Your First time home buyer mn bad credit images are available. First time home buyer mn bad credit are a topic that is being searched for and liked by netizens today. You can Download the First time home buyer mn bad credit files here. Find and Download all free vectors.

If you’re looking for first time home buyer mn bad credit images information linked to the first time home buyer mn bad credit keyword, you have come to the right blog. Our site frequently provides you with hints for seeing the maximum quality video and image content, please kindly hunt and find more informative video articles and images that match your interests.

First Time Home Buyer Mn Bad Credit. What this program does is help first time home buyers purchase a home in areas hit by foreclosures. First time home buyers with bad credit can get loans easily because there are also mortgage lenders who run mortgage programs for the first time home buyer programs with bad credit. The idea of buying a home for the first time will fill anybody with a mixture of excitement and anxiety. A buyer with a roommate, boarder, or other supplemental rental income;

Tips For First-time Home Buyers What You Must Know Before You Buy From thetruthaboutmortgage.com

Tips For First-time Home Buyers What You Must Know Before You Buy From thetruthaboutmortgage.com

In 12 months you’ll have a good credit history built up. Please note that all programs listed on this. Find more information and map of targeted area census tracts. Trouble as a first time home buyer with bad credit We are minnesota and wisconsin�s premier mortgage lender. Our combination of loan programs, rates, and services are unsurpassed in the marketplace.

We provide all zero down, low down 1st time buyer assistance, bond, grant, aid, city, county, state, programs.

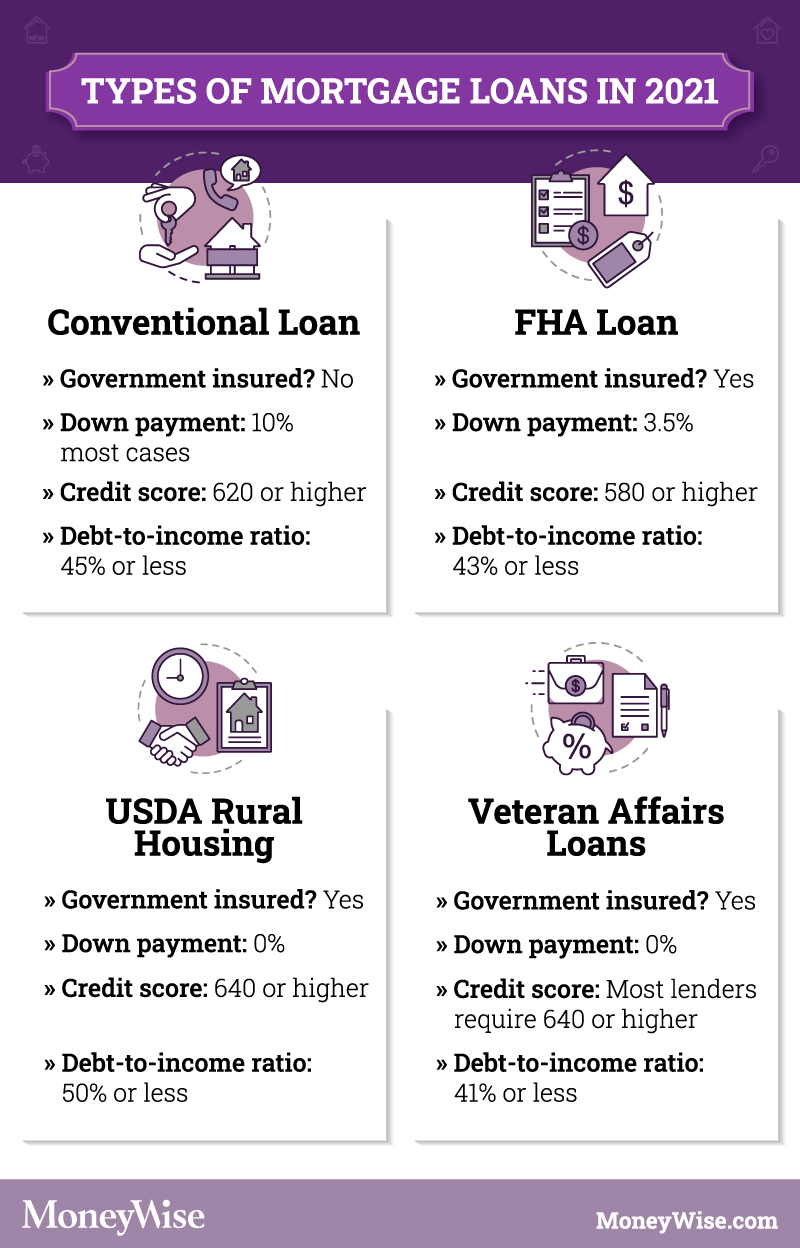

Borrowers need just a 3% down payment. Contact us for a personalized home mortgage loan. When you have already started to make a decision to buy a house, you need to look at your pocket. Find lenders offering 1st time home loans for people with poor credit. Find out if you’re eligible and how to apply. Folks with limited cash for down payment, and a credit score of 620 or up.

Source: thetruthaboutmortgage.com

Source: thetruthaboutmortgage.com

In 12 months you’ll have a good credit history built up. Income cannot exceed 100% of the area median income (ami). Our combination of loan programs, rates, and services are unsurpassed in the marketplace. What this program does is help first time home buyers purchase a home in areas hit by foreclosures. Consumers have access to one free credit score per year at freecreditscore.com;

Source: c4dcrew.com

Source: c4dcrew.com

First time home buyers with bad credit can get loans easily because there are also mortgage lenders who run mortgage programs for the first time home buyer programs with bad credit. Inside the first time homebuyers guide to mn you’ll also find information about the minneapolis advantage program or map. Increase your $10,000 lines to $15,000,you’re your $4500 usage will yield a 30 percent rate, and that will raise your score. Learn more about fha loan requirements. List of down payment assistance programs.

Source: time.com

Source: time.com

A first time home buyer with bad credit might need to place a substantially higher down payment on their house than others who have had mortgages previously or who have a more polished credit score. Find more information and map of targeted area census tracts. If you are a looking for a first time home loan for people with poor credit, hmbc is a great place to start. Down payment assistance programs generally assist you by offering small loans to cover part of your required down payment. While limited to specific neighborhoods these loans are on a first come first serve basis.

Source: thetruthaboutmortgage.com

Source: thetruthaboutmortgage.com

Working with one of minnesota housing’s participating lenders, you can determine which loan best suits your needs and apply for assistance. Please note that all programs listed on this. We provide all zero down, low down 1st time buyer assistance, bond, grant, aid, city, county, state, programs. First time home buying can be stressful, but if you have bad credit there are significant challenges in qualifying to finance the home as well. First time home buyer specialists.

Source: pinterest.com

Source: pinterest.com

A buyer with a roommate, boarder, or other supplemental rental income; If you are a looking for a first time home loan for people with poor credit, hmbc is a great place to start. We are minnesota and wisconsin�s premier mortgage lender. A buyer with a roommate, boarder, or other supplemental rental income; Borrowers need just a 3% down payment.

Source: directmortgageloans.com

Source: directmortgageloans.com

Much like the interest rate, a lender can use your down payment to give themselves a greater degree of security when it comes to issuing your loan. A buyer with a roommate, boarder, or other supplemental rental income; First time home buyer specialists. Working with one of minnesota housing’s participating lenders, you can determine which loan best suits your needs and apply for assistance. As mentioned above, fha loans are for anyone looking to purchase a home, not just first time home buyers in minnesota.

Source: myservion.com

Source: myservion.com

Inside the first time homebuyers guide to mn you’ll also find information about the minneapolis advantage program or map. Inside the first time homebuyers guide to mn you’ll also find information about the minneapolis advantage program or map. The idea of buying a home for the first time will fill anybody with a mixture of excitement and anxiety. Learn more about fha loan requirements. Borrowers must also attend a homebuyer.

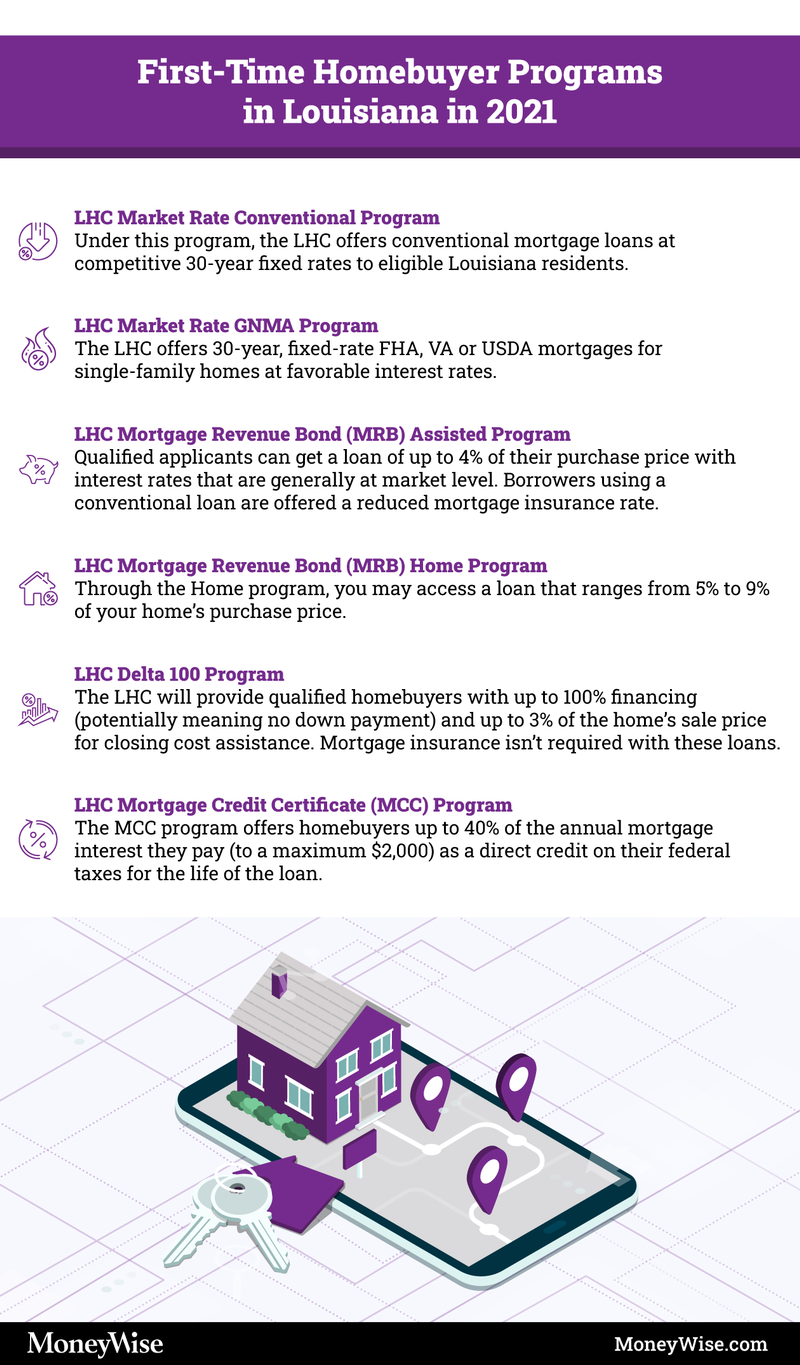

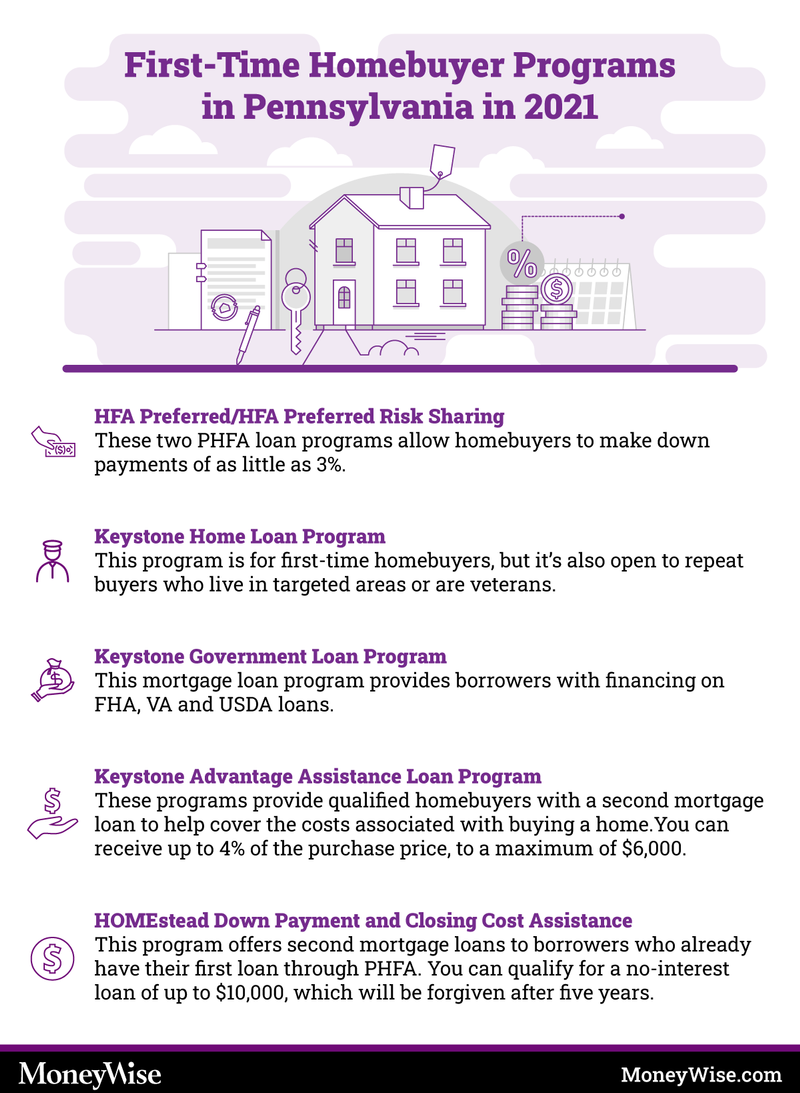

Source: moneywise.com

Source: moneywise.com

In 12 months you’ll have a good credit history built up. Income cannot exceed 100% of the area median income (ami). One easy way to lower that ratio without paying down your cards is to get a credit line increase. Please note that all programs listed on this. A buyer with a roommate, boarder, or other supplemental rental income;

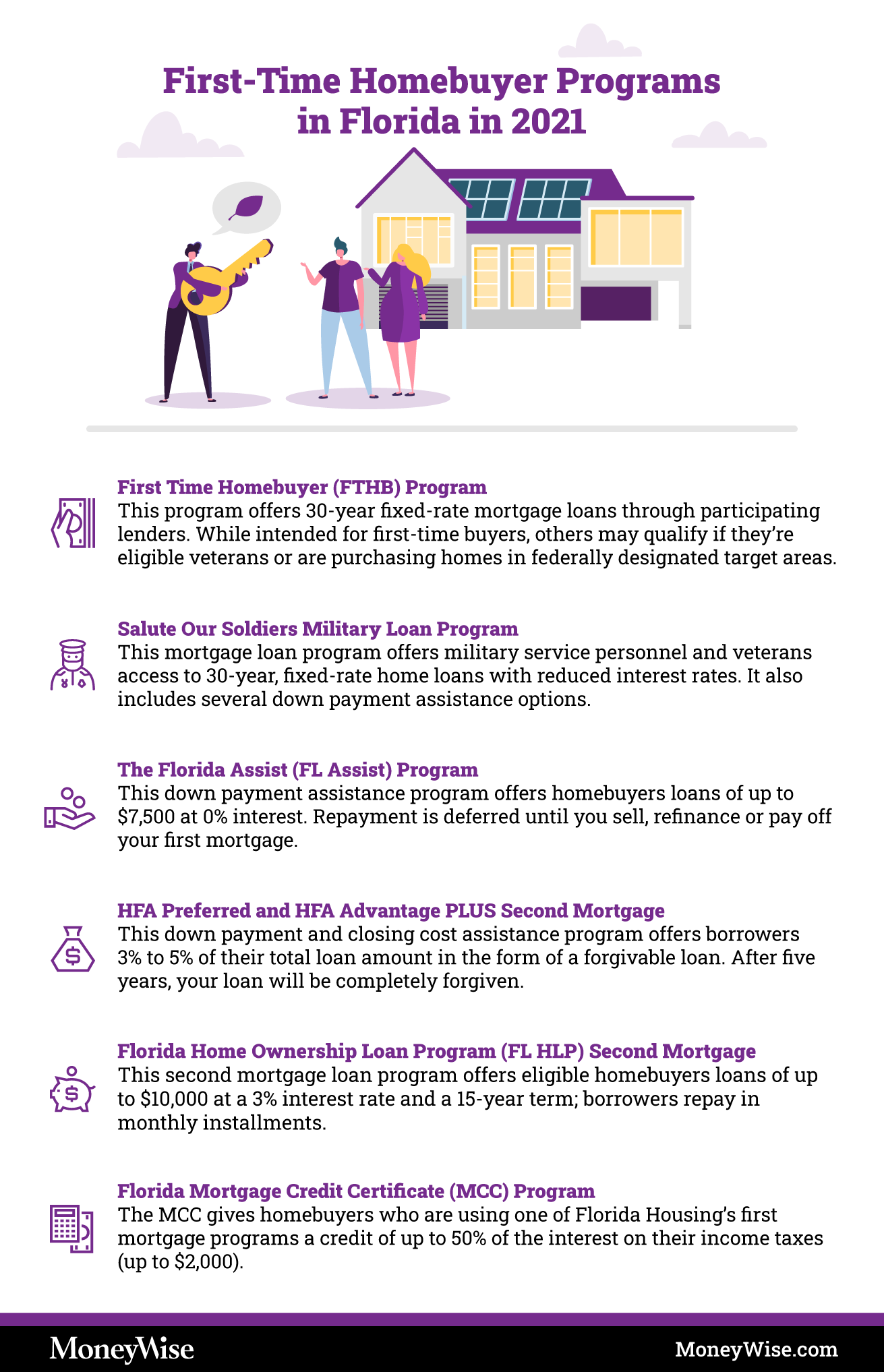

Source: moneywise.com

Source: moneywise.com

Increase your $10,000 lines to $15,000,you’re your $4500 usage will yield a 30 percent rate, and that will raise your score. List of down payment assistance programs. First time home buyers with bad credit can get loans easily because there are also mortgage lenders who run mortgage programs for the first time home buyer programs with bad credit. Find out if you’re eligible and how to apply. The excitement part comes from knowing that you could soon be.

Source: moneywise.com

Source: moneywise.com

Inside the first time homebuyers guide to mn you’ll also find information about the minneapolis advantage program or map. Find lenders offering 1st time home loans for people with poor credit. Our combination of loan programs, rates, and services are unsurpassed in the marketplace. Increase your $10,000 lines to $15,000,you’re your $4500 usage will yield a 30 percent rate, and that will raise your score. We provide all zero down, low down 1st time buyer assistance, bond, grant, aid, city, county, state, programs.

Source: moneywise.com

Source: moneywise.com

Income cannot exceed 100% of the area median income (ami). If you are a looking for a first time home loan for people with poor credit, hmbc is a great place to start. One piece of advice shared in our office is this: Find more information and map of targeted area census tracts. Cambria mortgage partners with the minnesota housing finance agency (mhfa) to provide down payment assistance loans to minnesota first time home buyers.

Source: moneywise.com

Source: moneywise.com

Working with one of minnesota housing’s participating lenders, you can determine which loan best suits your needs and apply for assistance. One piece of advice shared in our office is this: Consumers have access to one free credit score per year at freecreditscore.com; We are minnesota and wisconsin�s premier mortgage lender. Learn about the 6 credit mistakes first time home buyers should avoid so you can become a.

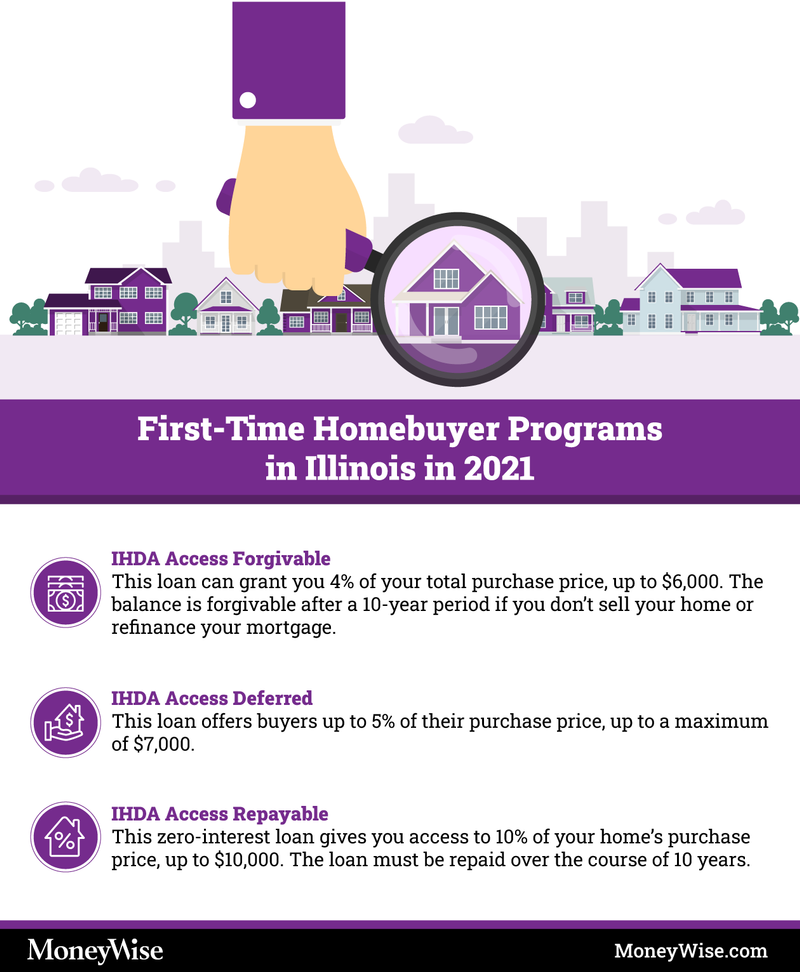

Source: tchabitat.org

Source: tchabitat.org

First time home buying can be stressful, but if you have bad credit there are significant challenges in qualifying to finance the home as well. The idea of buying a home for the first time will fill anybody with a mixture of excitement and anxiety. As mentioned above, fha loans are for anyone looking to purchase a home, not just first time home buyers in minnesota. If you are interested in purchasing a home, most times credit along with income is the deciding factor. Folks with limited cash for down payment, and a credit score of 620 or up.

Source: pinterest.com

Source: pinterest.com

Cambria mortgage partners with the minnesota housing finance agency (mhfa) to provide down payment assistance loans to minnesota first time home buyers. In 12 months you’ll have a good credit history built up. Increase your $10,000 lines to $15,000,you’re your $4500 usage will yield a 30 percent rate, and that will raise your score. If you are interested in purchasing a home, most times credit along with income is the deciding factor. Contact us for a personalized home mortgage loan.

Source: mlsmortgage.com

Source: mlsmortgage.com

The idea of buying a home for the first time will fill anybody with a mixture of excitement and anxiety. If you are interested in purchasing a home, most times credit along with income is the deciding factor. Your credit score will be higher if you can keep the ratio below 33 percent. The federal housing administration continues to be the most popular loan for first time home. One easy way to lower that ratio without paying down your cards is to get a credit line increase.

Source: fha.com

Source: fha.com

When you have already started to make a decision to buy a house, you need to look at your pocket. While limited to specific neighborhoods these loans are on a first come first serve basis. Find out if you’re eligible and how to apply. With this new first time home buyer program you can purchase a home in minnesota regardless of your credit score! Increase your $10,000 lines to $15,000,you’re your $4500 usage will yield a 30 percent rate, and that will raise your score.

Source: moneywise.com

Source: moneywise.com

If you are interested in purchasing a home, most times credit along with income is the deciding factor. Our combination of loan programs, rates, and services are unsurpassed in the marketplace. A buyer with a roommate, boarder, or other supplemental rental income; Find more information and map of targeted area census tracts. Borrowers must also attend a homebuyer.

Source: id.pinterest.com

Source: id.pinterest.com

Borrowers need just a 3% down payment. The federal housing administration continues to be the most popular loan for first time home. Your credit score will be higher if you can keep the ratio below 33 percent. In 12 months you’ll have a good credit history built up. List of down payment assistance programs.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title first time home buyer mn bad credit by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.