Your First time home buyer mn calculator images are available in this site. First time home buyer mn calculator are a topic that is being searched for and liked by netizens now. You can Get the First time home buyer mn calculator files here. Get all free photos and vectors.

If you’re searching for first time home buyer mn calculator pictures information connected with to the first time home buyer mn calculator interest, you have come to the right blog. Our website frequently provides you with hints for viewing the maximum quality video and picture content, please kindly surf and locate more enlightening video content and graphics that match your interests.

First Time Home Buyer Mn Calculator. One of the first costs you’ll come across is a home inspection. It’s not everyday that most people buy a home. This can be a critically important step to home ownership for people who have previously experienced foreclosure or divorce for example. Free mortgage calculator mn take advantage of your home equity:

Home Buying Checklist For First-time Home Buyers 2021 From themortgagereports.com

Home Buying Checklist For First-time Home Buyers 2021 From themortgagereports.com

This is when you find a home you’d like to buy. See how the balance of a reverse mortgage increases over time, comparing monthly advances to a. The only way to know for sure if you qualify or not is to apply by contacting sdhda or a participating lender. First time home buyer program is a generalize term used for to describe many different home mortgage loan programs, but essentially it means you get a little something special in a mortgage loan program because you never owned a home previously, or have not owned a home in the last three years, or to promote home ownership in certain target areas, usually inner cities. Calculate your home equity loan payment or home equity line of credit payment. The program applies to all homes purchased beginning january 1, 2021.

This can be a critically important step to home ownership for people who have previously experienced foreclosure or divorce for example.

Mortgage information for minnesota first time home buyers. One of the first costs you’ll come across is a home inspection. Free mortgage calculator mn take advantage of your home equity: The program applies to all homes purchased beginning january 1, 2021. The city of richfield and minnesota housing can help you with your downpayment! There is no end date specified, and the $15,000 tax.

Source: smartasset.com

Source: smartasset.com

If the answer is more than three years, you may qualify (again) as a first time buyer! Mortgage information for minnesota first time home buyers. If the answer is more than three years, you may qualify (again) as a first time buyer! The first time buyer program in minnesota helps you do exactly that, so you can select the right home for yourself and/or your family. Free mortgage calculator mn take advantage of your home equity:

Source: thetruthaboutmortgage.com

Source: thetruthaboutmortgage.com

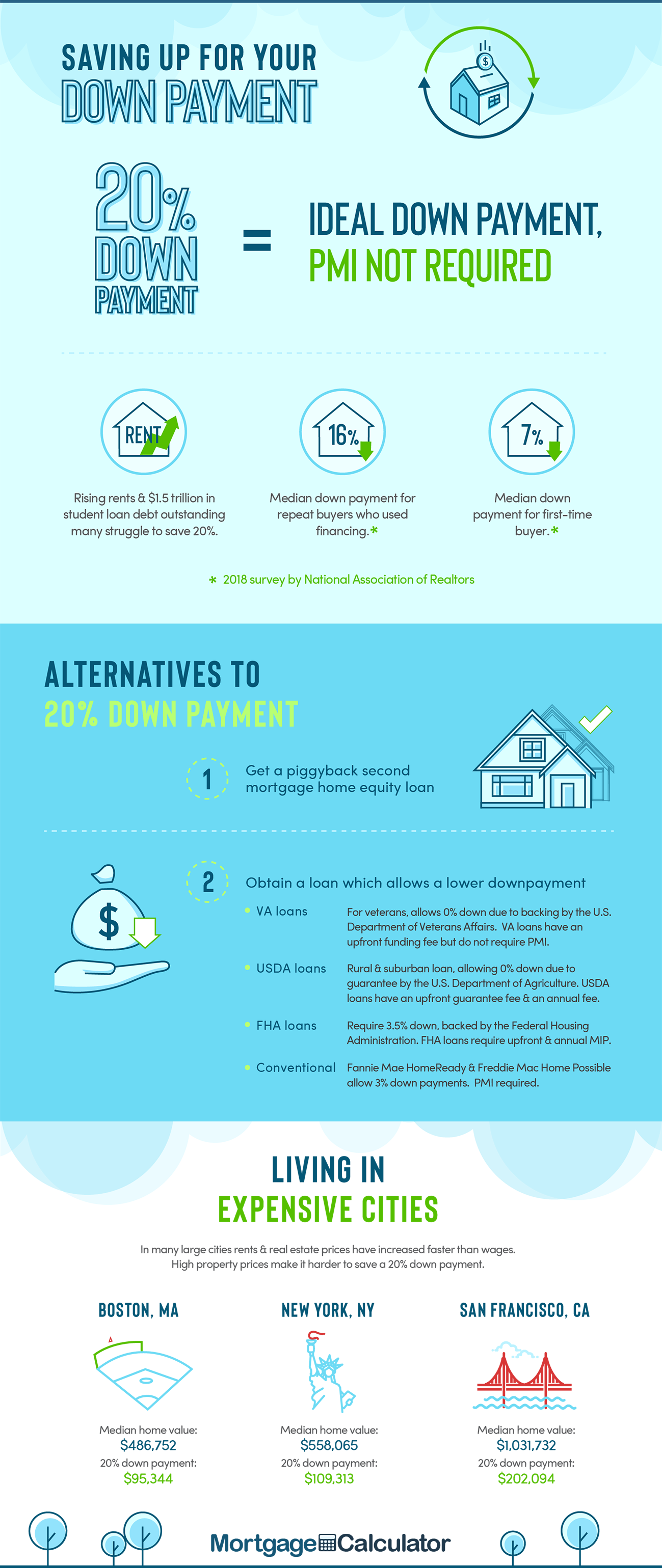

Whether you�ll need to pay a down payment or not, there are other expenses to take. One of the first costs you’ll come across is a home inspection. Learn about the home buying process, determine how much home you can afford, identify and overcome barriers to homeownership, and receive a comprehensive home buyer’s guidebook. It’s not everyday that most people buy a home. The first time buyer program in minnesota helps you do exactly that, so you can select the right home for yourself and/or your family.

Source: mortgagecalculator.org

Source: mortgagecalculator.org

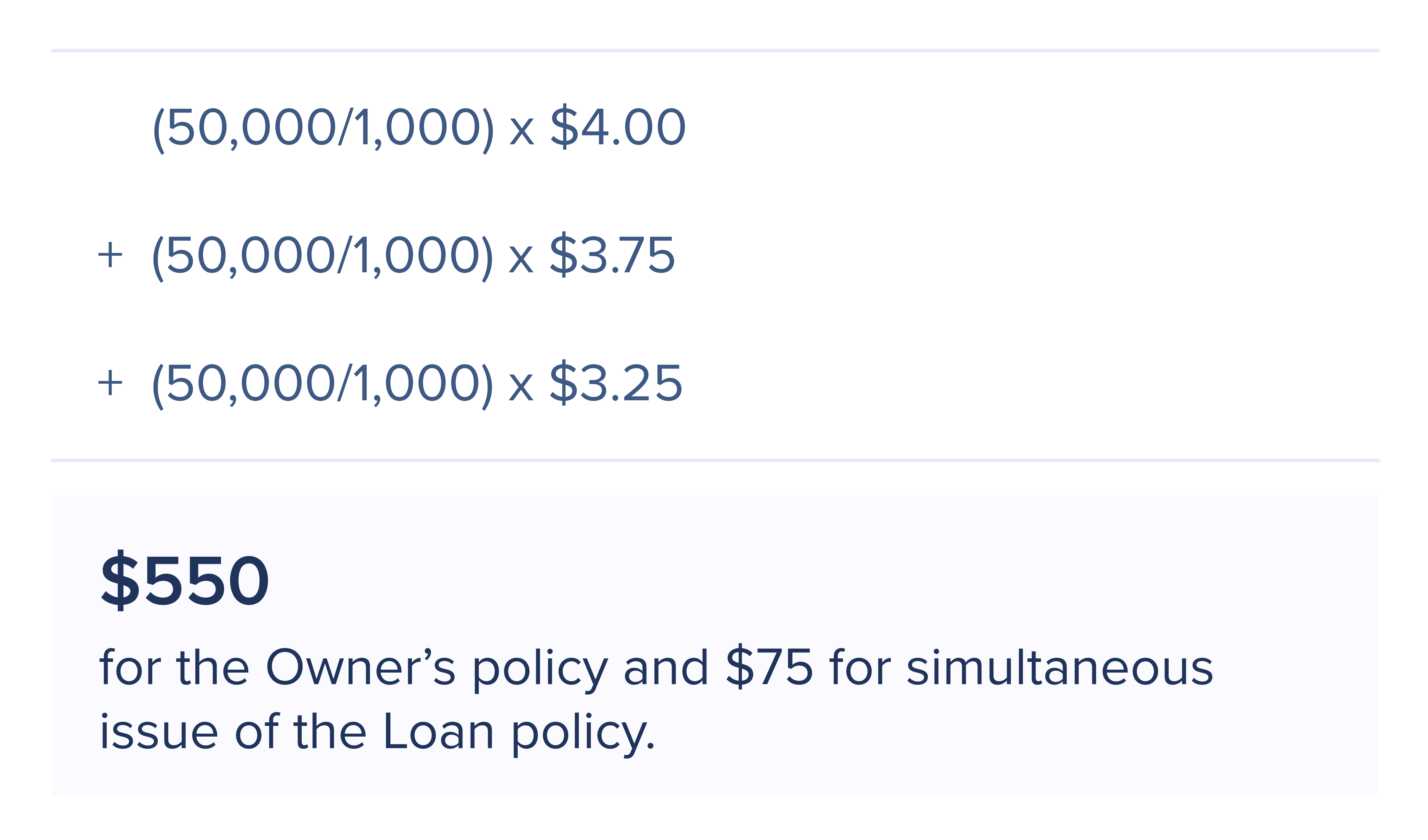

Costs to expect when buying a home in minnesota. Whether you�ll need to pay a down payment or not, there are other expenses to take. It’s not everyday that most people buy a home. City of richfield first time homebuyer program minnesota housing first time homebuyer programs • downpayment loans up to $15,000 • low interest mortgage products • visit for more info it’s easy to get started! This simple calculator can tell if might an eligible homebuyer.

Source: themortgagereports.com

Source: themortgagereports.com

This simple calculator can tell if might an eligible homebuyer. The city of richfield and minnesota housing can help you with your downpayment! Calculate your home equity loan payment or home equity line of credit payment. First time home buyer program is a generalize term used for to describe many different home mortgage loan programs, but essentially it means you get a little something special in a mortgage loan program because you never owned a home previously, or have not owned a home in the last three years, or to promote home ownership in certain target areas, usually inner cities. Learn about the home buying process, determine how much home you can afford, identify and overcome barriers to homeownership, and receive a comprehensive home buyer’s guidebook.

Source: upnest.com

Source: upnest.com

This is when you find a home you’d like to buy. The only way to know for sure if you qualify or not is to apply by contacting sdhda or a participating lender. Costs to expect when buying a home in minnesota. Learn about the home buying process, determine how much home you can afford, identify and overcome barriers to homeownership, and receive a comprehensive home buyer’s guidebook. The city of richfield and minnesota housing can help you with your downpayment!

Source: fha.com

Source: fha.com

Calculate your home equity loan payment or home equity line of credit payment. The only way to know for sure if you qualify or not is to apply by contacting sdhda or a participating lender. Learn about the home buying process, determine how much home you can afford, identify and overcome barriers to homeownership, and receive a comprehensive home buyer’s guidebook. One of the first costs you’ll come across is a home inspection. The city of richfield and minnesota housing can help you with your downpayment!

Source: minnesotafirsttimehomebuyer.com

Source: minnesotafirsttimehomebuyer.com

Costs to expect when buying a home in minnesota. Free mortgage calculator mn take advantage of your home equity: This simple calculator can tell if might an eligible homebuyer. The city of richfield and minnesota housing can help you with your downpayment! First time home buyer program is a generalize term used for to describe many different home mortgage loan programs, but essentially it means you get a little something special in a mortgage loan program because you never owned a home previously, or have not owned a home in the last three years, or to promote home ownership in certain target areas, usually inner cities.

Source: mortgagecalculator.org

Source: mortgagecalculator.org

Learn about the home buying process, determine how much home you can afford, identify and overcome barriers to homeownership, and receive a comprehensive home buyer’s guidebook. First time home buyer program is a generalize term used for to describe many different home mortgage loan programs, but essentially it means you get a little something special in a mortgage loan program because you never owned a home previously, or have not owned a home in the last three years, or to promote home ownership in certain target areas, usually inner cities. See how the balance of a reverse mortgage increases over time, comparing monthly advances to a. This is when you find a home you’d like to buy. The first time buyer program in minnesota helps you do exactly that, so you can select the right home for yourself and/or your family.

Source: mortgagecalculator.org

Source: mortgagecalculator.org

Calculate your home equity loan payment or home equity line of credit payment. There is no end date specified, and the $15,000 tax. Learn about the home buying process, determine how much home you can afford, identify and overcome barriers to homeownership, and receive a comprehensive home buyer’s guidebook. This is when you find a home you’d like to buy. If the answer is more than three years, you may qualify (again) as a first time buyer!

Source: mymortgageinsider.com

Source: mymortgageinsider.com

Free mortgage calculator mn take advantage of your home equity: This can be a critically important step to home ownership for people who have previously experienced foreclosure or divorce for example. See how the balance of a reverse mortgage increases over time, comparing monthly advances to a. This simple calculator can tell if might an eligible homebuyer. Costs to expect when buying a home in minnesota.

Source: minnesotafirsttimehomebuyer.com

Source: minnesotafirsttimehomebuyer.com

Mortgage information for minnesota first time home buyers. This can be a critically important step to home ownership for people who have previously experienced foreclosure or divorce for example. Mortgage information for minnesota first time home buyers. Find all available grant money, down payment assistance, and home buyer programs. The first time buyer program in minnesota helps you do exactly that, so you can select the right home for yourself and/or your family.

Source: anytimeestimate.com

Source: anytimeestimate.com

If the answer is more than three years, you may qualify (again) as a first time buyer! Costs to expect when buying a home in minnesota. Find all available grant money, down payment assistance, and home buyer programs. This simple calculator can tell if might an eligible homebuyer. It’s not everyday that most people buy a home.

Source: useelko.com

Source: useelko.com

Costs to expect when buying a home in minnesota. First time home buyer program is a generalize term used for to describe many different home mortgage loan programs, but essentially it means you get a little something special in a mortgage loan program because you never owned a home previously, or have not owned a home in the last three years, or to promote home ownership in certain target areas, usually inner cities. Learn about the home buying process, determine how much home you can afford, identify and overcome barriers to homeownership, and receive a comprehensive home buyer’s guidebook. This can be a critically important step to home ownership for people who have previously experienced foreclosure or divorce for example. One of the first costs you’ll come across is a home inspection.

Source: mortgagecalculator.org

Source: mortgagecalculator.org

The first time buyer program in minnesota helps you do exactly that, so you can select the right home for yourself and/or your family. City of richfield first time homebuyer program minnesota housing first time homebuyer programs • downpayment loans up to $15,000 • low interest mortgage products • visit for more info it’s easy to get started! Whether you�ll need to pay a down payment or not, there are other expenses to take. See how the balance of a reverse mortgage increases over time, comparing monthly advances to a. The only way to know for sure if you qualify or not is to apply by contacting sdhda or a participating lender.

Source: useelko.com

Source: useelko.com

Learn about the home buying process, determine how much home you can afford, identify and overcome barriers to homeownership, and receive a comprehensive home buyer’s guidebook. It’s not everyday that most people buy a home. Find all available grant money, down payment assistance, and home buyer programs. The program applies to all homes purchased beginning january 1, 2021. Whether you�ll need to pay a down payment or not, there are other expenses to take.

Source: mortgagecalculator.org

Source: mortgagecalculator.org

Costs to expect when buying a home in minnesota. This can be a critically important step to home ownership for people who have previously experienced foreclosure or divorce for example. Lino lakes real estate for sale brought to you by the homes of minnesota team, effective twin cities realtors specializing in first time home buyer representation. Aside from the standard loan types above, certain minnesota buyers may qualify for a home loan through the. To qualify a buyer must generally meet.

Source: mortgagecalculator.org

Source: mortgagecalculator.org

City of richfield first time homebuyer program minnesota housing first time homebuyer programs • downpayment loans up to $15,000 • low interest mortgage products • visit for more info it’s easy to get started! Free mortgage calculator mn take advantage of your home equity: The first time buyer program in minnesota helps you do exactly that, so you can select the right home for yourself and/or your family. The city of richfield and minnesota housing can help you with your downpayment! Whether you�ll need to pay a down payment or not, there are other expenses to take.

Source: themortgagereports.com

Source: themortgagereports.com

One of the first costs you’ll come across is a home inspection. Learn about the home buying process, determine how much home you can afford, identify and overcome barriers to homeownership, and receive a comprehensive home buyer’s guidebook. First time home buyer program is a generalize term used for to describe many different home mortgage loan programs, but essentially it means you get a little something special in a mortgage loan program because you never owned a home previously, or have not owned a home in the last three years, or to promote home ownership in certain target areas, usually inner cities. To qualify a buyer must generally meet. The only way to know for sure if you qualify or not is to apply by contacting sdhda or a participating lender.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title first time home buyer mn calculator by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.