Your First time home buyer iowa tax credit 2020 images are available. First time home buyer iowa tax credit 2020 are a topic that is being searched for and liked by netizens now. You can Find and Download the First time home buyer iowa tax credit 2020 files here. Get all free photos.

If you’re looking for first time home buyer iowa tax credit 2020 images information linked to the first time home buyer iowa tax credit 2020 topic, you have come to the right blog. Our website always provides you with suggestions for seeing the maximum quality video and image content, please kindly hunt and find more enlightening video content and graphics that fit your interests.

First Time Home Buyer Iowa Tax Credit 2020. The loans have fewer mortgage fees, and your interest rate isn’t influenced by your credit score. The firsthomes tax credit is not a loan. The 2nd loan program offers a loan of up to 5% of the home’s sale price or $5,000, (whichever is less) and is repayable at time of sale, refinance or first mortgage paid in full. Check out our help article for more information on.

Property Tax Abatements From gostacey.com

The home must be occupied by the buyer as a primary residence within 60 days of closing. In the state’s largest county, polk county, a couple with an annual income of up to $75,000 could qualify for the credit on a home that was purchased for. You can claim this tax deduction on the mortgage interest you pay for up to 5 years after buying or building your first home. Ultimately, the tax credit is applied directly to your federal tax bill. In the case of household income less than 30 percent of the area median income (ami), individuals may also receive up to $25,000. The 2nd loan program offers a loan of up to 5% of the home’s sale price or $5,000, (whichever is less) and is repayable at time of sale, refinance or first mortgage paid in full.

However, this tax credit cannot exceed $15,000.

Ultimately, the tax credit is applied directly to your federal tax bill. The federal housing administration allows down payments as low as 3.5% for those with credit scores of 580 or. The down payment assistance grant provides home buyers with a $2,500 grant to assist with down payment and closing costs. You can claim this tax deduction on the mortgage interest you pay for up to 5 years after buying or building your first home. Although, the biden first time homebuyer tax credit is unique in that it’s retroactive to december 31, 2020. Check out our help article for more information on.

Source:

For this program, the household income limit is $141,680 and the purchase price limit is $360,000. For this program, the household income limit is $141,680 and the purchase price limit is $360,000. This means home buyers who have already purchased a home can file an amended tax return and receive a cash payout once the bill is passed. The firsthomes tax credit is not a loan. Could claim a tax credit equal to 10% of the purchase price of the tax residence during that tax year.

Source: directmortgageloans.com

Source: directmortgageloans.com

In the state’s largest county, polk county, a couple with an annual income of up to $75,000 could qualify for the credit on a home that was purchased for. All loans subject to a. This means home buyers who have already purchased a home can file an amended tax return and receive a cash payout once the bill is passed. (1) the date on which the individual is named as a designated beneficiary of a fthsa and (2) the date of the qualified home purchase for which. The account holder can make unlimited deposits each year to the homebuyer savings account.

Source: startingyourbusiness.com

Source: startingyourbusiness.com

This means home buyers who have already purchased a home can file an amended tax return and receive a cash payout once the bill is passed. This means home buyers who have already purchased a home can file an amended tax return and receive a cash payout once the bill is passed. The firsthomes tax credit is not a loan. Check out our help article for more information on. For this program, the household income limit is $141,680 and the purchase price limit is $360,000.

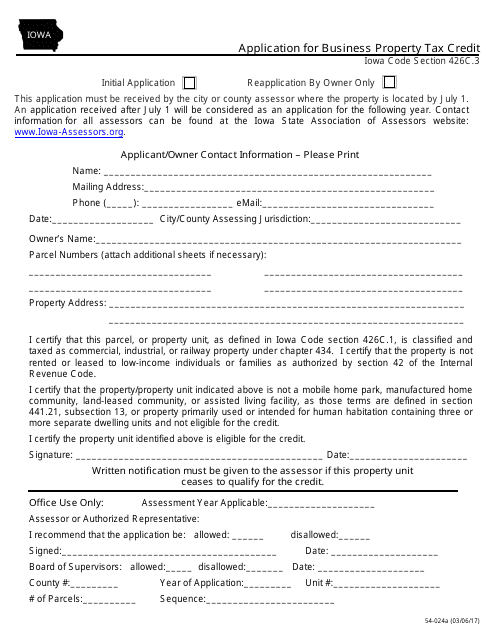

Source: templateroller.com

Source: templateroller.com

The firsthomes tax credit is not a loan. Could claim a tax credit equal to 10% of the purchase price of the tax residence during that tax year. The home must be occupied by the buyer as a primary residence within 60 days of closing. However, this tax credit cannot exceed $15,000. You can claim this tax deduction on the mortgage interest you pay for up to 5 years after buying or building your first home.

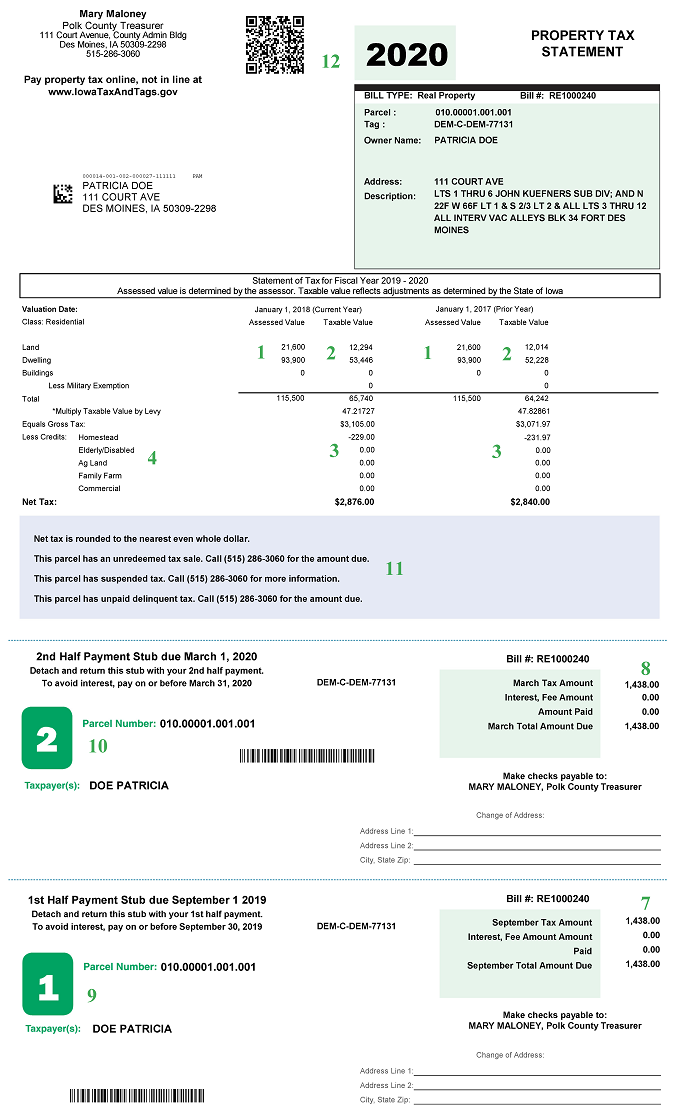

Source: polkcountyiowa.gov

Source: polkcountyiowa.gov

Check out our help article for more information on. However, this tax credit cannot exceed $15,000. (1) the date on which the individual is named as a designated beneficiary of a fthsa and (2) the date of the qualified home purchase for which. As of january 2015, you can reduce your annual income tax by up to $25,000. All loans subject to a.

Source: hrblock.com

Source: hrblock.com

As of january 2015, you can reduce your annual income tax by up to $25,000. (1) the date on which the individual is named as a designated beneficiary of a fthsa and (2) the date of the qualified home purchase for which. The 2nd loan program offers a loan of up to 5% of the home’s sale price or $5,000, (whichever is less) and is repayable at time of sale, refinance or first mortgage paid in full. In addition to loan and rate assistance programs, the iowa finance authority provides eligible homebuyers with a mortgage credit certificate to make homeownership even more affordable. You can claim this tax deduction on the mortgage interest you pay for up to 5 years after buying or building your first home.

Source: gosunpro.com

Source: gosunpro.com

The account holder can make unlimited deposits each year to the homebuyer savings account. The federal housing administration allows down payments as low as 3.5% for those with credit scores of 580 or. The account holder can make unlimited deposits each year to the homebuyer savings account. This means home buyers who have already purchased a home can file an amended tax return and receive a cash payout once the bill is passed. The down payment assistance grant provides home buyers with a $2,500 grant to assist with down payment and closing costs.

Source: polkcountyiowa.gov

Source: polkcountyiowa.gov

Check out our help article for more information on. All loans subject to a. In the case of household income less than 30 percent of the area median income (ami), individuals may also receive up to $25,000. (1) the date on which the individual is named as a designated beneficiary of a fthsa and (2) the date of the qualified home purchase for which. For this program, the household income limit is $141,680 and the purchase price limit is $360,000.

Source: gostacey.com

The federal housing administration allows down payments as low as 3.5% for those with credit scores of 580 or. The home must be occupied by the buyer as a primary residence within 60 days of closing. (1) the date on which the individual is named as a designated beneficiary of a fthsa and (2) the date of the qualified home purchase for which. The income tax deduction is limited to. Could claim a tax credit equal to 10% of the purchase price of the tax residence during that tax year.

Source: pinterest.com

Source: pinterest.com

The loans have fewer mortgage fees, and your interest rate isn’t influenced by your credit score. You can claim this tax deduction on the mortgage interest you pay for up to 5 years after buying or building your first home. The home must be occupied by the buyer as a primary residence within 60 days of closing. Although, the biden first time homebuyer tax credit is unique in that it’s retroactive to december 31, 2020. All loans subject to a.

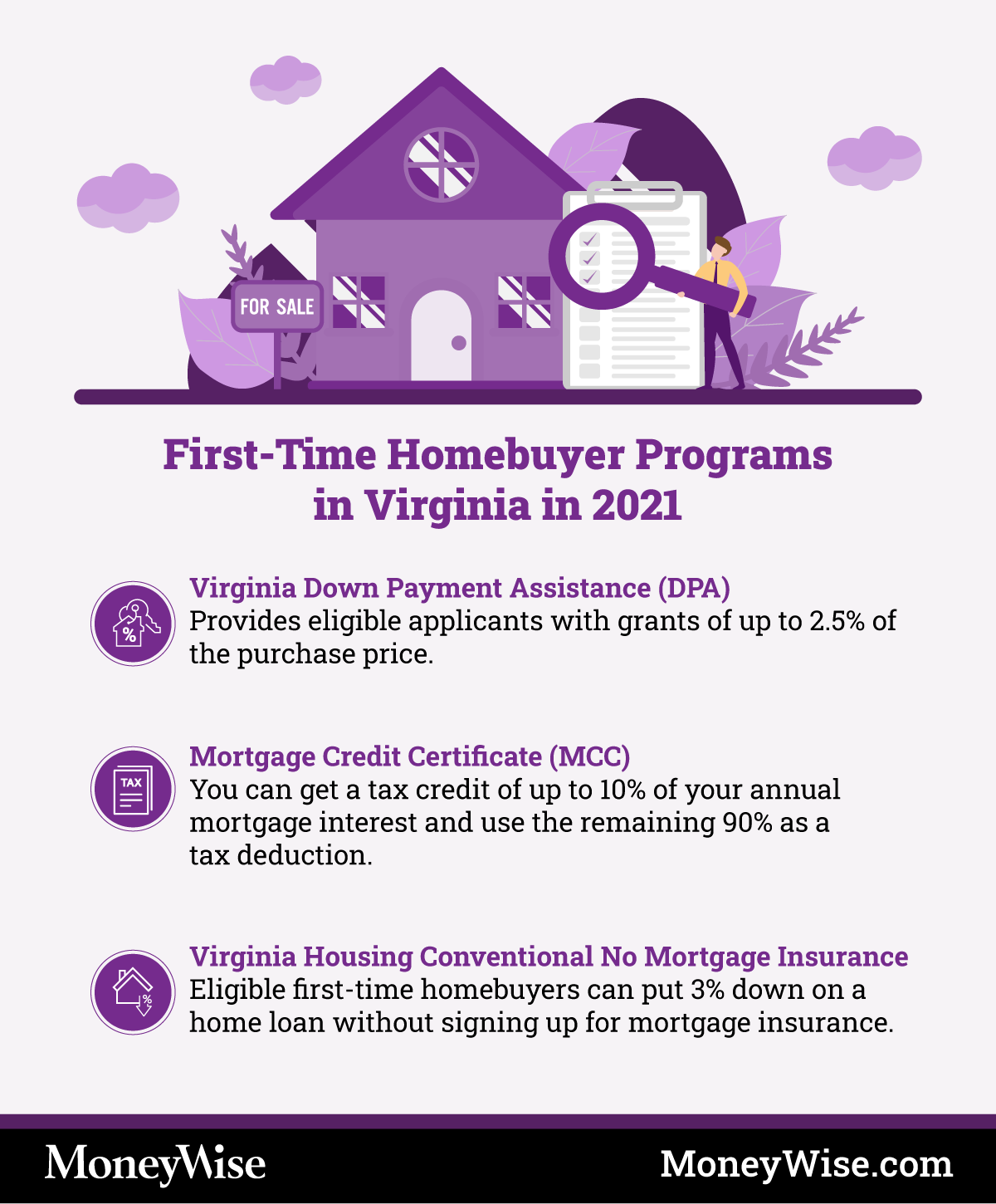

Source: moneywise.com

Source: moneywise.com

Check out our help article for more information on. Ultimately, the tax credit is applied directly to your federal tax bill. The firsthomes tax credit is not a loan. As of january 2015, you can reduce your annual income tax by up to $25,000. Through this program, borrowers receive an annual federal tax reduction equivalent to 50% of your mortgage interest up to $2,000 a year.

Source: howtostartanllc.com

Source: howtostartanllc.com

The down payment assistance grant provides home buyers with a $2,500 grant to assist with down payment and closing costs. Ultimately, the tax credit is applied directly to your federal tax bill. You can claim this tax deduction on the mortgage interest you pay for up to 5 years after buying or building your first home. The 2nd loan program offers a loan of up to 5% of the home’s sale price or $5,000, (whichever is less) and is repayable at time of sale, refinance or first mortgage paid in full. In the case of household income less than 30 percent of the area median income (ami), individuals may also receive up to $25,000.

Source: homesweetdesmoines.com

Source: homesweetdesmoines.com

The home must be occupied by the buyer as a primary residence within 60 days of closing. In the state’s largest county, polk county, a couple with an annual income of up to $75,000 could qualify for the credit on a home that was purchased for. Check out our help article for more information on. In addition to loan and rate assistance programs, the iowa finance authority provides eligible homebuyers with a mortgage credit certificate to make homeownership even more affordable. The home must be occupied by the buyer as a primary residence within 60 days of closing.

Source: pinterest.com

Source: pinterest.com

The home must be occupied by the buyer as a primary residence within 60 days of closing. This means home buyers who have already purchased a home can file an amended tax return and receive a cash payout once the bill is passed. Check out our help article for more information on. The 2nd loan program offers a loan of up to 5% of the home’s sale price or $5,000, (whichever is less) and is repayable at time of sale, refinance or first mortgage paid in full. Ultimately, the tax credit is applied directly to your federal tax bill.

Source: smartasset.com

Source: smartasset.com

All loans subject to a. Through this program, borrowers receive an annual federal tax reduction equivalent to 50% of your mortgage interest up to $2,000 a year. The account holder can make unlimited deposits each year to the homebuyer savings account. Check out our help article for more information on. As of january 2015, you can reduce your annual income tax by up to $25,000.

Source: blog.constellation.com

Source: blog.constellation.com

Could claim a tax credit equal to 10% of the purchase price of the tax residence during that tax year. This means home buyers who have already purchased a home can file an amended tax return and receive a cash payout once the bill is passed. Through this program, borrowers receive an annual federal tax reduction equivalent to 50% of your mortgage interest up to $2,000 a year. Check out our help article for more information on. Ultimately, the tax credit is applied directly to your federal tax bill.

Source: smartasset.com

Source: smartasset.com

The firsthomes tax credit is not a loan. For this program, the household income limit is $141,680 and the purchase price limit is $360,000. The firsthomes tax credit is not a loan. The loans have fewer mortgage fees, and your interest rate isn’t influenced by your credit score. In addition to loan and rate assistance programs, the iowa finance authority provides eligible homebuyers with a mortgage credit certificate to make homeownership even more affordable.

Source: dandelionenergy.com

Source: dandelionenergy.com

However, this tax credit cannot exceed $15,000. The income tax deduction is limited to. As of january 2015, you can reduce your annual income tax by up to $25,000. The home must be occupied by the buyer as a primary residence within 60 days of closing. All loans subject to a.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title first time home buyer iowa tax credit 2020 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.