Your First time home buyer arkansas tax credit images are available. First time home buyer arkansas tax credit are a topic that is being searched for and liked by netizens now. You can Download the First time home buyer arkansas tax credit files here. Find and Download all royalty-free vectors.

If you’re searching for first time home buyer arkansas tax credit pictures information linked to the first time home buyer arkansas tax credit topic, you have come to the ideal blog. Our site always gives you suggestions for refferencing the highest quality video and picture content, please kindly search and locate more informative video content and images that fit your interests.

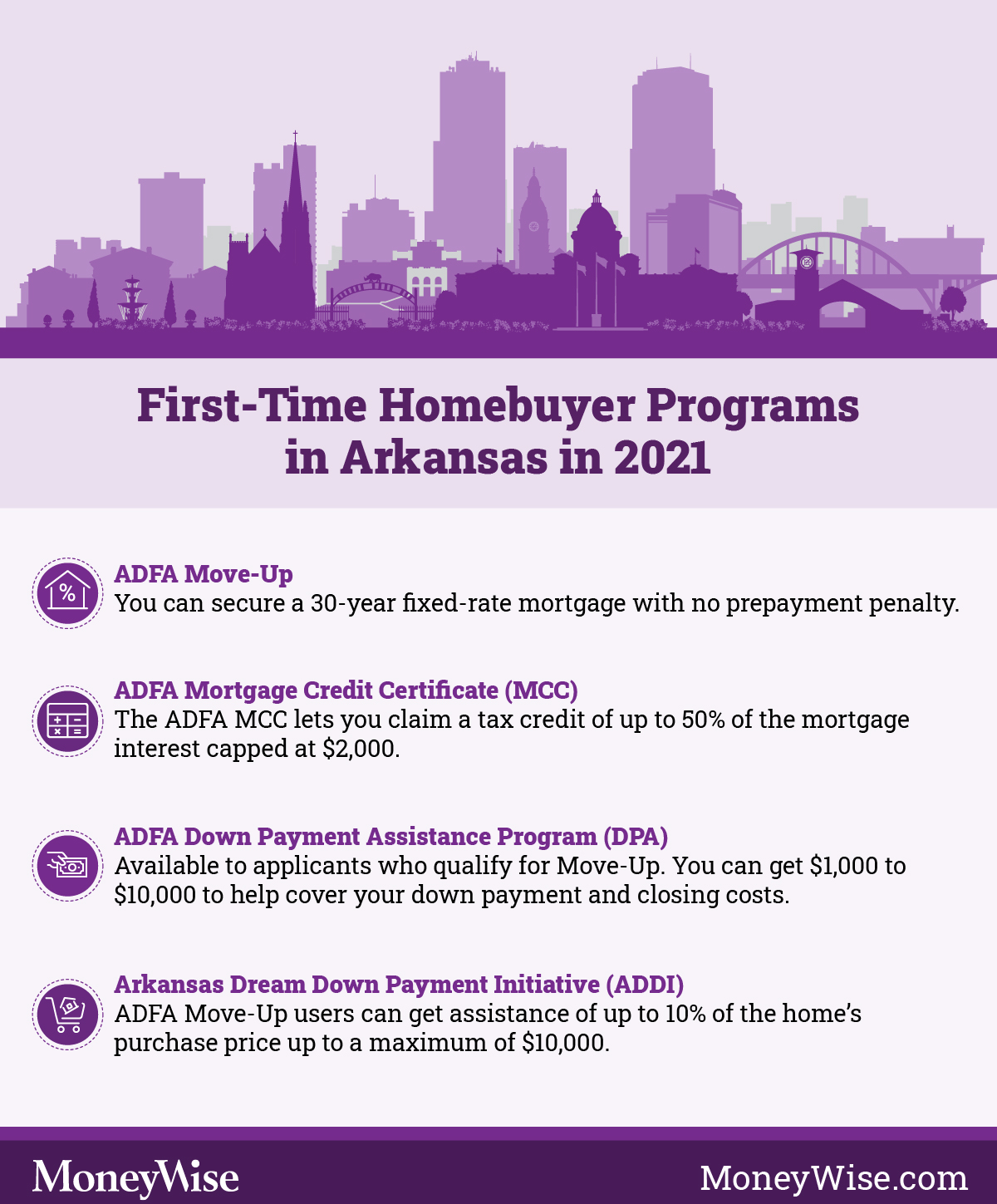

First Time Home Buyer Arkansas Tax Credit. How this works, is you can deduct up. The home purchased must also be at or below 110% of the median home price of their area. The certificate is issued by adfa and allows qualifying, taxpaying homebuyers to claim a tax credit of up to 50 percent of the mortgage interest paid per year, capped at $2,000 annually. The firsthomes tax credit is a great option to help new homebuyers save money.

Arkansas First Time Home Buyer Programs From firsthomebuyers.net

Arkansas First Time Home Buyer Programs From firsthomebuyers.net

Buying a home for the first time can be a challenging process. The home purchased must also be at or below 110% of the median home price of their area. Arkansas grant and assistance programs. The credit may be claimed for the life of the loan as long as the home. To learn more about the program visit the arkansas. They must also meet income limits of 160% or less of the median income of their area.

The certificate is issued by adfa and allows qualifying, taxpaying homebuyers to claim a tax credit of up to 50 percent of the mortgage interest paid per year, capped at $2,000 annually.

Arkansas first time home buyer tax credits. From the house hunting to the reams of paperwork to managing the down payment and closing costs, there is a lot to wade through. To be eligible for the first time homebuyer tax credit, prospective buyers must not have owned or purchased a home within the last three years. Unfortunately, this tax credit expired in 2010, so you are not eligible for the credit unless you bought your home between 2008 and 2010. Maximum of $15,000 total financed amount, and up to 90% msrp (including taxes and all other applicable fees) terms up to 60 months (new or up to four year old models) terms up to 48 months (vehicles up to seven years old) no prepayment penalties. Buying a home for the first time can be a challenging process.

Source: newhomesource.com

Source: newhomesource.com

To learn more about the program visit the arkansas. If this is the case, the credit would be cut in half and the first time home buyer would receive a $7,500 credit on their tax return. Payments can be made by phone, mail, in person or through online banking. Targeted areas of the state) with a mortgage credit certificate. The firsthomes tax credit is a great option to help new homebuyers save money.

Source: pinterest.com

Source: pinterest.com

It’s not a loan you have to pay back, nor is it a cash gift like the downpayment toward equity act. The tax credit is equivalent to 10% of the purchase price of your home and cannot exceed $15,000 in 2021. The home purchased must also be at or below 110% of the median home price of their area. Arkansas grant and assistance programs. Arkansas first time home buyer tax credits.

Source: moneywise.com

Source: moneywise.com

The down payment required for a conventional loan ranges mainly from 5% to 20%. From the house hunting to the reams of paperwork to managing the down payment and closing costs, there is a lot to wade through. How this works, is you can deduct up. Maximum of $15,000 total financed amount, and up to 90% msrp (including taxes and all other applicable fees) terms up to 60 months (new or up to four year old models) terms up to 48 months (vehicles up to seven years old) no prepayment penalties. Even though you missed out on the $8,000 tax credit, many state and local governments offer.

Source: co.pinterest.com

Source: co.pinterest.com

To be eligible for the first time homebuyer tax credit, prospective buyers must not have owned or purchased a home within the last three years. The tax credit is equivalent to 10% of the purchase price of your home and cannot exceed $15,000 in 2021. How this works, is you can deduct up. The down payment required for a conventional loan ranges mainly from 5% to 20%. For qualified applicants, the adfa can help secure a mortgage, supply a tax credit certificate, provide funds.

Source: firsthomebuyers.net

Source: firsthomebuyers.net

It was great while it lasted, but for now it is a thing of the past. The tax credit is equivalent to 10% of the purchase price of your home and cannot exceed $15,000 in 2021. To learn more about the program visit the arkansas. Unfortunately, this tax credit expired in 2010, so you are not eligible for the credit unless you bought your home between 2008 and 2010. Arkansas first time home buyer tax credits.

Source: firsthomebuyers.net

Source: firsthomebuyers.net

The home purchased must also be at or below 110% of the median home price of their area. You can also save a lot of money on your taxes through other tax breaks. The home purchased must also be at or below 110% of the median home price of their area. If this is the case, the credit would be cut in half and the first time home buyer would receive a $7,500 credit on their tax return. Buying a home for the first time can be a challenging process.

Source: pinterest.com

Source: pinterest.com

The firsthomes tax credit is a great option to help new homebuyers save money. Unfortunately, this tax credit expired in 2010, so you are not eligible for the credit unless you bought your home between 2008 and 2010. It’s not a loan you have to pay back, nor is it a cash gift like the downpayment toward equity act. It was great while it lasted, but for now it is a thing of the past. You can also save a lot of money on your taxes through other tax breaks.

Source: firsthomebuyers.net

Source: firsthomebuyers.net

To be eligible for the first time homebuyer tax credit, prospective buyers must not have owned or purchased a home within the last three years. They must also meet income limits of 160% or less of the median income of their area. Buying a home for the first time can be a challenging process. Arkansas grant and assistance programs. It’s not a loan you have to pay back, nor is it a cash gift like the downpayment toward equity act.

Source: pinterest.com

Source: pinterest.com

You can also save a lot of money on your taxes through other tax breaks. The tax credit is equivalent to 10% of the purchase price of your home and cannot exceed $15,000 in 2021. The certificate is issued by adfa and allows qualifying homebuyers to claim a tax credit of up to 50% of the mortgage interest paid per year. To be eligible for the first time homebuyer tax credit, prospective buyers must not have owned or purchased a home within the last three years. Arkansas grant and assistance programs.

Source: listwithclever.com

Source: listwithclever.com

The certificate is issued by adfa and allows qualifying, taxpaying homebuyers to claim a tax credit of up to 50 percent of the mortgage interest paid per year, capped at $2,000 annually. Targeted areas of the state) with a mortgage credit certificate. From the house hunting to the reams of paperwork to managing the down payment and closing costs, there is a lot to wade through. The home purchased must also be at or below 110% of the median home price of their area. Arkansas first time home buyer tax credits.

Source: pinterest.com

Source: pinterest.com

If you meet the requirements, these. From the house hunting to the reams of paperwork to managing the down payment and closing costs, there is a lot to wade through. The firsthomes tax credit is a great option to help new homebuyers save money. They must also meet income limits of 160% or less of the median income of their area. The certificate is issued by adfa and allows qualifying, taxpaying homebuyers to claim a tax credit of up to 50 percent of the mortgage interest paid per year, capped at $2,000 annually.

Source: homeloans.arkansas.gov

Source: homeloans.arkansas.gov

They must also meet income limits of 160% or less of the median income of their area. The adfa’s home to own program is designed to aid first time buyers who meet the income requirements and other criteria. The certificate is issued by adfa and allows qualifying homebuyers to claim a tax credit of up to 50% of the mortgage interest paid per year. For qualified applicants, the adfa can help secure a mortgage, supply a tax credit certificate, provide funds. The tax credit is equivalent to 10% of the purchase price of your home and cannot exceed $15,000 in 2021.

Source: firstbuyerprograms.com

Source: firstbuyerprograms.com

Payments can be made by phone, mail, in person or through online banking. It’s not a loan you have to pay back, nor is it a cash gift like the downpayment toward equity act. The tax credit is equivalent to 10% of the purchase price of your home and cannot exceed $15,000 in 2021. You can also save a lot of money on your taxes through other tax breaks. It was great while it lasted, but for now it is a thing of the past.

Source: pinterest.com

Source: pinterest.com

If this is the case, the credit would be cut in half and the first time home buyer would receive a $7,500 credit on their tax return. To be eligible for the first time homebuyer tax credit, prospective buyers must not have owned or purchased a home within the last three years. Even though you missed out on the $8,000 tax credit, many state and local governments offer. Arkansas first time home buyer tax credits. The firsthomes tax credit is a great option to help new homebuyers save money.

Source: afcu.org

Source: afcu.org

How this works, is you can deduct up. Even though you missed out on the $8,000 tax credit, many state and local governments offer. The tax credit is equivalent to 10% of the purchase price of your home and cannot exceed $15,000 in 2021. To learn more about the program visit the arkansas. The firsthomes tax credit is a great option to help new homebuyers save money.

Source: newhomesource.com

Source: newhomesource.com

The certificate is issued by adfa and allows qualifying homebuyers to claim a tax credit of up to 50% of the mortgage interest paid per year. They must also meet income limits of 160% or less of the median income of their area. How this works, is you can deduct up. The credit may be claimed for the life of the loan as long as the home. Payments can be made by phone, mail, in person or through online banking.

Source: firsthomebuyers.net

Source: firsthomebuyers.net

If this is the case, the credit would be cut in half and the first time home buyer would receive a $7,500 credit on their tax return. The credit may be claimed for the life of the loan as long as the home. It was great while it lasted, but for now it is a thing of the past. Arkansas grant and assistance programs. It’s not a loan you have to pay back, nor is it a cash gift like the downpayment toward equity act.

Source: moneywise.com

Source: moneywise.com

The certificate is issued by adfa and allows qualifying, taxpaying homebuyers to claim a tax credit of up to 50 percent of the mortgage interest paid per year, capped at $2,000 annually. If you meet the requirements, these. From the house hunting to the reams of paperwork to managing the down payment and closing costs, there is a lot to wade through. The down payment required for a conventional loan ranges mainly from 5% to 20%. In central arkansas, you can qualify for this type of loan as a first time home buyer if you have good credit, money for at least 5% of purchase price for a down payment and are making over the income limit for a rural development loan.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title first time home buyer arkansas tax credit by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.