home doesn�t come from navigating the obstacles created by your bad credit. The texas state affordable housing corporation (tsahc) is a nonprofit organization that was created by the texas legislature to help texans achieve their dream of homeownership. A credit score of at least 620 is. To qualify for an fha home loan, you’ll need to meet these requirements: A 3.5% down payment if your credit score is 580 or higher. There are mortgage programs such as fha home loans available to borrowers with a credit score as low as 500 with 10% down or 580 with 3.5% down.

The texas state affordable housing corporation (tsahc) is a nonprofit organization that was created by the texas legislature to help texans achieve their dream of homeownership.

(if this situation applies to. The federal housing administration allows down payments as low as. Rather, it comes from turning your bad credit into good credit so that you don�t have to deal with those obstacles in the first place. Fha loans and hud homes. An additional $5,000 for “socially and economically disadvantaged individuals” unlike many similar programs in the past, this bill would issue funds to buyers as they are buying the home, not in the form of a tax credit to be realized up to a year later when taxes are filed. A credit score of at least 620 is.

Source: firsthomebuyers.net

Source: firsthomebuyers.net

(if this situation applies to. Your best chance of buying a home doesn�t come from navigating the obstacles created by your bad credit. An additional $5,000 for “socially and economically disadvantaged individuals” unlike many similar programs in the past, this bill would issue funds to buyers as they are buying the home, not in the form of a tax credit to be realized up to a year later when taxes are filed. Fha loans are an ideal option for bad credit home loans because they require only a 3.5% down payment and a minimum credit score of 640. A 3.5% down payment if your credit score is 580 or higher.

Source: mymortgageinsider.com

Source: mymortgageinsider.com

Rather, it comes from turning your bad credit into good credit so that you don�t have to deal with those obstacles in the first place. Check the kāinga ora website for more information about home ownership and lenders’ credit criteria. Buying a home is exciting, but it can also be overwhelming. The texas state affordable housing corporation (tsahc) is a nonprofit organization that was created by the texas legislature to help texans achieve their dream of homeownership. The first time home buyers� program reduces or eliminates the amount of property transfer tax you pay when you purchase your first home.

Source: money.com

Source: money.com

The federal housing administration (fha) manages the fha loans program. First home grants (was called home start grant) first home loans; The first time home buyers� program reduces or eliminates the amount of property transfer tax you pay when you purchase your first home. Get your free credit score. We specialize in helping people buy a home for the first time.

Source: newhomesource.com

Source: newhomesource.com

Know where you stand before reaching out to a lender. We specialize in helping people buy a home for the first time. If you qualify for the program, you may be eligible for either a full or partial exemption from the tax. Unfortunately, this tax credit expired in 2010, so you are not eligible for the credit unless you bought your home between 2008 and 2010. A credit score of at least 620 is.

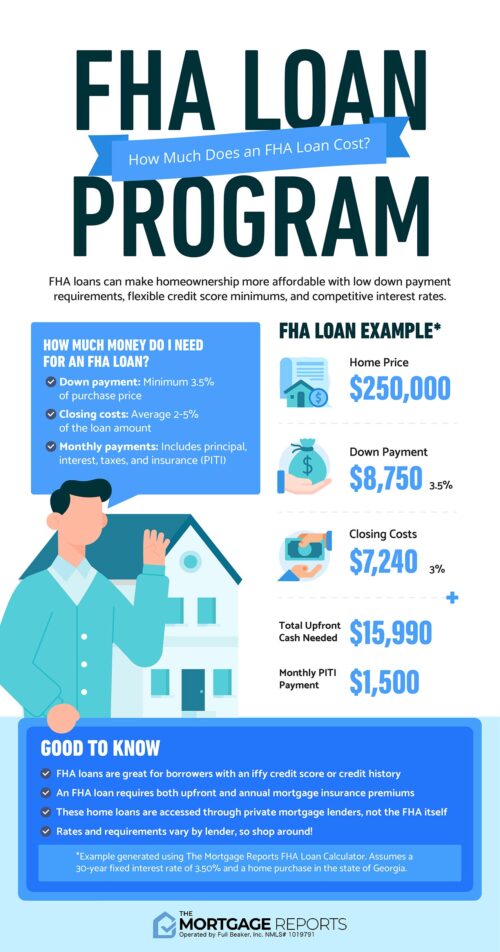

Source: themortgagereports.com

Source: themortgagereports.com

(if this situation applies to. There are mortgage programs such as fha home loans available to borrowers with a credit score as low as 500 with 10% down or 580 with 3.5% down. An additional $5,000 for “socially and economically disadvantaged individuals” unlike many similar programs in the past, this bill would issue funds to buyers as they are buying the home, not in the form of a tax credit to be realized up to a year later when taxes are filed. In order to qualify, buyers need. We offer low downpayment requirements, down payment assistance (up to 4% cash to.

Source: ncsha.org

Source: ncsha.org

Fha loans and hud homes. A credit score of at least 620 is. Your best chance of buying a home doesn�t come from navigating the obstacles created by your bad credit. An additional $5,000 for “socially and economically disadvantaged individuals” unlike many similar programs in the past, this bill would issue funds to buyers as they are buying the home, not in the form of a tax credit to be realized up to a year later when taxes are filed. A 3.5% down payment if your credit score is 580 or higher.

Source: themortgagereports.com

Source: themortgagereports.com

An additional $5,000 for “socially and economically disadvantaged individuals” unlike many similar programs in the past, this bill would issue funds to buyers as they are buying the home, not in the form of a tax credit to be realized up to a year later when taxes are filed. Get your free credit score. If you’re a homebuyer, the department of housing and urban development (hud) has two programs that may help make the process more affordable. Your best chance of buying a home doesn�t come from navigating the obstacles created by your bad credit. The federal housing administration (fha) manages the fha loans program.

Source: newhomesource.com

Source: newhomesource.com

Check the kāinga ora website for more information about home ownership and lenders’ credit criteria. To qualify for an fha home loan, you’ll need to meet these requirements: How to get preapproved for a home loan. Rather, it comes from turning your bad credit into good credit so that you don�t have to deal with those obstacles in the first place. The first time home buyers� program reduces or eliminates the amount of property transfer tax you pay when you purchase your first home.

Source: hs-re.com

Source: hs-re.com

Fha loans and hud homes. The first time home buyers� program reduces or eliminates the amount of property transfer tax you pay when you purchase your first home. Get your free credit score. Fha loans and hud homes. (if this situation applies to.

Source: nhmortgages.com

Source: nhmortgages.com

Your first step in the home buying process is to take our eligibility quiz.this short quiz will tell you if you qualify for our home. Simply put, it offered homebuyers a significant tax credit for the year in which they purchased their home. The first time home buyers� program reduces or eliminates the amount of property transfer tax you pay when you purchase your first home. The texas state affordable housing corporation (tsahc) is a nonprofit organization that was created by the texas legislature to help texans achieve their dream of homeownership. Unfortunately, this tax credit expired in 2010, so you are not eligible for the credit unless you bought your home between 2008 and 2010.

Source: themortgagereports.com

Source: themortgagereports.com

Rather, it comes from turning your bad credit into good credit so that you don�t have to deal with those obstacles in the first place. To qualify for an fha home loan, you’ll need to meet these requirements: While the specific programs may have different income limits, in general, we serve borrowers with incomes up to $137,400. How to get preapproved for a home loan. New hampshire housing offers a number of different homeownership programs to help make homeownership more affordable.

Source: homeloansforall.com

Source: homeloansforall.com

We specialize in helping people buy a home for the first time. If one or more of the purchasers don’t qualify, only the percentage of interest that the first time home buyer(s) have in the property is eligible. Your best chance of buying a home doesn�t come from navigating the obstacles created by your bad credit. A 3.5% down payment if your credit score is 580 or higher. New hampshire housing offers a number of different homeownership programs to help make homeownership more affordable.

Source: themortgagereports.com

Source: themortgagereports.com

First home grants (was called home start grant) first home loans; How to get preapproved for a home loan. If you qualify for the program, you may be eligible for either a full or partial exemption from the tax. Get your free credit score. While the specific programs may have different income limits, in general, we serve borrowers with incomes up to $137,400.

Source: forbes.com

Source: forbes.com

A 3.5% down payment if your credit score is 580 or higher. A 3.5% down payment if your credit score is 580 or higher. While the specific programs may have different income limits, in general, we serve borrowers with incomes up to $137,400. To qualify for an fha home loan, you’ll need to meet these requirements: The texas state affordable housing corporation (tsahc) is a nonprofit organization that was created by the texas legislature to help texans achieve their dream of homeownership.

Source: bluewatermtg.com

Source: bluewatermtg.com

There are mortgage programs such as fha home loans available to borrowers with a credit score as low as 500 with 10% down or 580 with 3.5% down. If you qualify for the program, you may be eligible for either a full or partial exemption from the tax. Your best chance of buying a home doesn�t come from navigating the obstacles created by your bad credit. There are mortgage programs such as fha home loans available to borrowers with a credit score as low as 500 with 10% down or 580 with 3.5% down. Get your free credit score.

Source: fhalenders.com

Source: fhalenders.com

A credit score of at least 620 is. The federal housing administration (fha) manages the fha loans program. First home grants (was called home start grant) first home loans; Get your free credit score. While the specific programs may have different income limits, in general, we serve borrowers with incomes up to $137,400.

Source: time.com

Source: time.com

In order to qualify, buyers need. First home grants (was called home start grant) first home loans; Fha loans and hud homes. There are mortgage programs such as fha home loans available to borrowers with a credit score as low as 500 with 10% down or 580 with 3.5% down. If one or more of the purchasers don’t qualify, only the percentage of interest that the first time home buyer(s) have in the property is eligible.

Source: bluewatermtg.com

Source: bluewatermtg.com

A credit score of at least 620 is. Buying a home is exciting, but it can also be overwhelming. Fha loans are an ideal option for bad credit home loans because they require only a 3.5% down payment and a minimum credit score of 640. A 3.5% down payment if your credit score is 580 or higher. The federal housing administration (fha) manages the fha loans program.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title first time home buyer nh bad credit by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.