Your First time home buyer missouri grants images are ready. First time home buyer missouri grants are a topic that is being searched for and liked by netizens today. You can Get the First time home buyer missouri grants files here. Find and Download all royalty-free photos.

If you’re looking for first time home buyer missouri grants images information linked to the first time home buyer missouri grants interest, you have visit the right site. Our website frequently gives you hints for downloading the maximum quality video and image content, please kindly search and find more informative video articles and images that fit your interests.

First Time Home Buyer Missouri Grants. They come with lower interest rates, but the biggest benefit is a low down payment requirement. Some of these loan options are but not limited to: Mdhc loans, home possible, fannie mae home ready and city of columbia grant money. The second mortgage will diminish after year five by 1/60 every month until year 10 when it.

Missouri First Time Home Buyer Programs From firsthomebuyers.net

Missouri First Time Home Buyer Programs From firsthomebuyers.net

The first home owner grant (fhog) scheme was introduced on 1 july 2000 to offset the effect of the gst on home ownership. Check out fha and va rates as well if you are doing low or no down payments. Welcome to the missouri down payment assistance grants page for first time home buyers. When you are buying your very first home it can just be overwhelming. (funding is not provided directly by the city of independence, mo) lien information A slightly better interest rate for homes purchased in opportunity areas;

Visit the mhdc website for addtional information.

The first home owner grant (fhog) scheme was introduced on 1 july 2000 to offset the effect of the gst on home ownership. It’s a great primer for learning about your first home purchase! The first home owner grant (fhog) scheme was introduced on 1 july 2000 to offset the effect of the gst on home ownership. According to the latest research, with an average household income of $46,867.00 per year, only 71.40% of the population paid off their mortgages on their homes. Incentives, programs and grants these first time home buyer programs in missouri make purchasing your first home a breeze! First time home buyer missouri 💲 nov 2021.

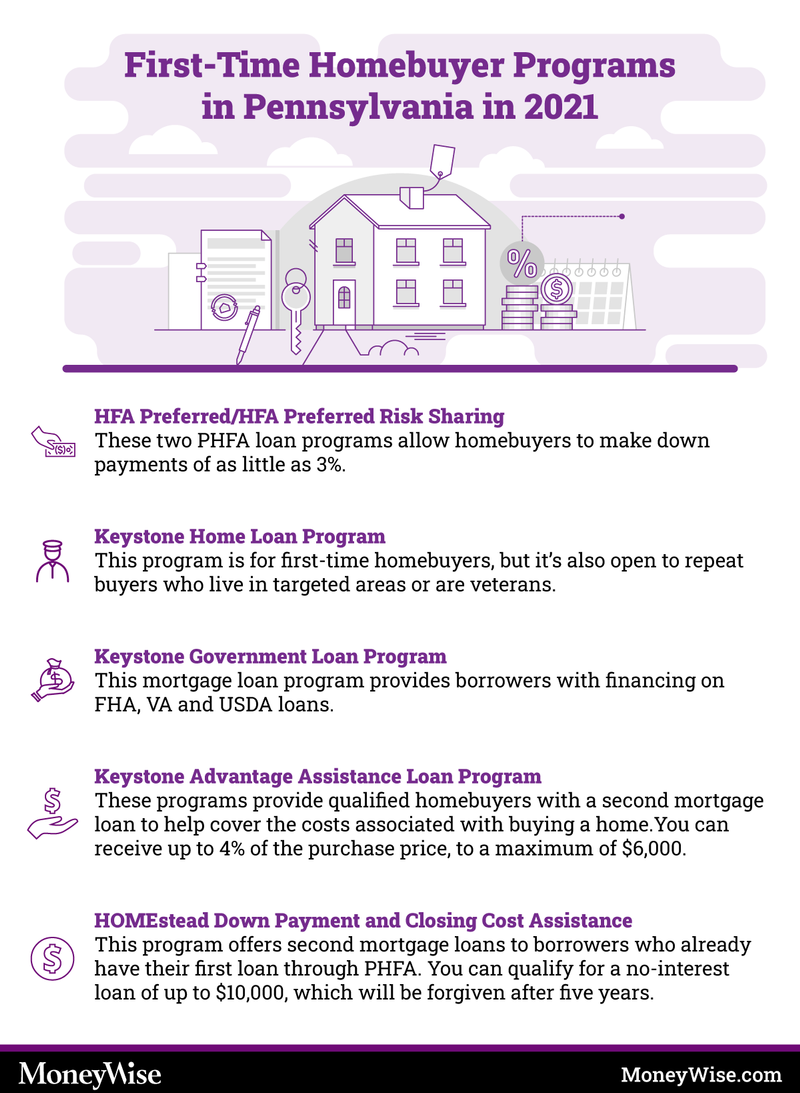

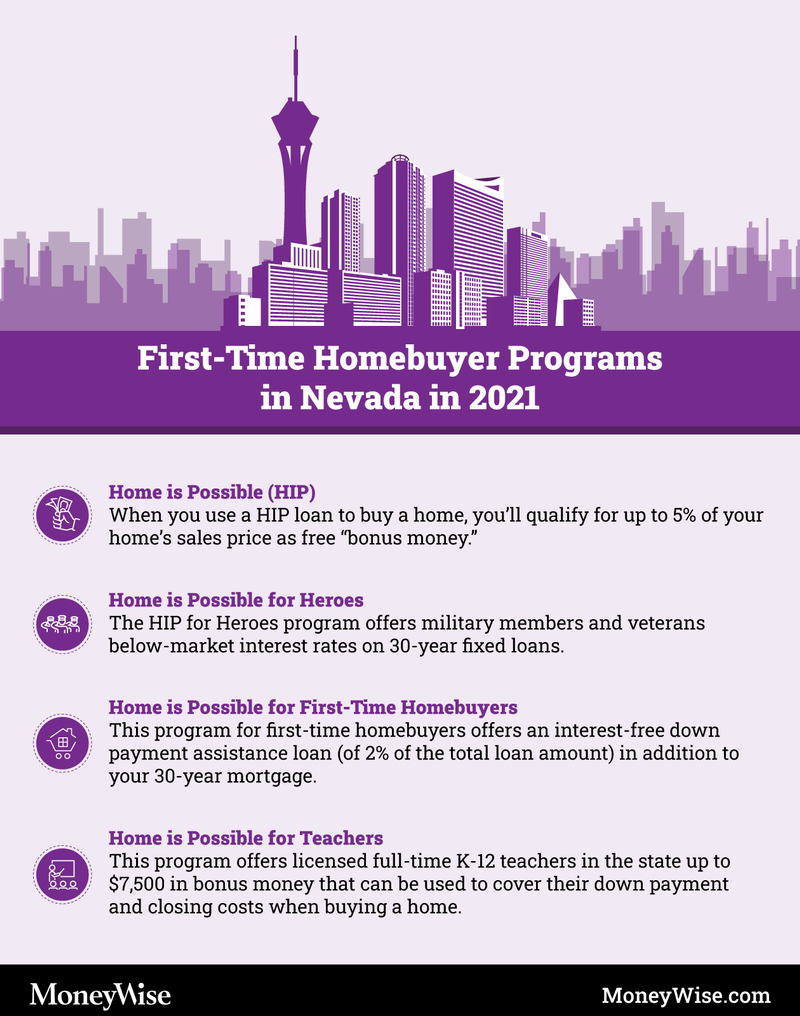

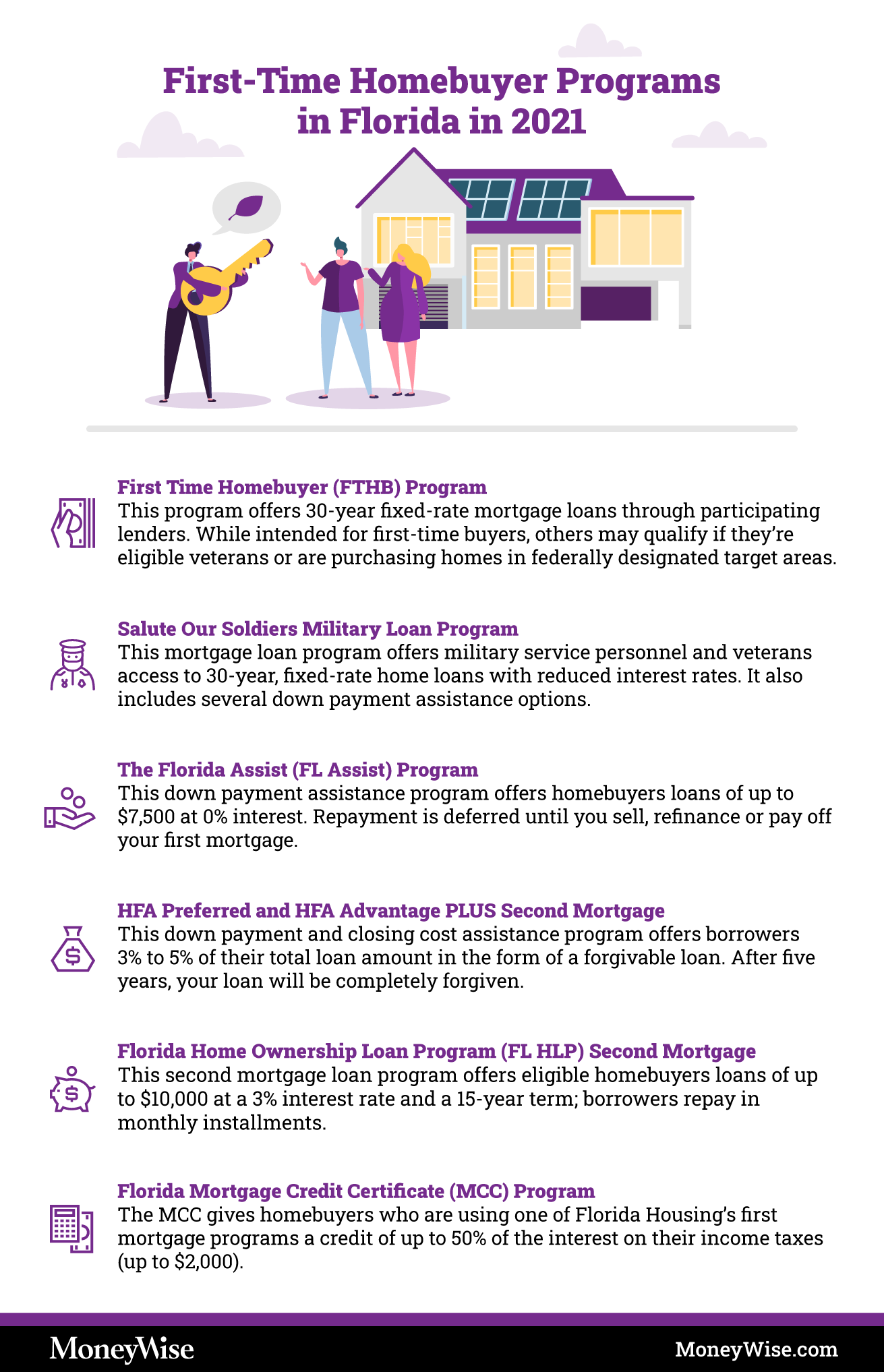

Source: moneywise.com

Source: moneywise.com

Check out fha and va rates as well if you are doing low or no down payments. First place loan mhdc provides a grant for the down payment assistance, up to 4%, of the final mortgage. We’re glad you’ve made your way here! It is a national scheme funded by the states and territories and administered under their own legislation. First time home buyer missouri:

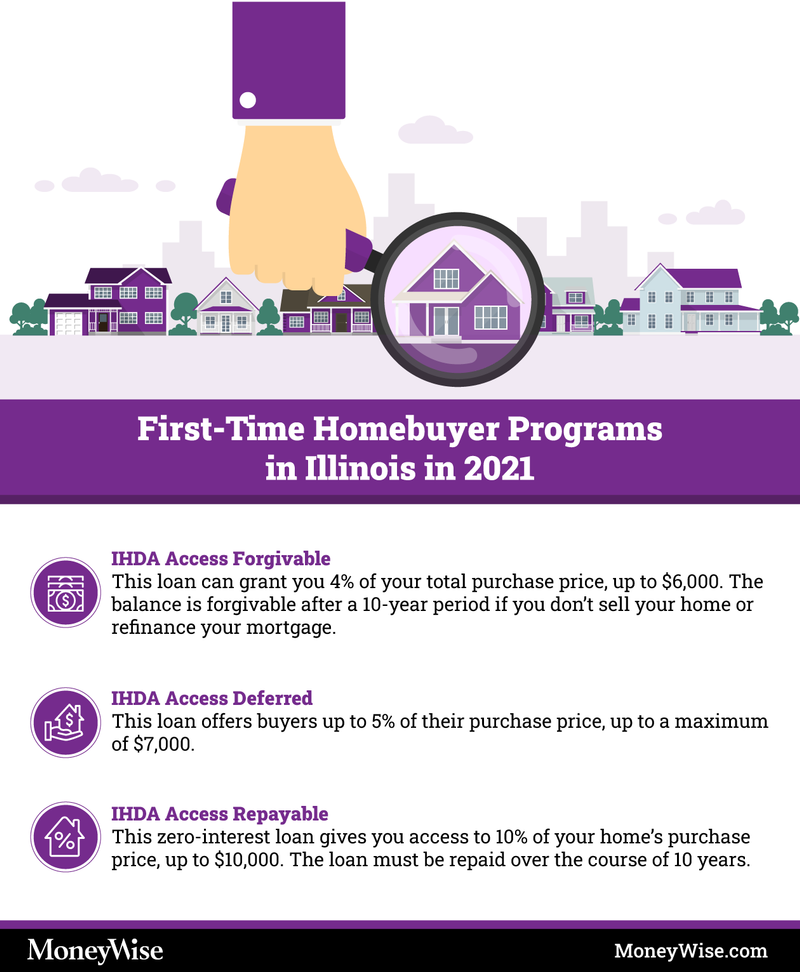

Source: moneywise.com

Source: moneywise.com

The first home owner grant (fhog) scheme was introduced on 1 july 2000 to offset the effect of the gst on home ownership. Affordable interest rates, in combination with additional incentives offered by mhdc, allow prospective buyers to obtain mortgage financing in a competitive market. Visit the mhdc website for addtional information. The second mortgage will be forgiven if the borrower stays in the home/loan for ten years. Some of these loan options are but not limited to:

Source: thetruthaboutmortgage.com

Source: thetruthaboutmortgage.com

Mortgagegrants.com provides a list of approved workshop dates and locations, along with hud certified housing counselors. As a first time home buyer, you should be sure to check out all of the valuable information available to you in our education section! According to the latest research, with an average household income of $46,867.00 per year, only 71.40% of the population paid off their mortgages on their homes. As for variable rates, the 5/1 arm rate currently stands at 4.56%. Independence first time home buyer program.

Source: pinterest.com

Source: pinterest.com

As for variable rates, the 5/1 arm rate currently stands at 4.56%. Affordable interest rates, in combination with additional incentives offered by mhdc, allow prospective buyers to obtain mortgage financing in a competitive market. As a first time home buyer, you should be sure to check out all of the valuable information available to you in our education section! There are many mortgage programs available for both first time home buyers and also the experienced home buyers in the state of missouri. It’s a great primer for learning about your first home purchase!

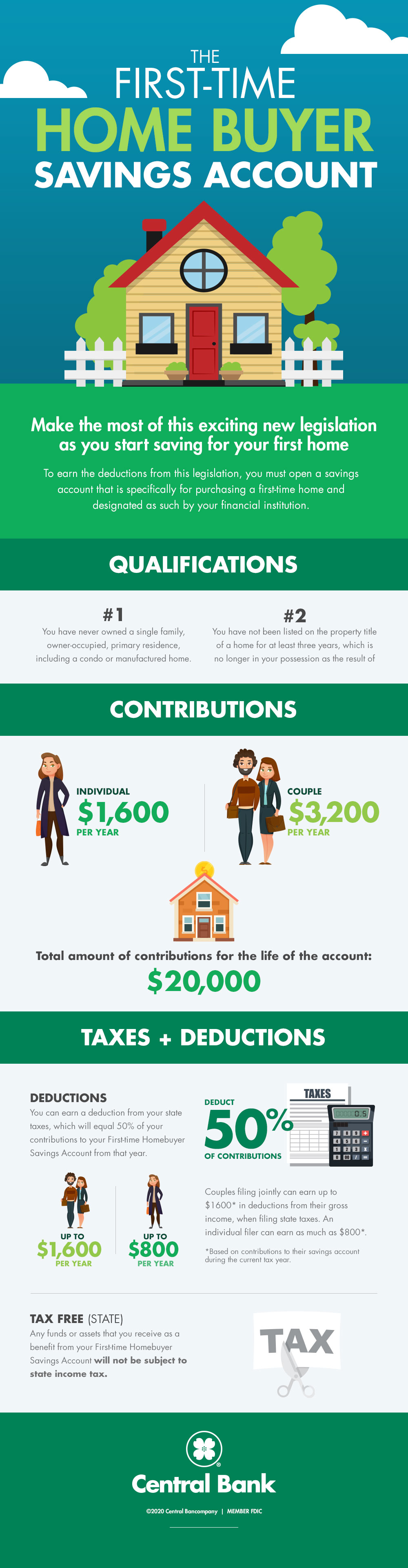

Source: centralbank.net

Source: centralbank.net

First time home buyer missouri: The second mortgage will diminish after year five by 1/60 every month until year 10 when it. Affordable interest rates, in combination with additional incentives offered by mhdc, allow prospective buyers to obtain mortgage financing in a competitive market. There are many mortgage programs available for both first time home buyers and also the experienced home buyers in the state of missouri. Most grants require potential home buyers to attend hud certified educational training and obtain a completion certificate.

Source: pinterest.com

Source: pinterest.com

Independence first time home buyer program. There are many mortgage programs available for both first time home buyers and also the experienced home buyers in the state of missouri. Mortgage rates are at 3.00% for the 30 year fixed loan program and at 2.56% for the 15 year fixed. Visit the mhdc website for addtional information. As a first time home buyer, you should be sure to check out all of the valuable information available to you in our education section!

Source: lowincomerelief.com

Source: lowincomerelief.com

As a first time home buyer, you should be sure to check out all of the valuable information available to you in our education section! Incentives, programs and grants these first time home buyer programs in missouri make purchasing your first home a breeze! First time home buyer programs. Usa mortgage has received a lot of. When you are buying your very first home it can just be overwhelming.

Source: id.pinterest.com

Source: id.pinterest.com

Affordable interest rates, in combination with additional incentives offered by mhdc, allow prospective buyers to obtain mortgage financing in a competitive market. The second mortgage will diminish after year five by 1/60 every month until year 10 when it. Incentives, programs and grants these first time home buyer programs in missouri make purchasing your first home a breeze! Most grants require potential home buyers to attend hud certified educational training and obtain a completion certificate. As for variable rates, the 5/1 arm rate currently stands at 4.56%.

Buying a home can always be stressful. First place loan mhdc provides a grant for the down payment assistance, up to 4%, of the final mortgage. First time home buyer missouri: The second mortgage will be forgiven if the borrower stays in the home/loan for ten years. Incentives, programs and grants these first time home buyer programs in missouri make purchasing your first home a breeze!

Source: usdamortgagesource.com

Source: usdamortgagesource.com

Mortgagegrants.com provides a list of approved workshop dates and locations, along with hud certified housing counselors. Some of these loan options are but not limited to: Most grants require potential home buyers to attend hud certified educational training and obtain a completion certificate. They come with lower interest rates, but the biggest benefit is a low down payment requirement. Mortgagegrants.com provides a list of approved workshop dates and locations, along with hud certified housing counselors.

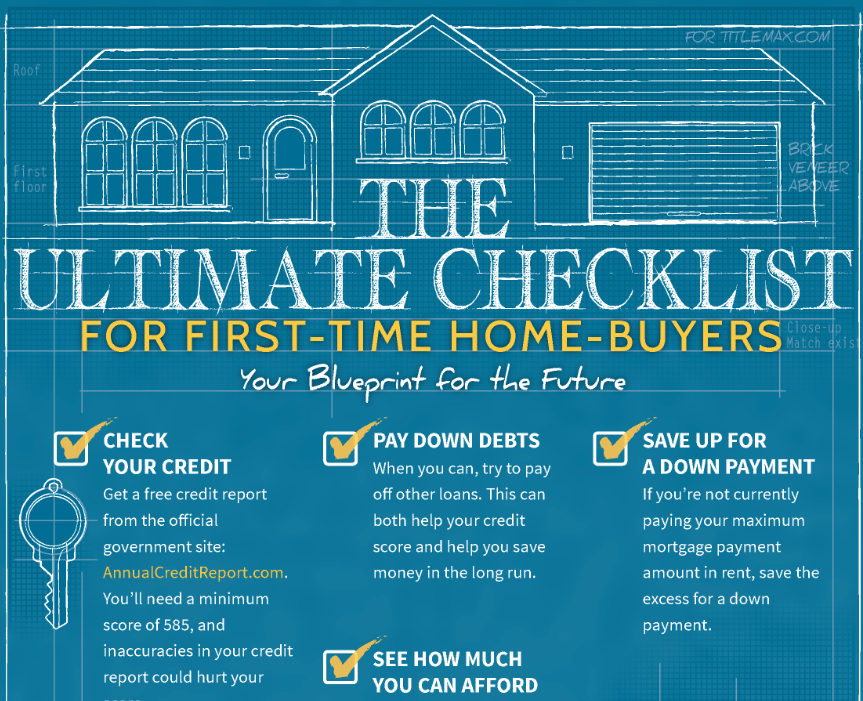

Source: titlemax.com

Source: titlemax.com

Today’s rates for first time homebuyers in missouri. The first home owner grant (fhog) scheme was introduced on 1 july 2000 to offset the effect of the gst on home ownership. Usa mortgage has received a lot of. Some of these loan options are but not limited to: Mdhc loans, home possible, fannie mae home ready and city of columbia grant money.

Source: newhomesource.com

Source: newhomesource.com

Visit the mhdc website for addtional information. Mdhc loans, home possible, fannie mae home ready and city of columbia grant money. A slightly better interest rate for homes purchased in opportunity areas; First time home buyer programs. Some of these loan options are but not limited to:

Source: pinterest.com

Source: pinterest.com

There are many mortgage programs available for both first time home buyers and also the experienced home buyers in the state of missouri. As for variable rates, the 5/1 arm rate currently stands at 4.56%. As a first time home buyer, you should be sure to check out all of the valuable information available to you in our education section! We’re glad you’ve made your way here! Check out fha and va rates as well if you are doing low or no down payments.

Source: moneywise.com

Source: moneywise.com

Independence first time home buyer program. Check out fha and va rates as well if you are doing low or no down payments. First time home buyer missouri 💲 nov 2021. It’s a great primer for learning about your first home purchase! Buying a home can always be stressful.

Source: newhomesource.com

Source: newhomesource.com

First time home buyer programs. Today’s rates for first time homebuyers in missouri. A slightly better interest rate for homes purchased in opportunity areas; When you are buying your very first home it can just be overwhelming. Usa mortgage goes above and beyond to bring as many as of first time home buyer loans and programs to its clients and referral partners.

Source: firsthomebuyers.net

Source: firsthomebuyers.net

Independence first time home buyer program. Visit the mhdc website for addtional information. There are many mortgage programs available for both first time home buyers and also the experienced home buyers in the state of missouri. It’s a great primer for learning about your first home purchase! Affordable interest rates, in combination with additional incentives offered by mhdc, allow prospective buyers to obtain mortgage financing in a competitive market.

Source: time.com

Source: time.com

First time home buyer programs. Welcome to the missouri down payment assistance grants page for first time home buyers. Mdhc loans, home possible, fannie mae home ready and city of columbia grant money. First time home buyer programs. Independence first time home buyer program.

Source: moneywise.com

Source: moneywise.com

According to the latest research, with an average household income of $46,867.00 per year, only 71.40% of the population paid off their mortgages on their homes. It’s a great primer for learning about your first home purchase! First time home buyer missouri: The first home owner grant (fhog) scheme was introduced on 1 july 2000 to offset the effect of the gst on home ownership. According to the latest research, with an average household income of $46,867.00 per year, only 71.40% of the population paid off their mortgages on their homes.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title first time home buyer missouri grants by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.