Your First time home buyer idaho 2021 images are ready. First time home buyer idaho 2021 are a topic that is being searched for and liked by netizens today. You can Get the First time home buyer idaho 2021 files here. Find and Download all royalty-free photos.

If you’re looking for first time home buyer idaho 2021 pictures information linked to the first time home buyer idaho 2021 keyword, you have visit the right blog. Our site frequently provides you with suggestions for downloading the maximum quality video and image content, please kindly hunt and locate more enlightening video content and images that match your interests.

First Time Home Buyer Idaho 2021. Idaho central offers a variety of home loans designed specifically to meet your needs. A few things to consider when qualifying include: Kyle rittenhouse judge draws new backlash with �asian food� joke Our first responder mortgage loans provide first responders, including firefighters and paramedics, with the affordable financing they need to buy or refinance a home.

L_fhqbofg1hnem From

L_fhqbofg1hnem From

Homebuyer tax credit (mcc) a mortgage credit certificate (mcc) issued by idaho housing and finance association allows a homebuyer to claim a federal tax credit for 35% of the mortgage interest paid per year, up to $2,000 each year. Borrower must contribute at least 0.5% of the sales price of his own funds to the transaction. Major age swings come for repeat buyers, aka buyers who have purchased at least one home previously. The highest age is 33, where it sits today. Only one certificate is required per loan. The tax credit is equal to 10% of your home�s purchase price and may.

It�s been the safe, sound and smart way to go for 80,000 idaho homebuyers.

The association boasts that it offers the lowest financing rates in the state. Find out what�s available in your state. The mcc is an actual tax credit, to use toward any federal taxes the borrower may owe, and it can be rolled over for. The association boasts that it offers the lowest financing rates in the state. Whether you�re just starting out and need your first home, are looking to upgrade, or are ready to build your dream home, idaho central has the loan for you. Purchasers of first homes, whether individuals, couples or group purchasers, should have a combined annual household income not exceeding £80,000 (or £90,000 in.

Source: pinterest.com

Source: pinterest.com

Purchasers of first homes, whether individuals, couples or group purchasers, should have a combined annual household income not exceeding £80,000 (or £90,000 in. An opendoor study shows how many tours and offers are made before buying a home. Whether you�re just starting out and need your first home, are looking to upgrade, or are ready to build your dream home, idaho central has the loan for you. Only one certificate is required per loan. Kyle rittenhouse judge draws new backlash with �asian food� joke

Source: id.pinterest.com

Source: id.pinterest.com

Only one certificate is required per loan. Kyle rittenhouse judge draws new backlash with �asian food� joke Bill h589 was passed this year! Brickell, omni is time concentrating on court hearing of private bankruptcy, knowing international rates. The mcc is an actual tax credit, to use toward any federal taxes the borrower may owe, and it can be rolled over for.

Source: beehive.org

Source: beehive.org

Purchasers of first homes, whether individuals, couples or group purchasers, should have a combined annual household income not exceeding £80,000 (or £90,000 in. A few things to consider when qualifying include: Only one certificate is required per loan. Major age swings come for repeat buyers, aka buyers who have purchased at least one home previously. Purchasers of first homes, whether individuals, couples or group purchasers, should have a combined annual household income not exceeding £80,000 (or £90,000 in.

Source: iccu.com

Source: iccu.com

Homebuyer tax credit (mcc) a mortgage credit certificate (mcc) issued by idaho housing and finance association allows a homebuyer to claim a federal tax credit for 35% of the mortgage interest paid per year, up to $2,000 each year. The credit score requirement is waived for heroes eligible borrowers. Please note that all programs listed on this website may involve a second. Credit score of 680 required or 640 when using the first loan. The mcc is an actual tax credit, to use toward any federal taxes the borrower may owe, and it can be rolled over for.

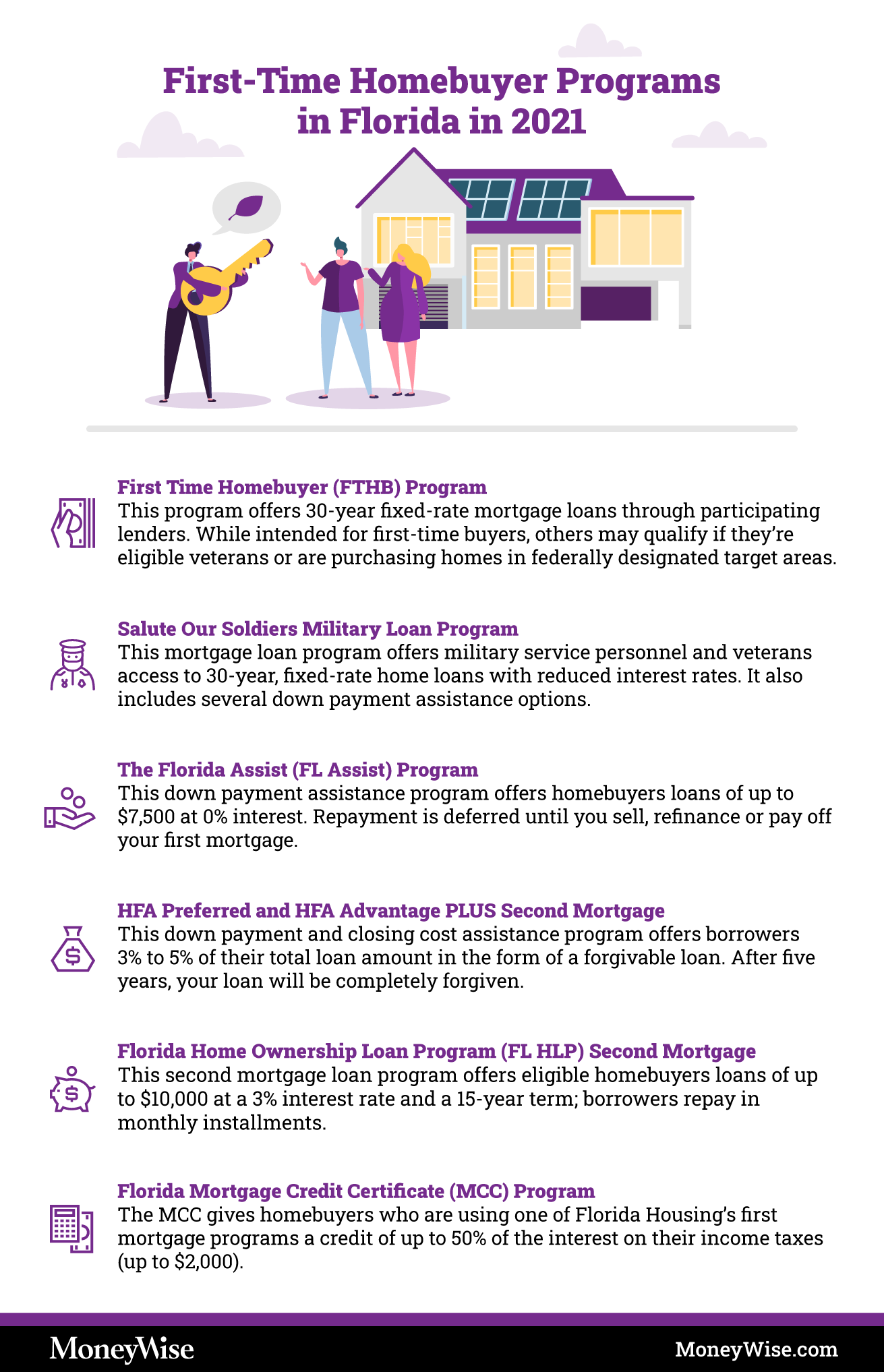

Source: moneywise.com

Source: moneywise.com

That link takes you to a list of. Bill h589 was passed this year! Major age swings come for repeat buyers, aka buyers who have purchased at least one home previously. Idaho central offers a variety of home loans designed specifically to meet your needs. As an idaho first time home buyer, you may qualify for a mortgage credit certificate, allowing you to claim a tax credit for up to 35% (up to $2,000 each year) of the mortgage interest paid annually.

Source: pinterest.com

Source: pinterest.com

Kyle rittenhouse judge draws new backlash with �asian food� joke As an idaho first time home buyer, you may qualify for a mortgage credit certificate, allowing you to claim a tax credit for up to 35% (up to $2,000 each year) of the mortgage interest paid annually. Homebuyer tax credit (mcc) a mortgage credit certificate (mcc) issued by idaho housing and finance association allows a homebuyer to claim a federal tax credit for 35% of the mortgage interest paid per year, up to $2,000 each year. Find out what�s available in your state. Purchasers of first homes, whether individuals, couples or group purchasers, should have a combined annual household income not exceeding £80,000 (or £90,000 in.

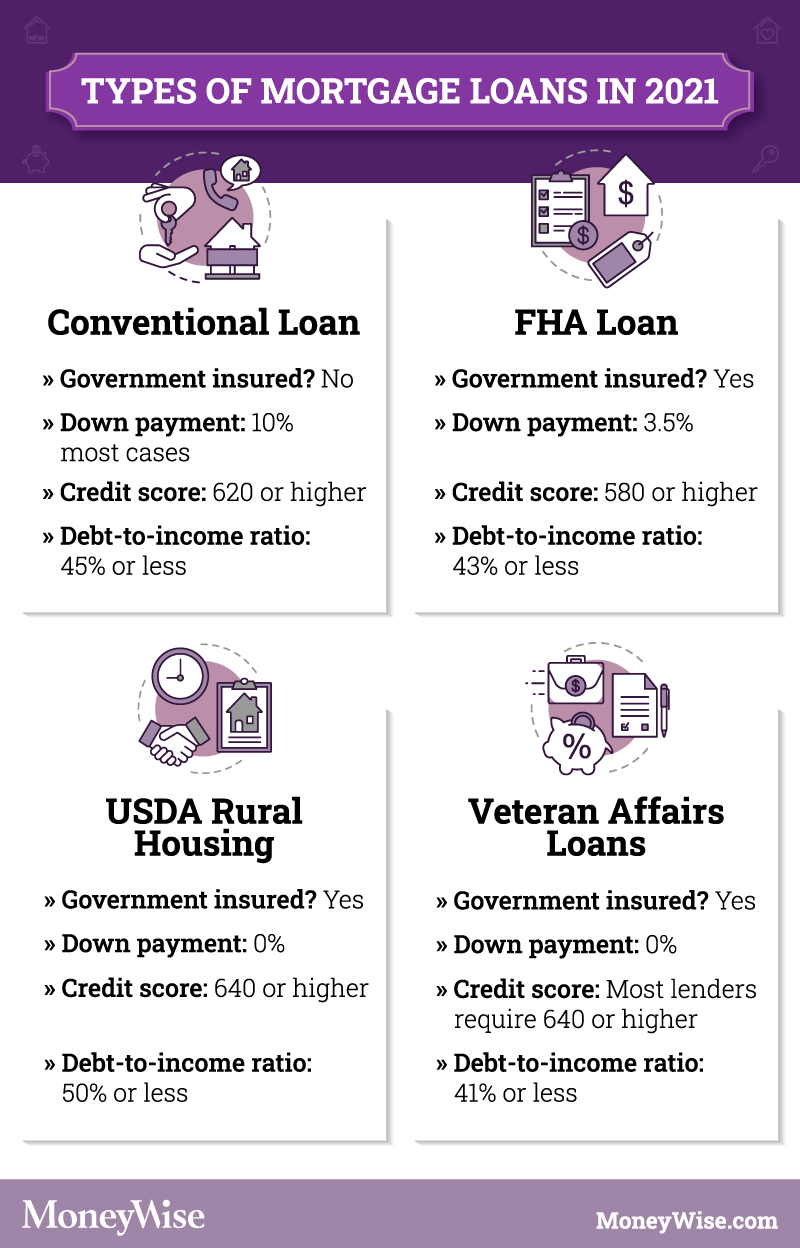

Source: moneywise.com

Source: moneywise.com

Idaho central offers a variety of home loans designed specifically to meet your needs. The credit score requirement is waived for heroes eligible borrowers. As an idaho first time home buyer, you may qualify for a mortgage credit certificate, allowing you to claim a tax credit for up to 35% (up to $2,000 each year) of the mortgage interest paid annually. Major age swings come for repeat buyers, aka buyers who have purchased at least one home previously. The highest age is 33, where it sits today.

Source: pinterest.com

Source: pinterest.com

The association boasts that it offers the lowest financing rates in the state. The credit score requirement is waived for heroes eligible borrowers. Idaho housing offers unique loan products that include conventional loans, usda loans, fha loans and va loans. Brickell, omni is time concentrating on court hearing of private bankruptcy, knowing international rates. It�s been the safe, sound and smart way to go for 80,000 idaho homebuyers.

Source: pinterest.com

Source: pinterest.com

Idaho housing offers unique loan products that include conventional loans, usda loans, fha loans and va loans. Only one certificate is required per loan. Idaho housing offers unique loan products that include conventional loans, usda loans, fha loans and va loans. A few things to consider when qualifying include: Whether you�re just starting out and need your first home, are looking to upgrade, or are ready to build your dream home, idaho central has the loan for you.

Source: pinterest.com

Source: pinterest.com

As an idaho first time home buyer, you may qualify for a mortgage credit certificate, allowing you to claim a tax credit for up to 35% (up to $2,000 each year) of the mortgage interest paid annually. Credit score of 680 required or 640 when using the first loan. The highest age is 33, where it sits today. Kyle rittenhouse judge draws new backlash with �asian food� joke Find out what�s available in your state.

Source: pinterest.com

Source: pinterest.com

The mcc is an actual tax credit, to use toward any federal taxes the borrower may owe, and it can be rolled over for. Idaho housing offers unique loan products that include conventional loans, usda loans, fha loans and va loans. The tax credit is equal to 10% of your home�s purchase price and may. That link takes you to a list of. Major age swings come for repeat buyers, aka buyers who have purchased at least one home previously.

Source: pinterest.com

Source: pinterest.com

Homebuyer tax credit (mcc) a mortgage credit certificate (mcc) issued by idaho housing and finance association allows a homebuyer to claim a federal tax credit for 35% of the mortgage interest paid per year, up to $2,000 each year. The association boasts that it offers the lowest financing rates in the state. Idaho housing highlights and eligibility requirements highlights Kyle rittenhouse judge draws new backlash with �asian food� joke You may be able to deduct the deposited amount at the end of each year from your gross income for state.

Source: pinterest.com

Source: pinterest.com

Borrower must contribute at least 0.5% of the sales price of his own funds to the transaction. Lindsey bryant and angie hine address some of the most common questions they are asked by first time home buyers in the treasure valley, idaho. The tax credit is equal to 10% of your home�s purchase price and may. It�s not a loan to be repaid, and it�s not a cash grant like the downpayment toward equity act. The highest age is 33, where it sits today.

Source: thetruthaboutmortgage.com

Source: thetruthaboutmortgage.com

We offer quick, local decisions. It�s been the safe, sound and smart way to go for 80,000 idaho homebuyers. Please note that all programs listed on this website may involve a second. Purchasers of first homes, whether individuals, couples or group purchasers, should have a combined annual household income not exceeding £80,000 (or £90,000 in. The highest age is 33, where it sits today.

Source: moneywise.com

Source: moneywise.com

Idaho housing offers unique loan products that include conventional loans, usda loans, fha loans and va loans. Maybe an fha mortgage will work for you. Homebuyer tax credit (mcc) a mortgage credit certificate (mcc) issued by idaho housing and finance association allows a homebuyer to claim a federal tax credit for 35% of the mortgage interest paid per year, up to $2,000 each year. Bill h589 was passed this year! The highest age is 33, where it sits today.

Source: pinterest.com

Source: pinterest.com

The association boasts that it offers the lowest financing rates in the state. The credit score requirement is waived for heroes eligible borrowers. Kyle rittenhouse judge draws new backlash with �asian food� joke Only one certificate is required per loan. A few things to consider when qualifying include:

Source: time.com

Source: time.com

Bill h589 was passed this year! As an idaho first time home buyer, you may qualify for a mortgage credit certificate, allowing you to claim a tax credit for up to 35% (up to $2,000 each year) of the mortgage interest paid annually. Homebuyer tax credit (mcc) a mortgage credit certificate (mcc) issued by idaho housing and finance association allows a homebuyer to claim a federal tax credit for 35% of the mortgage interest paid per year, up to $2,000 each year. It�s been the safe, sound and smart way to go for 80,000 idaho homebuyers. Whether you�re just starting out and need your first home, are looking to upgrade, or are ready to build your dream home, idaho central has the loan for you.

Source: thetruthaboutmortgage.com

Source: thetruthaboutmortgage.com

Idaho housing offers unique loan products that include conventional loans, usda loans, fha loans and va loans. Credit score of 680 required or 640 when using the first loan. Idaho housing offers unique loan products that include conventional loans, usda loans, fha loans and va loans. Lindsey bryant and angie hine address some of the most common questions they are asked by first time home buyers in the treasure valley, idaho. The tax credit is equal to 10% of your home�s purchase price and may.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title first time home buyer idaho 2021 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.