Your First time home buyer mn tax credit images are ready in this website. First time home buyer mn tax credit are a topic that is being searched for and liked by netizens now. You can Get the First time home buyer mn tax credit files here. Find and Download all royalty-free photos.

If you’re searching for first time home buyer mn tax credit images information connected with to the first time home buyer mn tax credit keyword, you have pay a visit to the right blog. Our site always provides you with hints for viewing the highest quality video and image content, please kindly surf and locate more informative video content and images that match your interests.

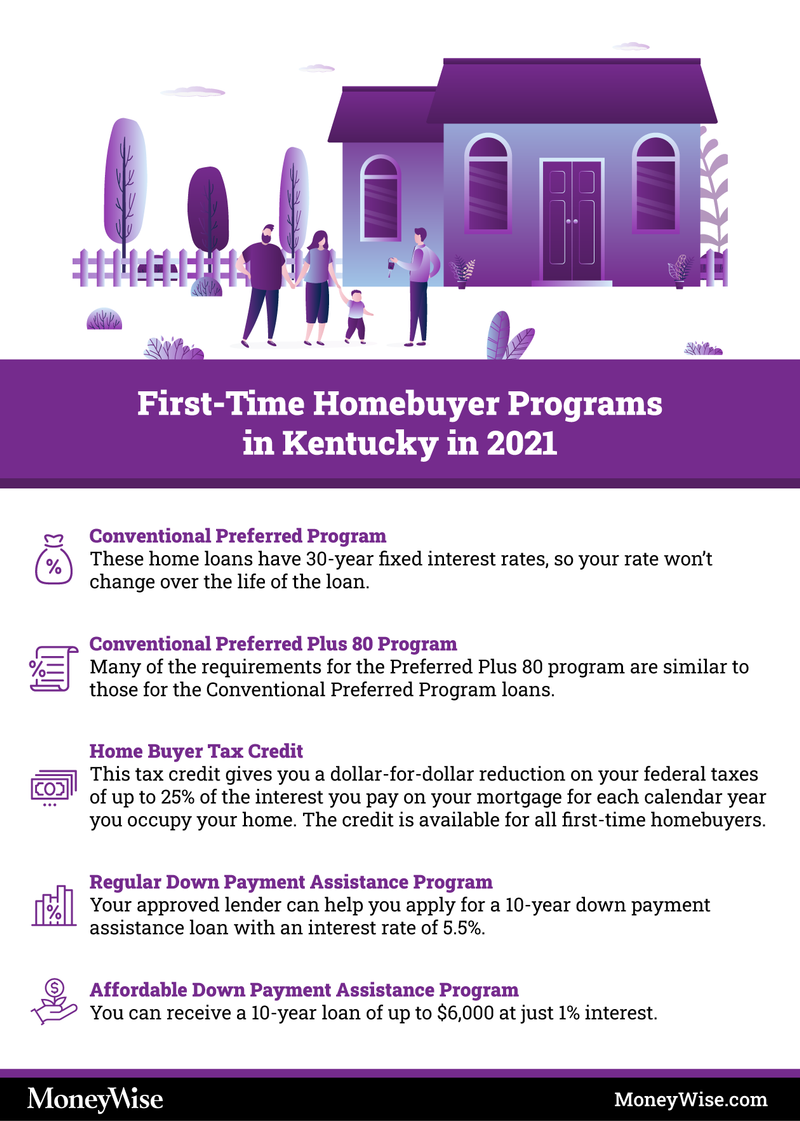

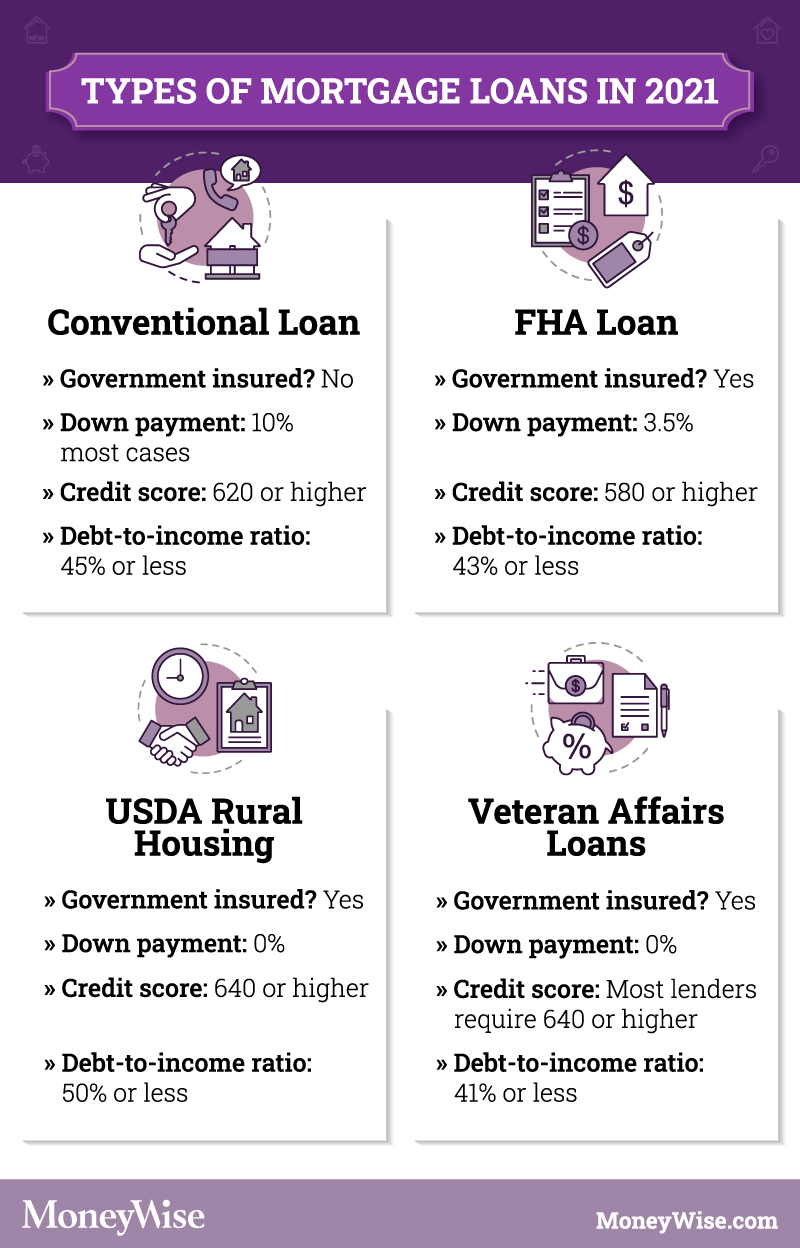

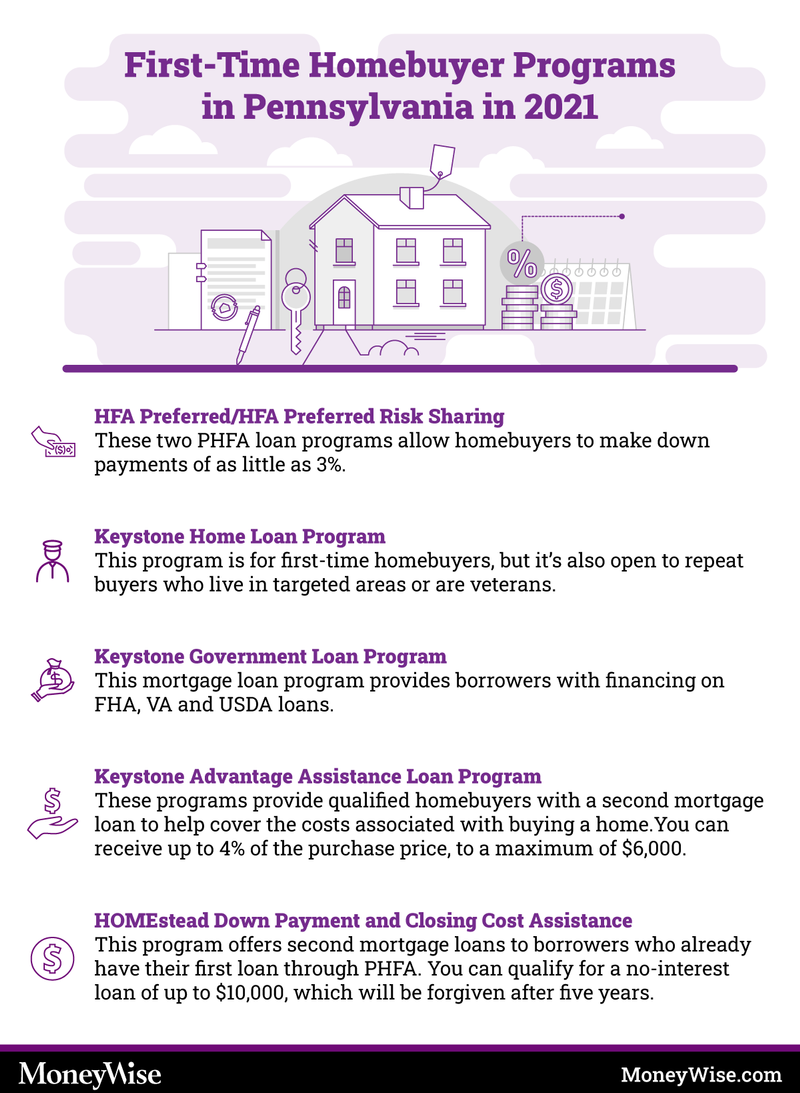

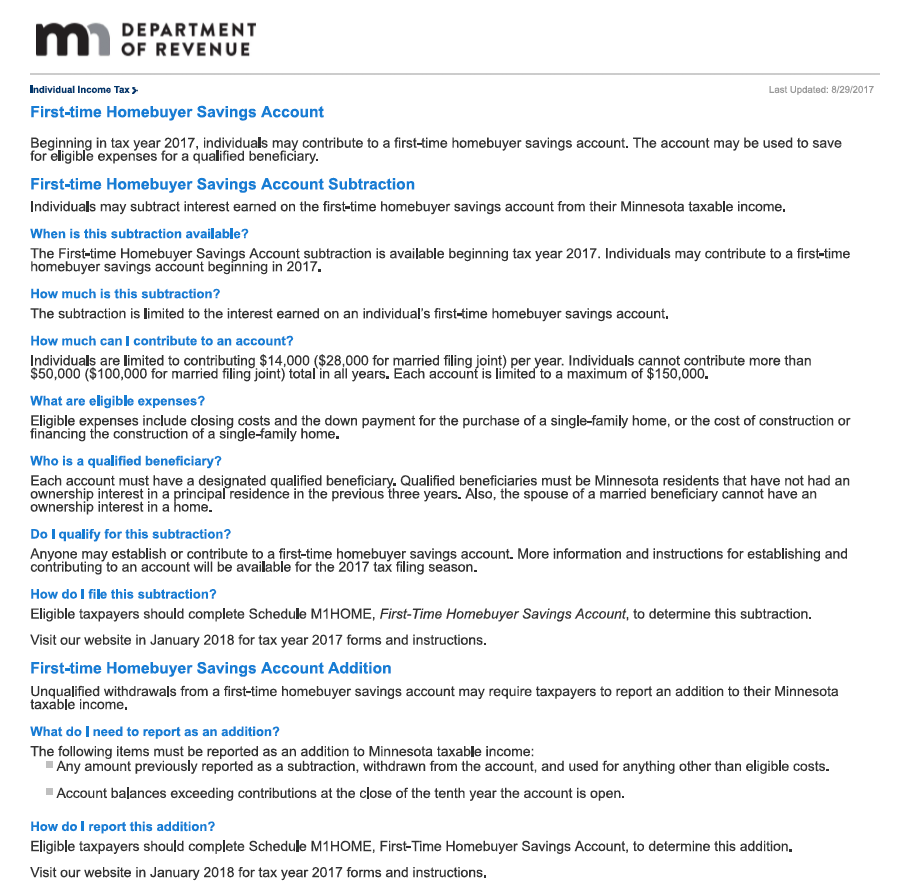

First Time Home Buyer Mn Tax Credit. While limited to specific neighborhoods these loans are on a first come first serve basis. Fha requires a 3.5% down payment, and there are numerous grants and down payment assistance programs both through the state of minnesota as well as individual cities and counties. Currently, the government is not offering a federal tax credit for buying a home. Our team is fortunate to work with one of the best first time home buyer lenders in minnesota, waterstone mortgage.

First Time Home Buyer Loan Programs Grants And Assistance From firsttimehomebuyer.com

First Time Home Buyer Loan Programs Grants And Assistance From firsttimehomebuyer.com

Economy during the great recession as a part of the housing and economic recovery act. Currently, the government is not offering a federal tax credit for buying a home. Inside the first time homebuyers guide to mn you’ll also find information about the minneapolis advantage program or map. Please note that all programs listed on this. Created as a response to the 2008 financial crisis, the housing and economic recovery act (hera) allowed new homebuyers to get a tax credit of up t0 $7,500 during the first year of the initiative. You’re eligible to claim $5,000 for the purchase of a qualifying home if both of the following points apply:

Right now, it appears that these buyers would qualify for a $6250 tax credit.

If you thought this all sounded slightly familiar, that’s because it is. The tax credit can be combined with the mrb home buyer program. Consumers have access to one free credit score per year at freecreditscore.com; Created as a response to the 2008 financial crisis, the housing and economic recovery act (hera) allowed new homebuyers to get a tax credit of up t0 $7,500 during the first year of the initiative. Economy during the great recession as a part of the housing and economic recovery act. Real estate agents are already pushing to have it extended and possibly even offered to all home buyers.

Source: proteammn.com

Source: proteammn.com

It’s not a loan you have to pay back, nor is it a cash gift like the downpayment toward equity act. What this program does is help first time home buyers purchase a home in areas hit by foreclosures. You must apply to receive the credit on the tax return in the same year in which you purchase a home. If you purchased in any of the years that the tax credit was available, you need to be aware that the federal tax rules are not the same with each year’s program. Minnesota first time home buyers to get $8,000 tax credit it�s finally official, the dust has settled!

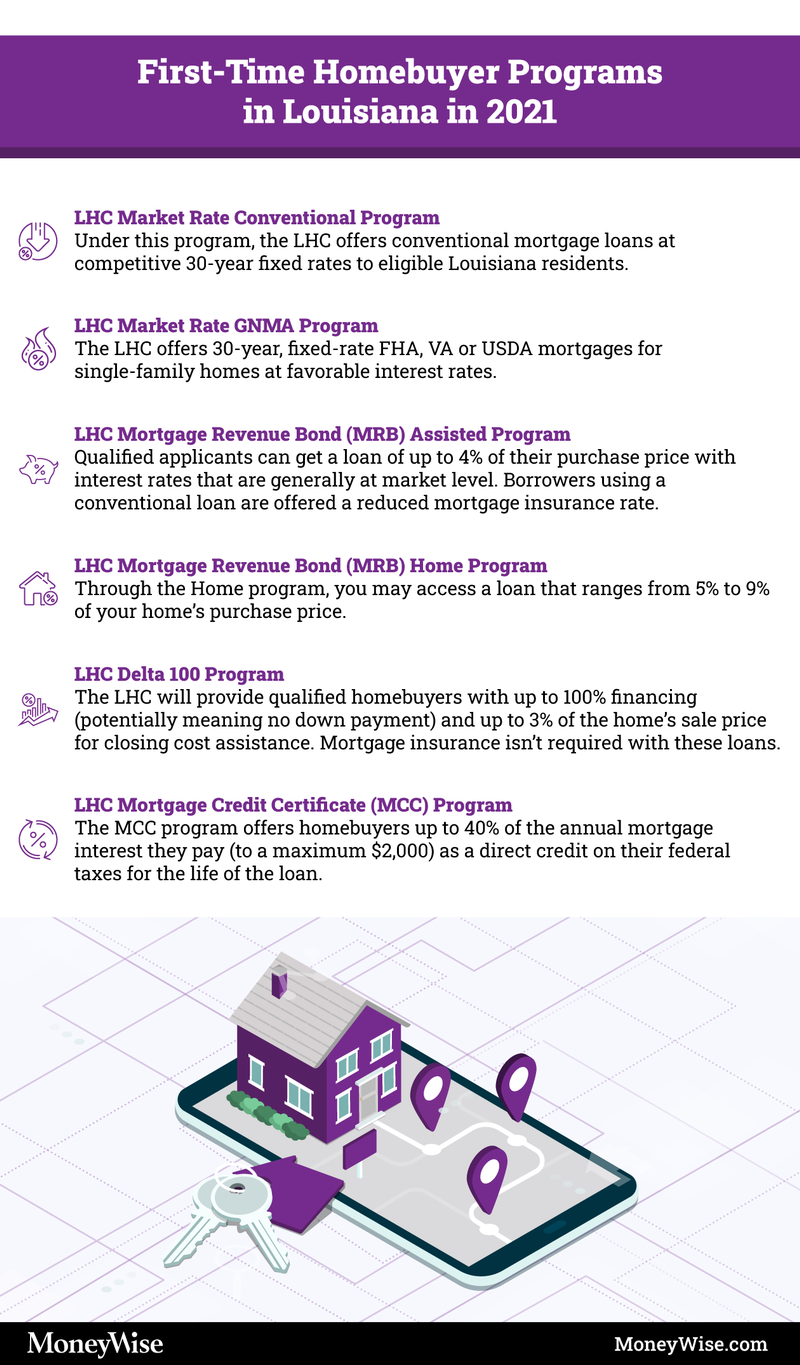

Source: moneywise.com

Source: moneywise.com

Consumers have access to one free credit score per year at freecreditscore.com; The tax credit can be combined with the mrb home buyer program. Economy during the great recession as a part of the housing and economic recovery act. First time home buyers entire mn 11 county metro up to $10,000 down payment assistance. You must apply to receive the credit on the tax return in the same year in which you purchase a home.

Source: moneywise.com

Source: moneywise.com

Economy during the great recession as a part of the housing and economic recovery act. First time home buyers entire mn 11 county metro up to $10,000 down payment assistance. Our team is fortunate to work with one of the best first time home buyer lenders in minnesota, waterstone mortgage. The credit is scaled (reduced) for gross individual incomes between $75,001 and $95,000, and individual home buyers with gross incomes greater. Currently, the government is not offering a federal tax credit for buying a home.

Source: tchabitat.org

Source: tchabitat.org

First time home buyers entire mn 11 county metro up to $10,000 down payment assistance. The tax credit can be combined with the mrb home buyer program. Unfortunately, this tax credit expired in 2010, so you are not eligible for the credit unless you bought your home between 2008 and 2010. You must apply to receive the credit on the tax return in the same year in which you purchase a home. The tax credit is equivalent to 10% of the purchase price of.

Source: creditkarma.com

Source: creditkarma.com

President obama signed into law a. Unfortunately, this tax credit expired in 2010, so you are not eligible for the credit unless you bought your home between 2008 and 2010. Created as a response to the 2008 financial crisis, the housing and economic recovery act (hera) allowed new homebuyers to get a tax credit of up t0 $7,500 during the first year of the initiative. The tax credit is equivalent to 10% of the purchase price of. Fha requires a 3.5% down payment, and there are numerous grants and down payment assistance programs both through the state of minnesota as well as individual cities and counties.

Source: ar.pinterest.com

Source: ar.pinterest.com

Fha requires a 3.5% down payment, and there are numerous grants and down payment assistance programs both through the state of minnesota as well as individual cities and counties. First time home buyers entire mn 11 county metro up to $10,000 down payment assistance. Inside the first time homebuyers guide to mn you’ll also find information about the minneapolis advantage program or map. President obama signed into law a. Economy during the great recession as a part of the housing and economic recovery act.

Source: thetruthaboutmortgage.com

Source: thetruthaboutmortgage.com

The first time home buyer tax credit will continue continue at $8,000. While limited to specific neighborhoods these loans are on a first come first serve basis. If you purchased in any of the years that the tax credit was available, you need to be aware that the federal tax rules are not the same with each year’s program. Right now, it appears that these buyers would qualify for a $6250 tax credit. You must apply to receive the credit on the tax return in the same year in which you purchase a home.

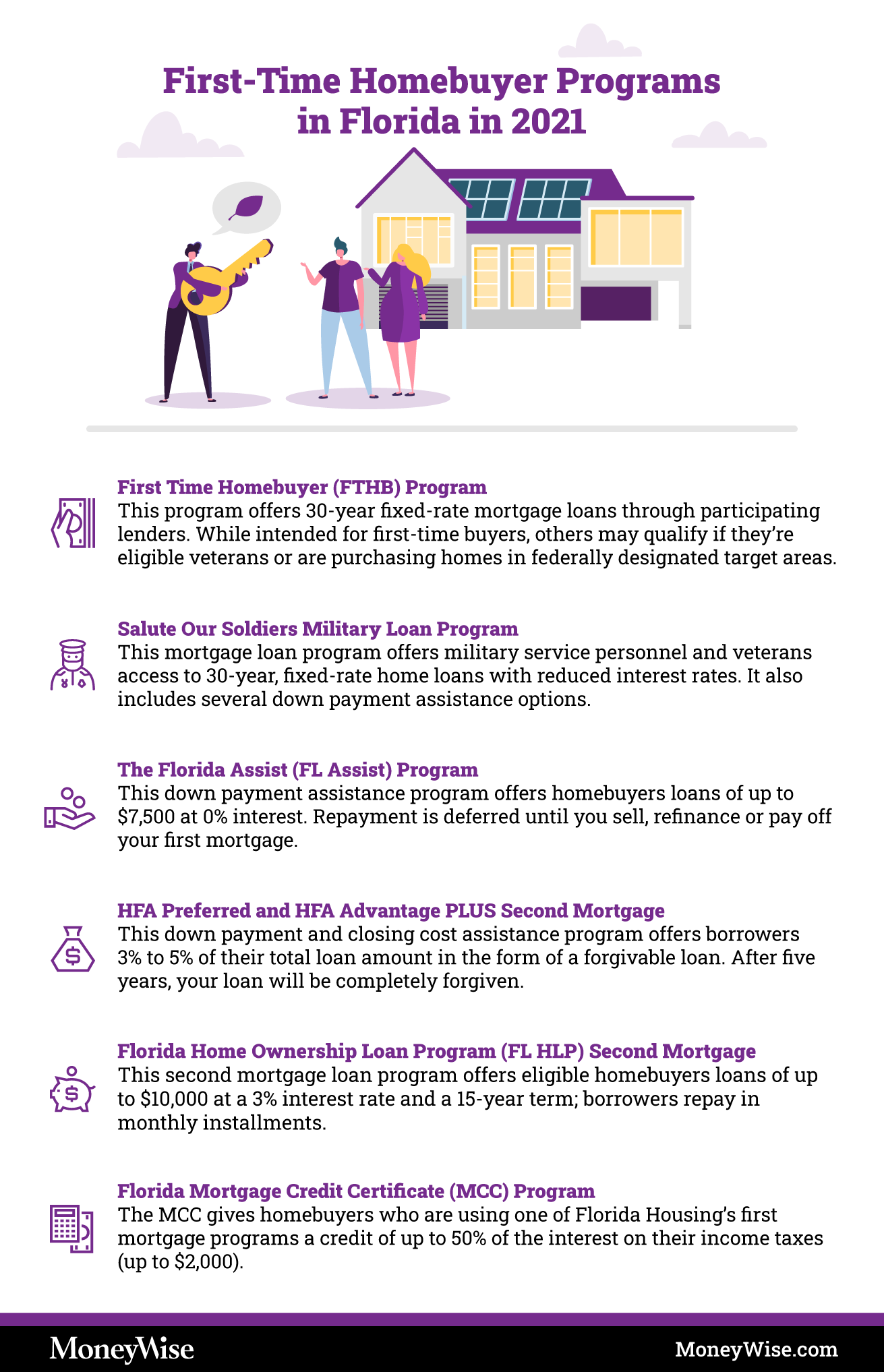

Source: moneywise.com

Source: moneywise.com

Minnesota first time home buyers to get $8,000 tax credit it�s finally official, the dust has settled! Find out if you’re eligible and how to apply. The credit is scaled (reduced) for gross individual incomes between $75,001 and $95,000, and individual home buyers with gross incomes greater. Fha requires a 3.5% down payment, and there are numerous grants and down payment assistance programs both through the state of minnesota as well as individual cities and counties. Inside the first time homebuyers guide to mn you’ll also find information about the minneapolis advantage program or map.

Source: firsttimehomebuyer.com

Source: firsttimehomebuyer.com

Inside the first time homebuyers guide to mn you’ll also find information about the minneapolis advantage program or map. Right now, it appears that these buyers would qualify for a $6250 tax credit. You’re eligible to claim $5,000 for the purchase of a qualifying home if both of the following points apply: Consumers have access to one free credit score per year at freecreditscore.com; • a first time home buyer is defined as someone who has not owned a home in the last three years • the credit amounts to 10% of the purchase price of the home not to exceed $8,000 • the tax credit does not need to be paid back if you continue living in the home as your primary residence for three years without selling it

Source: pinterest.com

Source: pinterest.com

Find out if you’re eligible and how to apply. Find out if you’re eligible and how to apply. Real estate agents are already pushing to have it extended and possibly even offered to all home buyers. Consumers have access to one free credit score per year at freecreditscore.com; Please note that all programs listed on this.

Source: mlsmortgage.com

Source: mlsmortgage.com

• a first time home buyer is defined as someone who has not owned a home in the last three years • the credit amounts to 10% of the purchase price of the home not to exceed $8,000 • the tax credit does not need to be paid back if you continue living in the home as your primary residence for three years without selling it (if this situation applies to you, it’s highly advisable to see a tax professional. It’s not a loan you have to pay back, nor is it a cash gift like the downpayment toward equity act. Fha requires a 3.5% down payment, and there are numerous grants and down payment assistance programs both through the state of minnesota as well as individual cities and counties. You’re eligible to claim $5,000 for the purchase of a qualifying home if both of the following points apply:

Source: in.pinterest.com

Source: in.pinterest.com

Inside the first time homebuyers guide to mn you’ll also find information about the minneapolis advantage program or map. Inside the first time homebuyers guide to mn you’ll also find information about the minneapolis advantage program or map. The tax credit will be expanded to include additional home buyers who have been in their homes at least five years. You must apply to receive the credit on the tax return in the same year in which you purchase a home. Our team is fortunate to work with one of the best first time home buyer lenders in minnesota, waterstone mortgage.

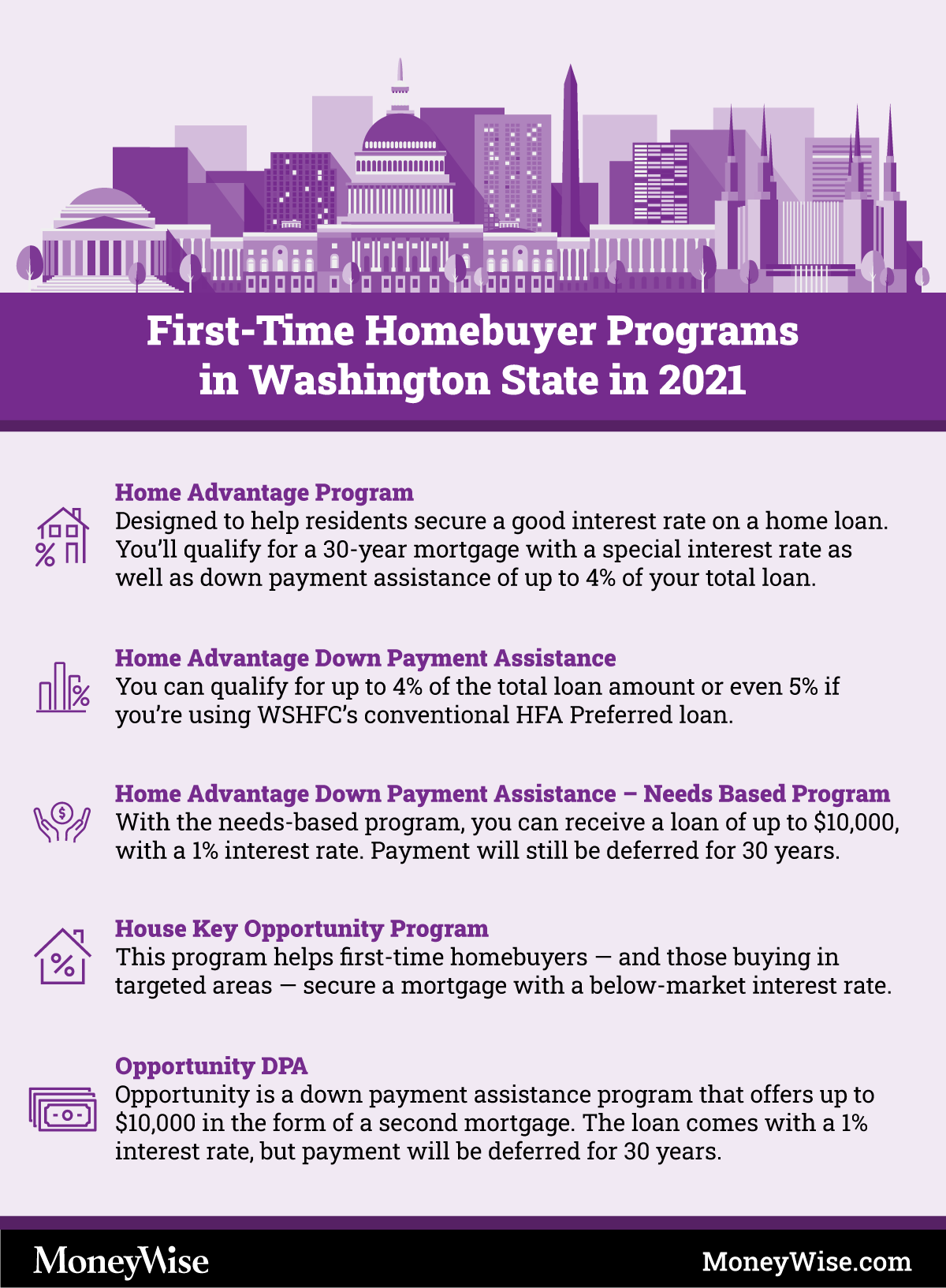

Source: moneywise.com

Source: moneywise.com

Our team is fortunate to work with one of the best first time home buyer lenders in minnesota, waterstone mortgage. Created as a response to the 2008 financial crisis, the housing and economic recovery act (hera) allowed new homebuyers to get a tax credit of up t0 $7,500 during the first year of the initiative. Right now, it appears that these buyers would qualify for a $6250 tax credit. What this program does is help first time home buyers purchase a home in areas hit by foreclosures. (if this situation applies to you, it’s highly advisable to see a tax professional.

Source: time.com

Source: time.com

The credit is scaled (reduced) for gross individual incomes between $75,001 and $95,000, and individual home buyers with gross incomes greater. Fha requires a 3.5% down payment, and there are numerous grants and down payment assistance programs both through the state of minnesota as well as individual cities and counties. If you thought this all sounded slightly familiar, that’s because it is. Consumers have access to one free credit score per year at freecreditscore.com; Federal tax credit for minnesota first time home buyers.

Source: moneywise.com

Source: moneywise.com

If you purchased in any of the years that the tax credit was available, you need to be aware that the federal tax rules are not the same with each year’s program. It’s not a loan you have to pay back, nor is it a cash gift like the downpayment toward equity act. Currently, the government is not offering a federal tax credit for buying a home. (if this situation applies to you, it’s highly advisable to see a tax professional. The tax credit is equivalent to 10% of the purchase price of.

Source: moneywise.com

Source: moneywise.com

Consumers have access to one free credit score per year at freecreditscore.com; It’s not a loan you have to pay back, nor is it a cash gift like the downpayment toward equity act. The credit is scaled (reduced) for gross individual incomes between $75,001 and $95,000, and individual home buyers with gross incomes greater. Inside the first time homebuyers guide to mn you’ll also find information about the minneapolis advantage program or map. Hennepin, ramsey, anoka, isanti, sherburne, wright, chisago, scott, dakota, ramsey, and washington first time home buyer programs.

Source: thetruthaboutmortgage.com

Source: thetruthaboutmortgage.com

(if this situation applies to you, it’s highly advisable to see a tax professional. Find out if you’re eligible and how to apply. First time home buyers entire mn 11 county metro up to $10,000 down payment assistance. If this is the case, the credit would be cut in half and the first time home buyer would receive a $7,500. If you purchased in any of the years that the tax credit was available, you need to be aware that the federal tax rules are not the same with each year’s program.

Source: homeownershipmatters.realtor

Source: homeownershipmatters.realtor

Our team is fortunate to work with one of the best first time home buyer lenders in minnesota, waterstone mortgage. Federal tax credit for minnesota first time home buyers. Our team is fortunate to work with one of the best first time home buyer lenders in minnesota, waterstone mortgage. Minnesota first time home buyers to get $8,000 tax credit it�s finally official, the dust has settled! Created as a response to the 2008 financial crisis, the housing and economic recovery act (hera) allowed new homebuyers to get a tax credit of up t0 $7,500 during the first year of the initiative.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title first time home buyer mn tax credit by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.