Your First time home buyer idaho tax credit images are available. First time home buyer idaho tax credit are a topic that is being searched for and liked by netizens now. You can Download the First time home buyer idaho tax credit files here. Get all free images.

If you’re searching for first time home buyer idaho tax credit images information related to the first time home buyer idaho tax credit interest, you have visit the right site. Our website always gives you suggestions for downloading the highest quality video and picture content, please kindly hunt and locate more informative video articles and images that match your interests.

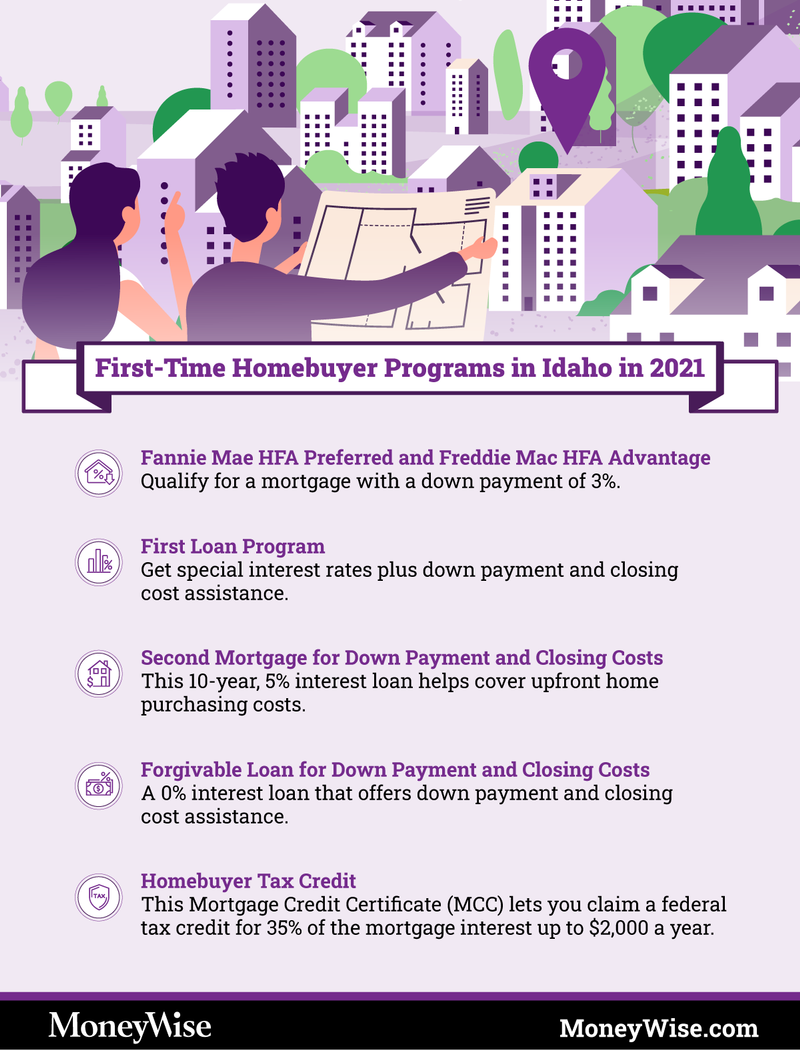

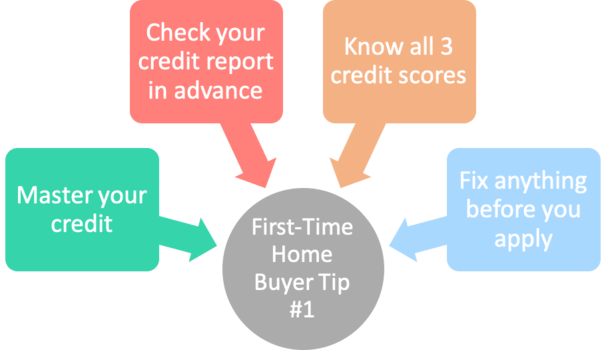

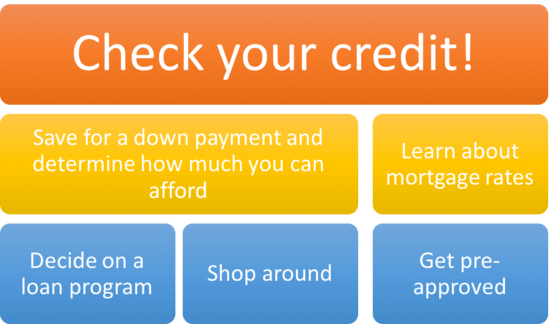

First Time Home Buyer Idaho Tax Credit. The credit score requirement is waived for heroes eligible borrowers. Homebuyer tax credit (mcc) a mortgage credit certificate (mcc) issued by idaho housing and finance association allows a homebuyer to claim a federal tax credit for 35% of the mortgage interest paid per year, up to $2,000 each year. With that, the home must be purchased as the buyer’s primary residence. It can take several (or more).

First-time Homebuyer Grants And Programs In Idaho From fha.com

First-time Homebuyer Grants And Programs In Idaho From fha.com

The firsthomes tax credit is a great option to help new homebuyers save money. Allows the homebuyer to claim a tax credit for some portion of the mortgage interest per year. If you thought this all sounded slightly familiar, that’s because it is. It can take several (or more). Only one certificate is required per loan. With that, the home must be purchased as the buyer’s primary residence.

Homebuyer tax credit (mcc) a mortgage credit certificate (mcc) issued by idaho housing and finance association allows a homebuyer to claim a federal tax credit for 35% of the mortgage interest paid per year, up to $2,000 each year.

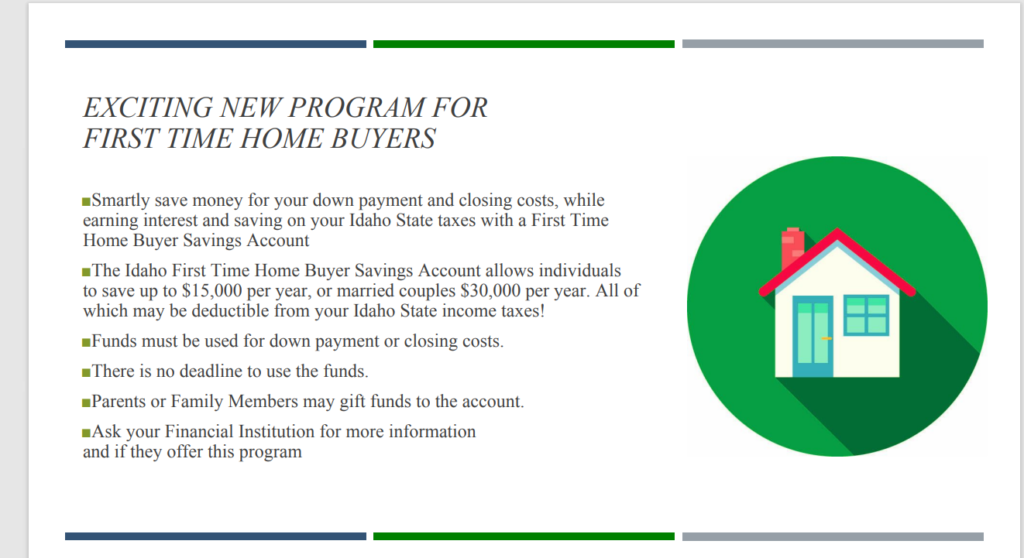

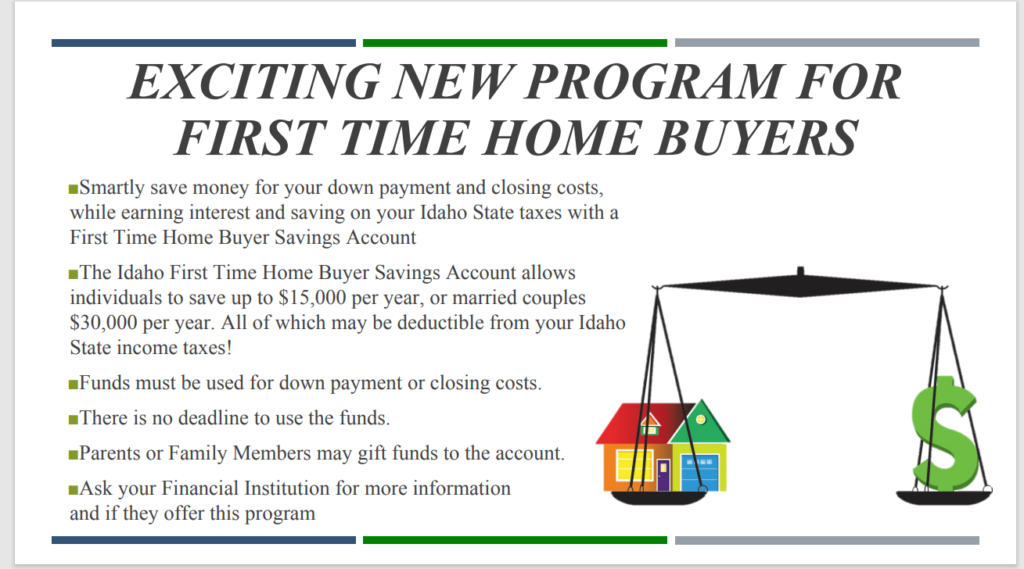

Economy during the great recession as a part of the housing and economic recovery act. 30 of this year could claim a credit of up to $8,000 on their 2008 or 2009 income tax return. Targeted areas of the state) with a mortgage credit certificate. Married couples filing a joint tax return can deduct up to $30,000 yearly. Idaho housing and finance homebuyer tax credit. Allows the homebuyer to claim a tax credit for some portion of the mortgage interest per year.

Source: fha.com

Source: fha.com

Credit score of 680 required or 640 when using the first loan. Please note that all programs listed on this website may involve a second. 30 of this year could claim a credit of up to $8,000 on their 2008 or 2009 income tax return. In theory, when this tax credit is passed, the tax credit for first time home buyers will be equal to 10% of the home’s purchase price. Finally home!® homebuyer education is required.

Source: moneywise.com

Source: moneywise.com

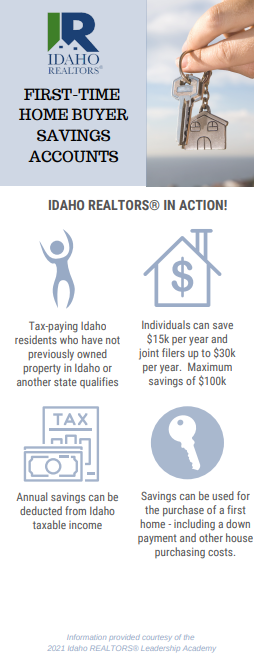

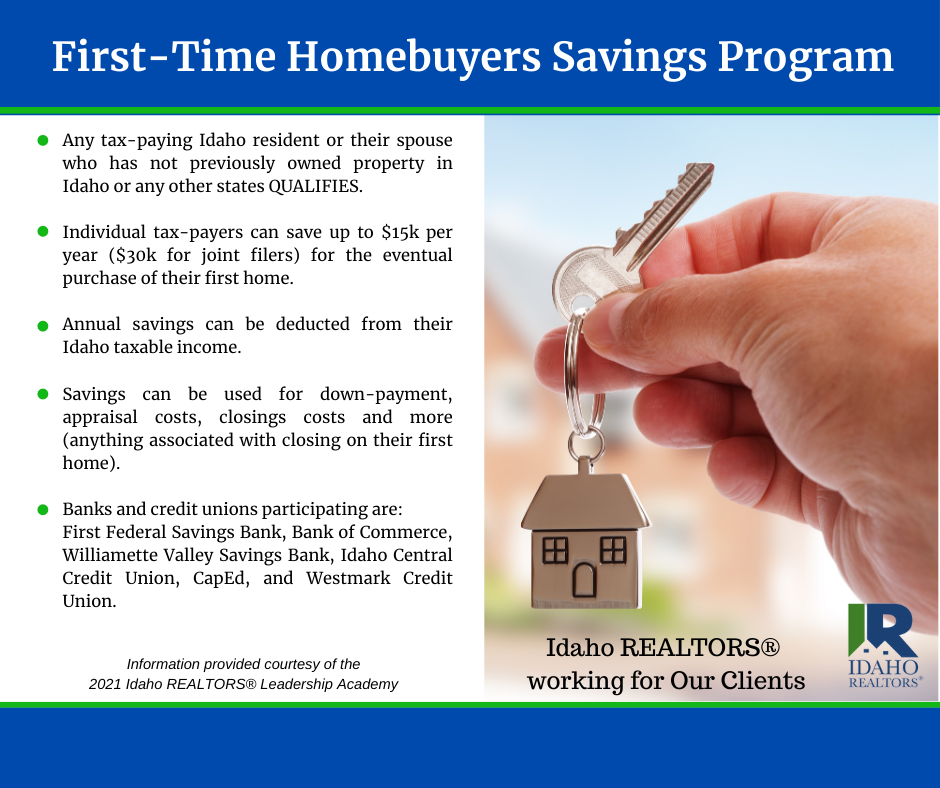

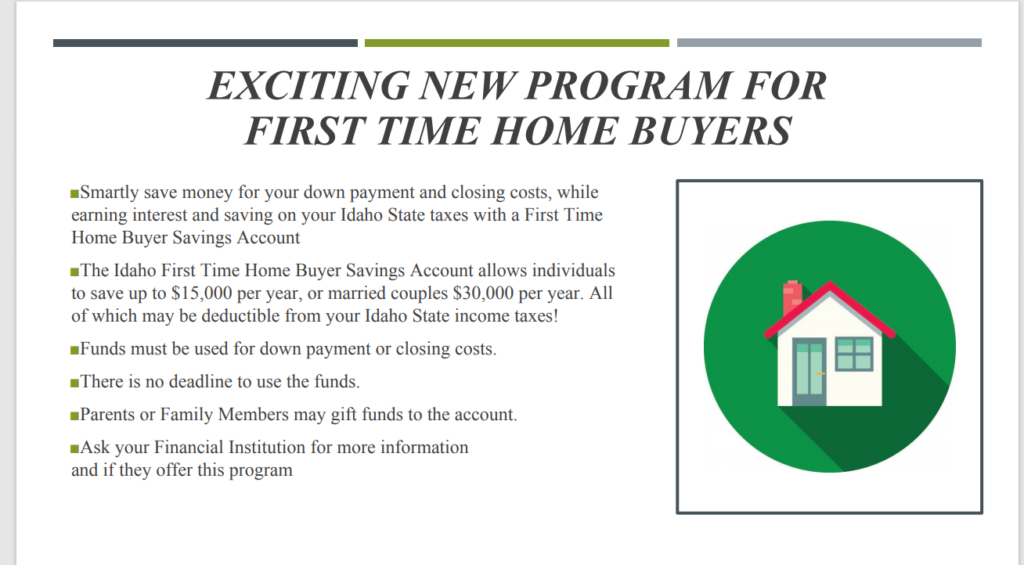

Individuals can deduct up to $15,000 each year. Targeted areas of the state) with a mortgage credit certificate. Up to $2000 of total mortgage interest paid in income tax credits each year. Finally home!® homebuyer education is required. Please note that all programs listed on this website may involve a second.

Source: idahohousing.com

Source: idahohousing.com

However, you may still be eligible for sales closing by june 30, 2010 provided there�s a binding sales contract in force on or before april 30, 2010. Unused tax credit can be carried forward for up to three years. Credit score of 680 required or 640 when using the first loan. In theory, when this tax credit is passed, the tax credit for first time home buyers will be equal to 10% of the home’s purchase price. Up to $2000 of total mortgage interest paid in income tax credits each year.

Source: weknowboise.com

Source: weknowboise.com

It can take several (or more). Homebuyer tax credit (mcc) a mortgage credit certificate (mcc) issued by idaho housing and finance association allows a homebuyer to claim a federal tax credit for 35% of the mortgage interest paid per year, up to $2,000 each year. Up to $2000 of total mortgage interest paid in income tax credits each year. Borrower must contribute at least 0.5% of the sales price of his own funds to the transaction. Economy during the great recession as a part of the housing and economic recovery act.

Source: moneywise.com

Source: moneywise.com

If you thought this all sounded slightly familiar, that’s because it is. If you intend to take advantage of this opportunity and you�re looking for a great buy, don�t wait too long. Borrower must contribute at least 0.5% of the sales price of his own funds to the transaction. However, you may still be eligible for sales closing by june 30, 2010 provided there�s a binding sales contract in force on or before april 30, 2010. Only one certificate is required per loan.

Source: idahohousing.com

Source: idahohousing.com

However, you may still be eligible for sales closing by june 30, 2010 provided there�s a binding sales contract in force on or before april 30, 2010. The mcc is an actual tax credit, to use toward any federal taxes the borrower may owe, and it can be rolled over for. The credit score requirement is waived for heroes eligible borrowers. If you thought this all sounded slightly familiar, that’s because it is. Up to $2000 of total mortgage interest paid in income tax credits each year.

Source: idahorealtors.com

Source: idahorealtors.com

Credit score of 680 required or 640 when using the first loan. If you intend to take advantage of this opportunity and you�re looking for a great buy, don�t wait too long. Economy during the great recession as a part of the housing and economic recovery act. Credit score of 680 required or 640 when using the first loan. Targeted areas of the state) with a mortgage credit certificate.

Source: idahorealtors.com

Source: idahorealtors.com

Can be used with idaho housing loan programs, only.: Up to $2000 of total mortgage interest paid in income tax credits each year. The mcc is an actual tax credit, to use toward any federal taxes the borrower may owe, and it can be rolled over for. Homebuyer tax credit (mcc) a mortgage credit certificate (mcc) issued by idaho housing and finance association allows a homebuyer to claim a federal tax credit for 35% of the mortgage interest paid per year, up to $2,000 each year. Economy during the great recession as a part of the housing and economic recovery act.

Source: lookoutcu.com

Source: lookoutcu.com

Bill h589 was passed this year! Find out if you�re eligible and how to apply. Individuals can deduct up to $15,000 each year. Credit score of 680 required or 640 when using the first loan. It can take several (or more).

Source: thetruthaboutmortgage.com

Source: thetruthaboutmortgage.com

Created as a response to the 2008 financial crisis, the housing and economic recovery act (hera) allowed new homebuyers to get a tax credit of up t0 $7,500 during the first year of the initiative. Borrower must contribute at least 0.5% of the sales price of his own funds to the transaction. However, you may still be eligible for sales closing by june 30, 2010 provided there�s a binding sales contract in force on or before april 30, 2010. Married couples filing a joint tax return can deduct up to $30,000 yearly. In theory, when this tax credit is passed, the tax credit for first time home buyers will be equal to 10% of the home’s purchase price.

Source: idahorealtors.com

Source: idahorealtors.com

Find out if you�re eligible and how to apply. Economy during the great recession as a part of the housing and economic recovery act. You may be able to deduct the deposited amount at the end of each year from your gross income for state income. Up to $2000 of total mortgage interest paid in income tax credits each year. Directly reduces income tax due.

Source: boirealtors.com

Source: boirealtors.com

Homebuyer tax credit (mcc) a mortgage credit certificate (mcc) issued by idaho housing and finance association allows a homebuyer to claim a federal tax credit for 35% of the mortgage interest paid per year, up to $2,000 each year. It can take several (or more). Unused tax credit can be carried forward for up to three years. Find out if you�re eligible and how to apply. You may be able to deduct the deposited amount at the end of each year from your gross income for state income.

Source: idahorealtors.com

Source: idahorealtors.com

Bill h589 was passed this year! The credit score requirement is waived for heroes eligible borrowers. Please note that all programs listed on this website may involve a second. Up to $2000 of total mortgage interest paid in income tax credits each year. With that, the home must be purchased as the buyer’s primary residence.

Source: idahorealtors.com

Source: idahorealtors.com

The firsthomes tax credit is a great option to help new homebuyers save money. If you thought this all sounded slightly familiar, that’s because it is. Bill h589 was passed this year! You may be able to deduct the deposited amount at the end of each year from your gross income for state income. You can claim part of the annual interest paid on your mortgage (35% of the interest) as a special federal tax credit, up to $2,000 a year.

Source: dmgloans.com

Source: dmgloans.com

However, you may still be eligible for sales closing by june 30, 2010 provided there�s a binding sales contract in force on or before april 30, 2010. 30 of this year could claim a credit of up to $8,000 on their 2008 or 2009 income tax return. If you thought this all sounded slightly familiar, that’s because it is. Married couples filing a joint tax return can deduct up to $30,000 yearly. Please note that all programs listed on this website may involve a second.

Source: idahorealtors.com

Source: idahorealtors.com

A mortgage credit certificate (mcc) issued by idaho housing allows a homebuyer to claim a federal tax credit for 35% of the mortgage interest they pay, up to $2,000 a year. Idaho housing and finance homebuyer tax credit. Unused tax credit can be carried forward for up to three years. A mortgage credit certificate (mcc) issued by idaho housing allows a homebuyer to claim a federal tax credit for 35% of the mortgage interest they pay, up to $2,000 a year. 30 of this year could claim a credit of up to $8,000 on their 2008 or 2009 income tax return.

Source: idahorealtors.com

Source: idahorealtors.com

Finally home!® homebuyer education is required. Targeted areas of the state) with a mortgage credit certificate. However, you may still be eligible for sales closing by june 30, 2010 provided there�s a binding sales contract in force on or before april 30, 2010. Allows the homebuyer to claim a tax credit for some portion of the mortgage interest per year. Only one certificate is required per loan.

Source: thetruthaboutmortgage.com

Source: thetruthaboutmortgage.com

You can claim part of the annual interest paid on your mortgage (35% of the interest) as a special federal tax credit, up to $2,000 a year. Targeted areas of the state) with a mortgage credit certificate. If you intend to take advantage of this opportunity and you�re looking for a great buy, don�t wait too long. If you thought this all sounded slightly familiar, that’s because it is. Find out if you�re eligible and how to apply.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title first time home buyer idaho tax credit by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.