Your First time home buyer idaho bad credit images are available. First time home buyer idaho bad credit are a topic that is being searched for and liked by netizens now. You can Download the First time home buyer idaho bad credit files here. Download all free images.

If you’re looking for first time home buyer idaho bad credit pictures information connected with to the first time home buyer idaho bad credit interest, you have come to the right site. Our website frequently gives you suggestions for seeing the maximum quality video and image content, please kindly search and locate more informative video articles and images that fit your interests.

First Time Home Buyer Idaho Bad Credit. First time home buyers with bad credit; Maybe an fha mortgage will work for you. Bill h589 was passed this year! First time home buyer required except for targeted counties in idaho;

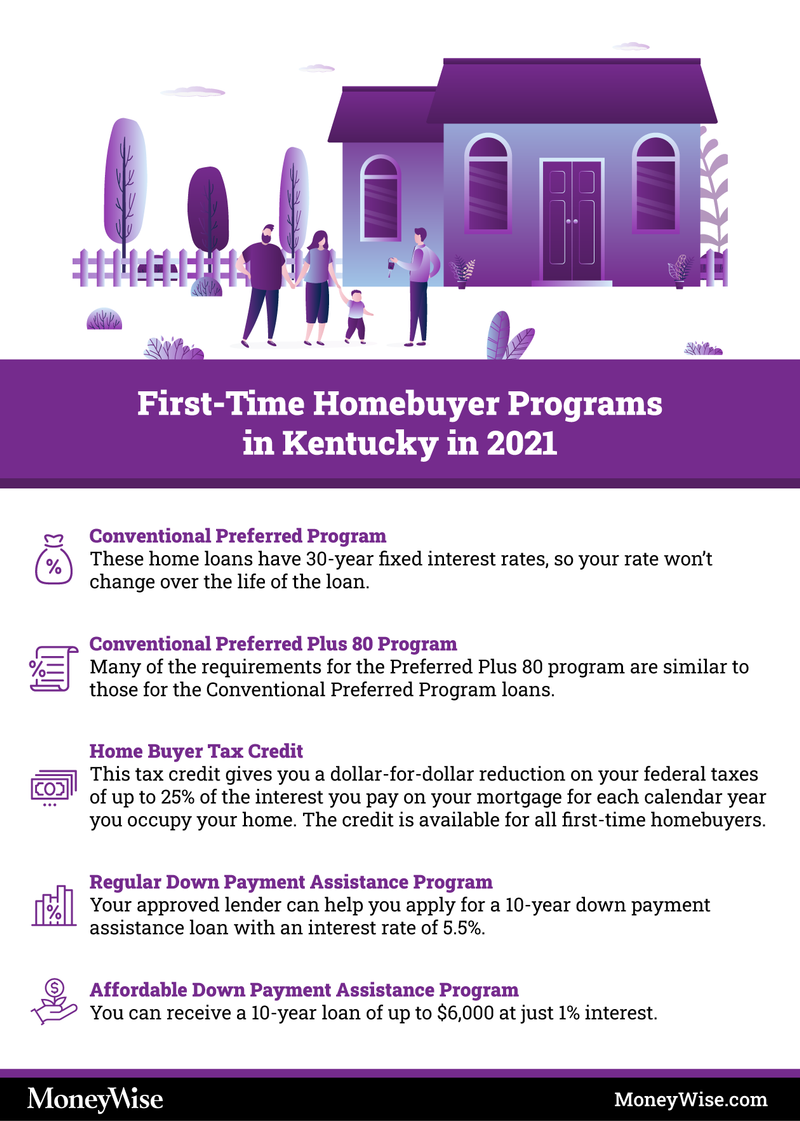

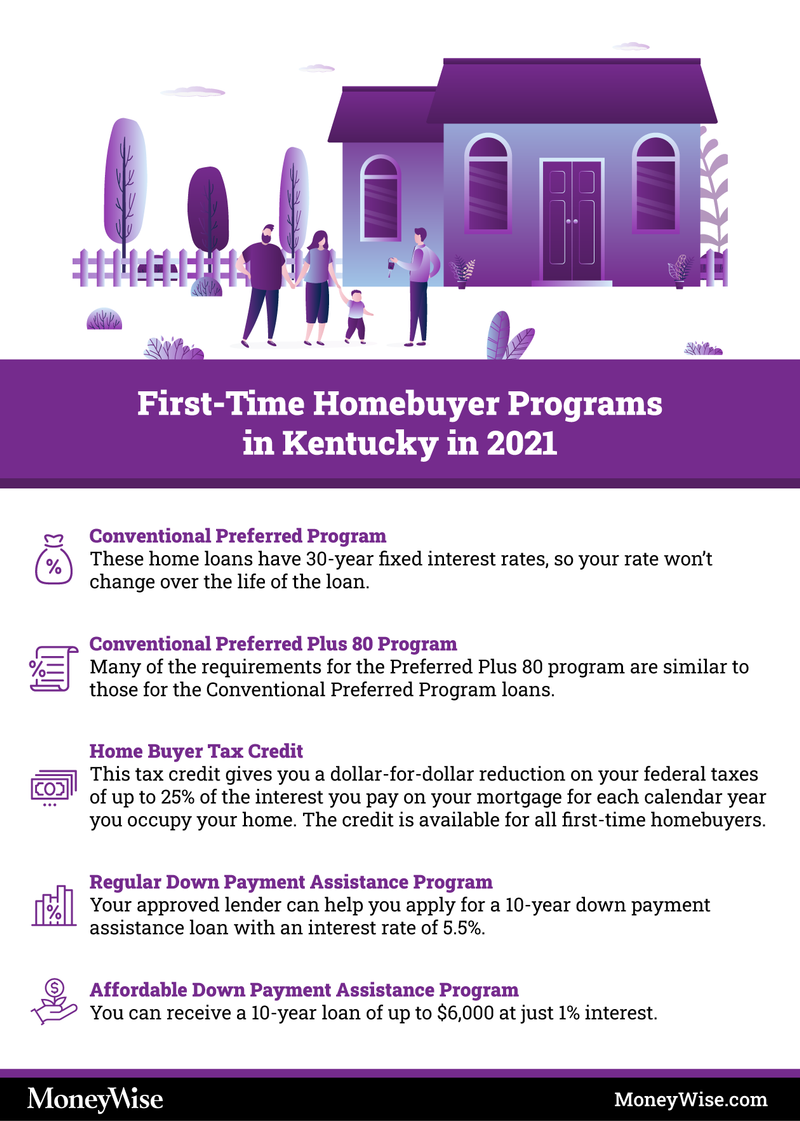

First-time Homebuyer Programs In Kentucky 2021 From moneywise.com

First-time Homebuyer Programs In Kentucky 2021 From moneywise.com

Fha down payment assistance programs; You may be able to deduct the deposited amount at the end of each year from your gross income for state. There are mortgage programs that can help. Find out if you�re eligible and how to apply. Down payment assistance available for remaining 3.5% =learn more; A mortgage credit certificate (mcc) issued by idaho housing and finance association allows a homebuyer to claim a tax credit for 35% of the mortgage interest paid per year, up to an annual maximum of $2,000.

Buying a home with lousy credit is not impossible.

You may be able to deduct the deposited amount at the end of each year from your gross income for state. Find out what�s available in your state. Down payment assistance available for remaining 3.5% =learn more; First time home buyers with bad credit; Your credit score is just one of the many factors that mortgage lenders scrutinize when determining whether you’re eligible for. Bad credit home mortgage loan

Source: moneywise.com

Source: moneywise.com

The following is a news release from the idaho state tax commission. Folks with limited cash for down payment, and a credit score of 620 or up. Borrowers need just a 3% down payment. Down payment assistance available for remaining 3.5% =learn more; Finally home!® homebuyer education is required.

Source: pinterest.com

Source: pinterest.com

A mortgage credit certificate (mcc) issued by idaho housing and finance association allows a homebuyer to claim a tax credit for 35% of the mortgage interest paid per year, up to an annual maximum of $2,000. You may be able to deduct the deposited amount at the end of each year from your gross income for state. The following is a news release from the idaho state tax commission. First time home buyer required except for targeted counties in idaho; Home loans for bad credit;

Source: weknowboise.com

Source: weknowboise.com

Maybe an fha mortgage will work for you. Finally home!® homebuyer education is required. Borrowers need just a 3% down payment. Buying a home with lousy credit is not impossible. A buyer with a roommate, boarder, or other supplemental rental income;

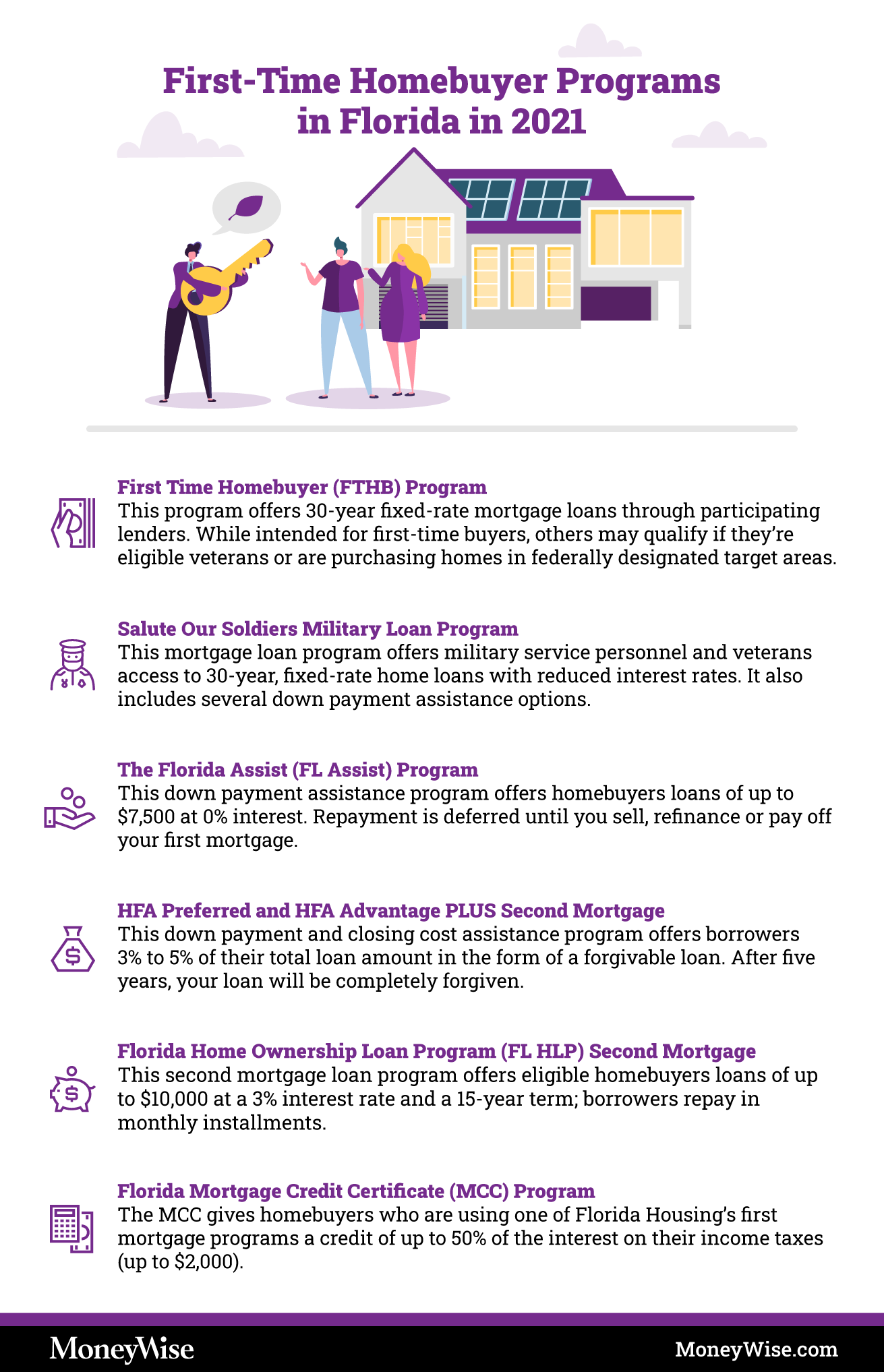

Source: moneywise.com

Source: moneywise.com

Mortgage loans for bad credit; Rent or buy a home; Only one certificate is required per loan. A buyer with a roommate, boarder, or other supplemental rental income; Bad credit home mortgage loan

Source: idahorealtors.com

Source: idahorealtors.com

Find out if you�re eligible and how to apply. Rent or buy a home; Fha down payment assistance programs; Credit score of 680 required or 640 when using the first loan. There are mortgage programs that can help.

Source: thetruthaboutmortgage.com

Source: thetruthaboutmortgage.com

Down payment assistance available for remaining 3.5% =learn more; First, low down payment requirements of only 3.5% of the purchase price. Rent or buy a home; The credit score requirement is waived for heroes eligible borrowers. Bad credit home mortgage loan

Source: thetruthaboutmortgage.com

Source: thetruthaboutmortgage.com

Credit score of 680 required or 640 when using the first loan. Rent or buy a home; Mortgage loans for bad credit; Many times people sell a home giving them their down payment, but of course that would not be true for a first time home buyer. Conventional vs fha home loans;

Source: fha.com

Source: fha.com

Rent or buy a home; (if you have 680 or better, you might get even better pricing.) You may be able to deduct the deposited amount at the end of each year from your gross income for state. This is often times very helpful for the first. Find out if you�re eligible and how to apply.

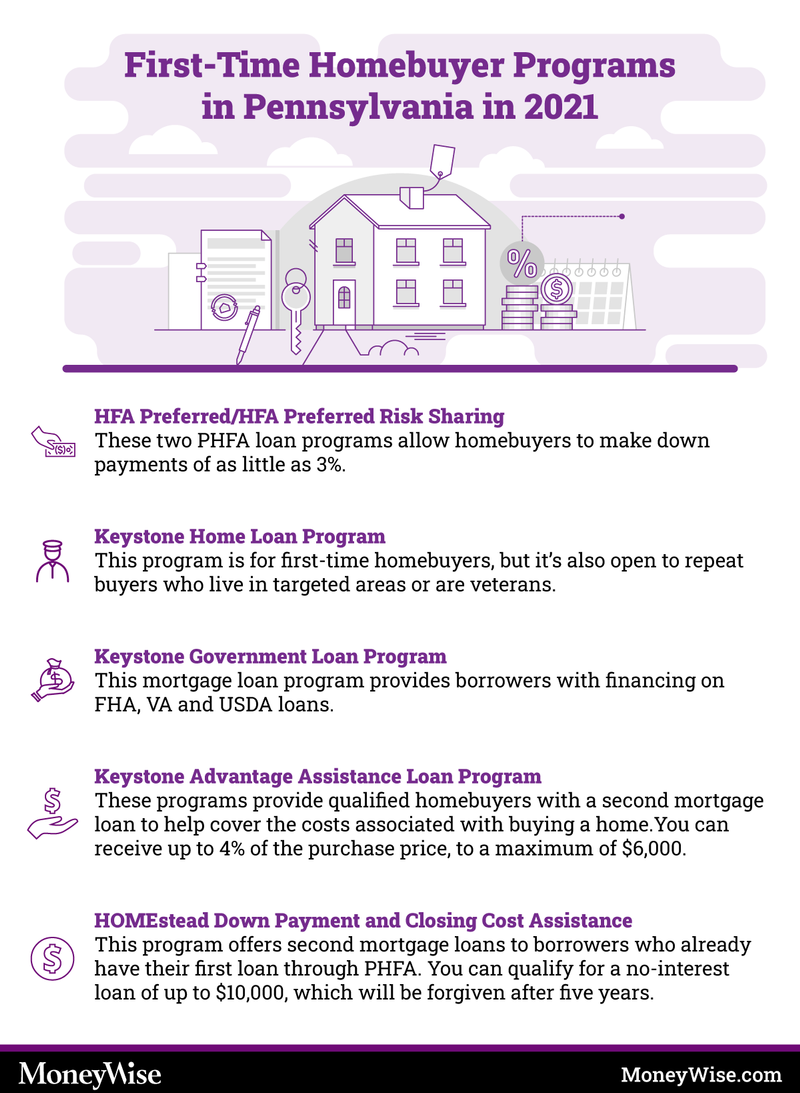

Source: moneywise.com

Source: moneywise.com

Find out if you�re eligible and how to apply. Bad credit home mortgage loan The credit score requirement is waived for heroes eligible borrowers. A buyer with a roommate, boarder, or other supplemental rental income; Fha down payment assistance programs;

Source: time.com

Source: time.com

A “bad” credit score falls somewhere between 300 and 579 on the fico credit scoring scale. Income cannot exceed 100% of the area median income (ami). A first time home buyer with bad credit might need to place a substantially higher down payment on their house than others who have had mortgages previously or who have a more polished credit score. Finally home!® homebuyer education is required. Seller can pay for all closing costs

Source: fha.com

Source: fha.com

Your credit score is just one of the many factors that mortgage lenders scrutinize when determining whether you’re eligible for. Buying a home with lousy credit is not impossible. A “bad” credit score falls somewhere between 300 and 579 on the fico credit scoring scale. Down payment assistance available for remaining 3.5% =learn more; A mortgage credit certificate (mcc) issued by idaho housing and finance association allows a homebuyer to claim a tax credit for 35% of the mortgage interest paid per year, up to an annual maximum of $2,000.

Source: iccu.com

Source: iccu.com

Seller can pay for all closing costs The credit score requirement is waived for heroes eligible borrowers. Bill h589 was passed this year! Home loans for bad credit; Your credit score is just one of the many factors that mortgage lenders scrutinize when determining whether you’re eligible for.

Source: moneywise.com

Source: moneywise.com

Many times people sell a home giving them their down payment, but of course that would not be true for a first time home buyer. Maybe an fha mortgage will work for you. You may be able to deduct the deposited amount at the end of each year from your gross income for state. Rent or buy a home; First time home buyers with bad credit;

Source: idahohousing.com

Source: idahohousing.com

Maybe an fha mortgage will work for you. Find out what�s available in your state. Buying a home with lousy credit is not impossible. A first time home buyer with bad credit might need to place a substantially higher down payment on their house than others who have had mortgages previously or who have a more polished credit score. It�s been the safe, sound and smart way to go for 80,000 idaho homebuyers.

Source: id.pinterest.com

Source: id.pinterest.com

Many times people sell a home giving them their down payment, but of course that would not be true for a first time home buyer. Borrower must contribute at least 0.5% of the sales price of his own funds to the transaction. Conventional vs fha home loans; There are mortgage programs that can help. The following is a news release from the idaho state tax commission.

Source: firsthomebuyers.net

Source: firsthomebuyers.net

First time home buyers with bad credit; Seller can pay for all closing costs Idaho housing first loan plus (purchase) excellent program for 1st time home buyers and sometimes 2nd time home buyers that offers 100% financing. First, low down payment requirements of only 3.5% of the purchase price. Bad credit home mortgage loan

Source: moneywise.com

Source: moneywise.com

(if you have 680 or better, you might get even better pricing.) This is often times very helpful for the first. Buying a home with lousy credit is not impossible. Only one certificate is required per loan. Folks with limited cash for down payment, and a credit score of 620 or up.

Source: pinterest.com

Source: pinterest.com

Borrower must contribute at least 0.5% of the sales price of his own funds to the transaction. There are mortgage programs that can help. Bad credit home mortgage loan Credit score of 680 required or 640 when using the first loan. A “bad” credit score falls somewhere between 300 and 579 on the fico credit scoring scale.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title first time home buyer idaho bad credit by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.