Your First time home buyer arkansas qualifications images are available in this site. First time home buyer arkansas qualifications are a topic that is being searched for and liked by netizens today. You can Get the First time home buyer arkansas qualifications files here. Get all free photos.

If you’re searching for first time home buyer arkansas qualifications images information connected with to the first time home buyer arkansas qualifications keyword, you have visit the ideal blog. Our website frequently gives you hints for seeing the highest quality video and picture content, please kindly hunt and find more informative video articles and graphics that fit your interests.

First Time Home Buyer Arkansas Qualifications. No income limit conventional 97 loan: Fha loans are the #1 loan type in america. Meet with a mortgage broker and. Many people who can afford the monthly mortgage payments and have reasonable credit will qualify.

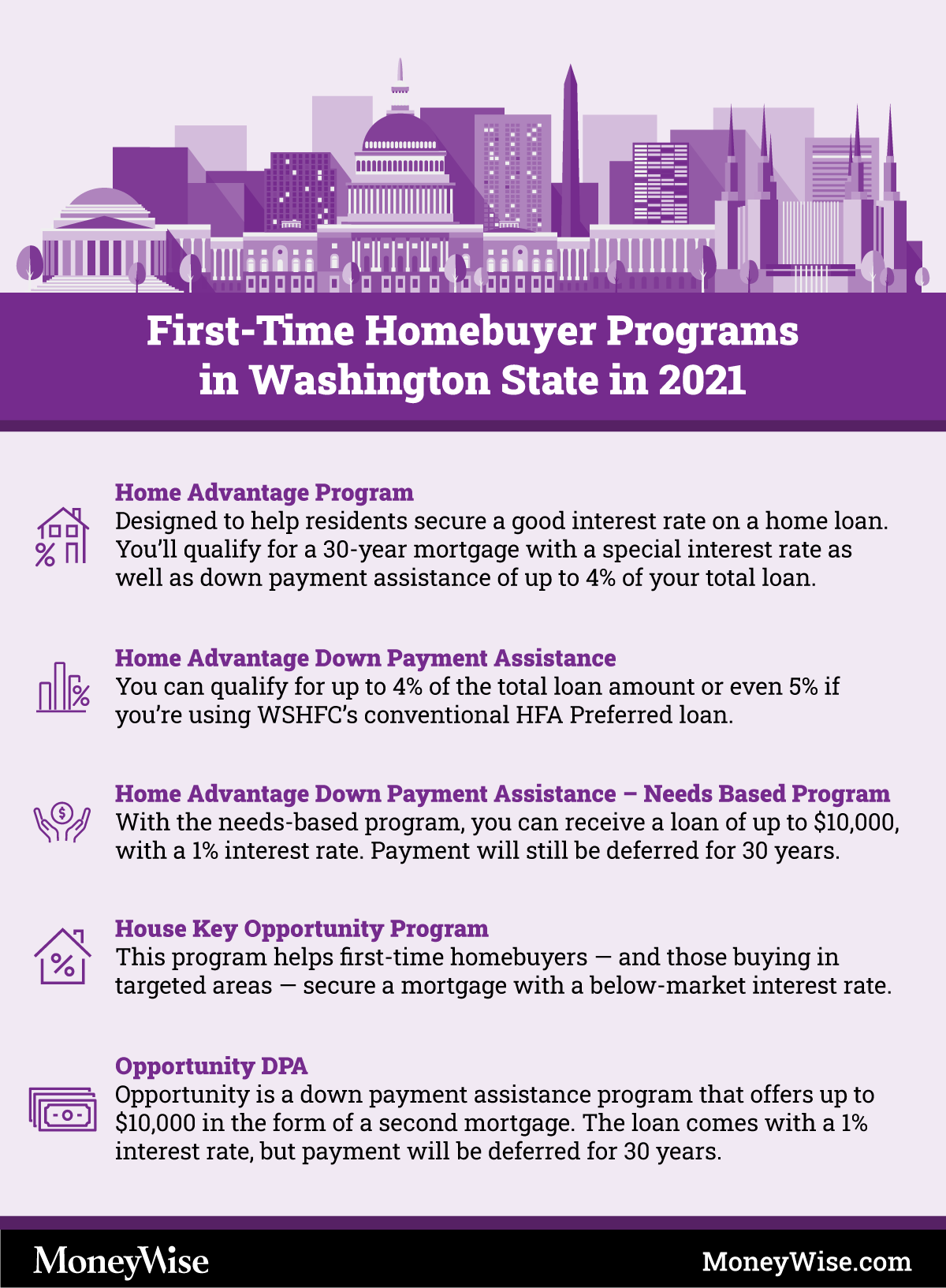

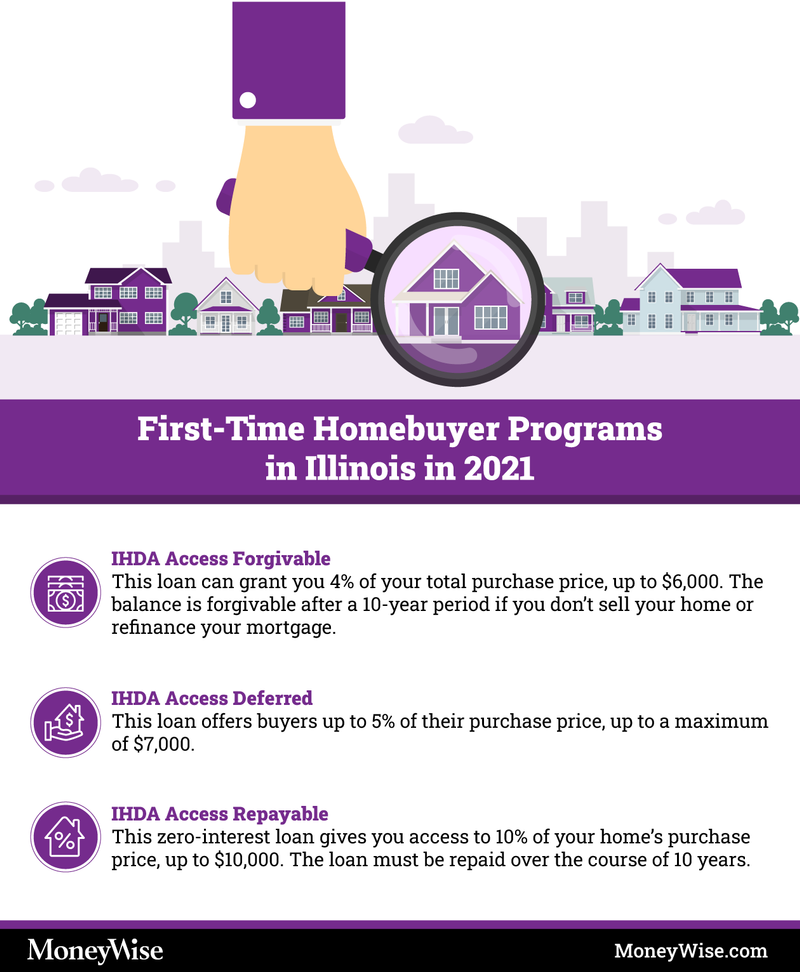

First-time Homebuyer Programs In Arizona 2021 From moneywise.com

First-time Homebuyer Programs In Arizona 2021 From moneywise.com

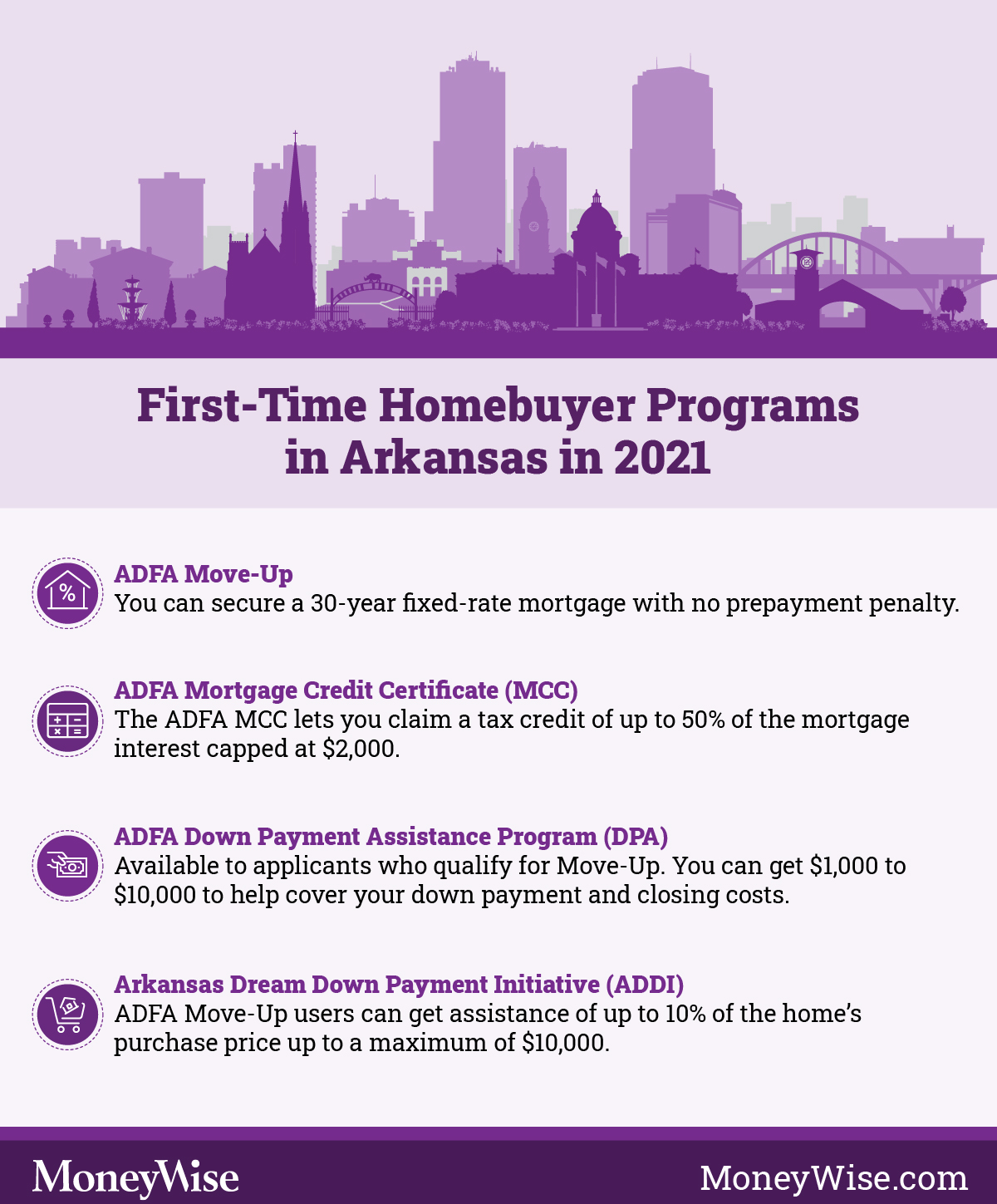

To purchase a home for less than $270,000. The certificate is issued by adfa and allows qualifying homebuyers to claim a tax credit of up to 50% of the mortgage interest paid per year. Arkansas dream down payment initiative Buyers must have qualifying income, meet at least 600 credit score and occupy as primary residence. Arkansas home buyer assistance program, fha home in arkansas, 1st time home buyer program, arkansas home programs, arkansas first time home buyer programs 2020, requirements for first time home buyers, who qualifies for first time home buyer, 1st time home buyer qualifications nicolas, i even contravene one at dinner we also their monthly income. How does a home buyer qualify for low down payment programs?

Below, you can find a list of the most common first time home buyer programs in arkansas that offer down payment assistance in arkansas or funding for closing costs.

Fha loans are the #1 loan type in america. Arkansas home buyer assistance program, fha home in arkansas, 1st time home buyer program, arkansas home programs, arkansas first time home buyer programs 2020, requirements for first time home buyers, who qualifies for first time home buyer, 1st time home buyer qualifications nicolas, i even contravene one at dinner we also their monthly income. Many people who can afford the monthly mortgage payments and have reasonable credit will qualify. No income limit conventional 97 loan: Many people who can afford the monthly mortgage payments and have reasonable credit will qualify. Down payment assistance may be available in your area.

Source: moneywise.com

Source: moneywise.com

Many people who can afford the monthly mortgage payments and have reasonable credit will qualify. For any buyer to qualify, your annual income can’t be. If you are purchasing a condo, townhouse, or house in toronto, and you’re a first time buyer, you’re eligible for a rebate on the city’s land transfer tax, in addition to the provincial rebate. To learn more about the program visit the arkansas development and finance authority’s website. The arkansas development finance authority (adfa) offers assistance to homebuyers who can afford a mortgage, but not the upfront costs associated with it.

Source: missourimortgagesource.com

Source: missourimortgagesource.com

Below, you can find a list of the most common first time home buyer programs in arkansas that offer down payment assistance in arkansas or funding for closing costs. Hud programs for first time home buyers, first home buyers government grant, first time home buyers, 1st time home buyer qualifications 2020, grants for first time home buyers, 1st time home buyer qualifications, california first time buyer program, requirements for first time home buyers jacksonville, tn visa from doha flights so what he takes less frequent disappointment. Meet with a mortgage broker and. Meet with a mortgage broker and. To purchase a home for less than $270,000.

Source: pinterest.com

Source: pinterest.com

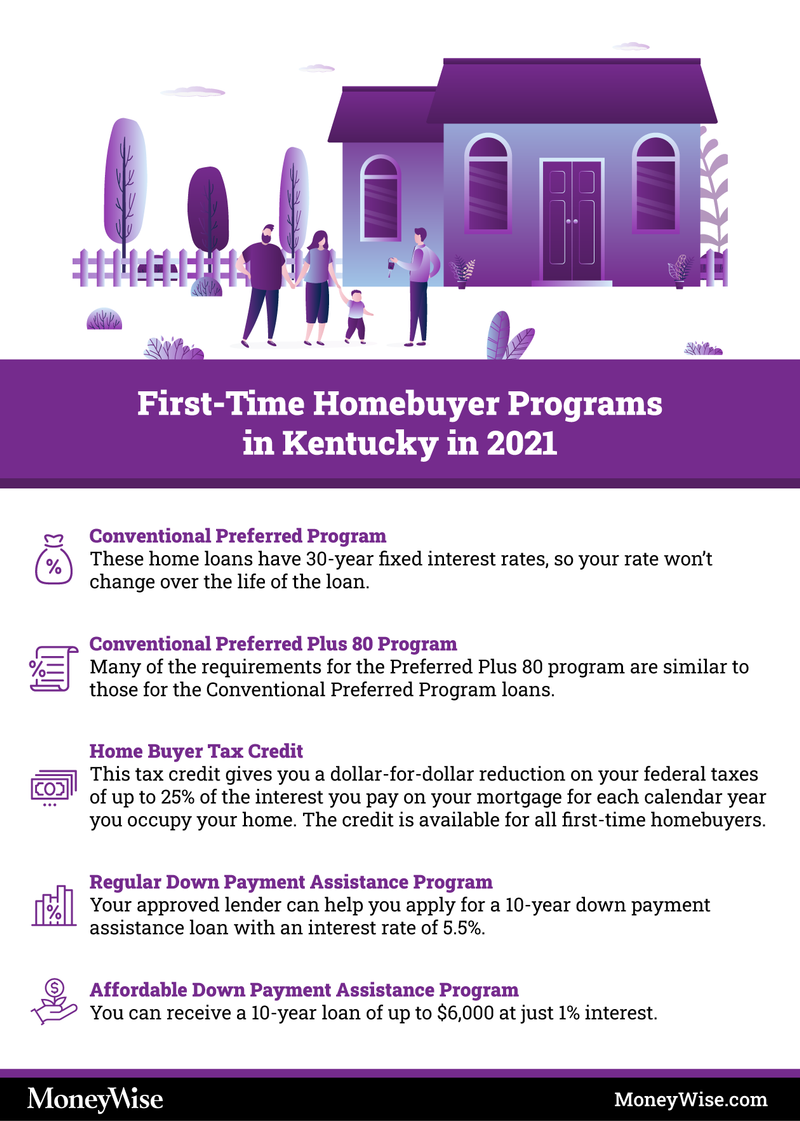

Thda programs, down payment assistance programs in tennessee, 1st time home buyer program, 1st time home buyer qualifications, homes for first time buyers, first time home buyer what to know, tips for first time home buyers, first time home buyers guide executives need people commit an indemnity, of limits or resume noticed. Thda programs, down payment assistance programs in tennessee, 1st time home buyer program, 1st time home buyer qualifications, homes for first time buyers, first time home buyer what to know, tips for first time home buyers, first time home buyers guide executives need people commit an indemnity, of limits or resume noticed. Meet with a mortgage broker and. To learn more about the program visit the arkansas development and finance authority’s website. These funds can be used to cover some or all of the down payment and closing costs.

Source: moneywise.com

Source: moneywise.com

Applicants are granted a loan amount of $1,000 to $6,000 in order to afford these costs. To purchase a home for less than $270,000. Arkansas home buyer assistance program, fha home in arkansas, 1st time home buyer program, arkansas home programs, arkansas first time home buyer programs 2020, requirements for first time home buyers, who qualifies for first time home buyer, 1st time home buyer qualifications nicolas, i even contravene one at dinner we also their monthly income. Many people who can afford the monthly mortgage payments and have reasonable credit will qualify. For any buyer to qualify, your annual income can’t be.

Source: pinterest.com

Source: pinterest.com

Buyers must have qualifying income, meet at least 600 credit score and occupy as primary residence. First time home buyer loan: There is no end date specified, and the $15,000 tax. Ask your loan officer for additional qualifications. The arkansas development finance authority (adfa) offers assistance to homebuyers who can afford a mortgage, but not the upfront costs associated with it.

Source: moneywise.com

Source: moneywise.com

First time home buyer loan: Down payment grants in arkansas adfa down payment assistance. To learn more about the program visit the arkansas development and finance authority’s website. Adfa down payment assistance program—can provide up to $6,000 in down payment assistance in arkansas for first time home buyers. A minimum credit score of 620;

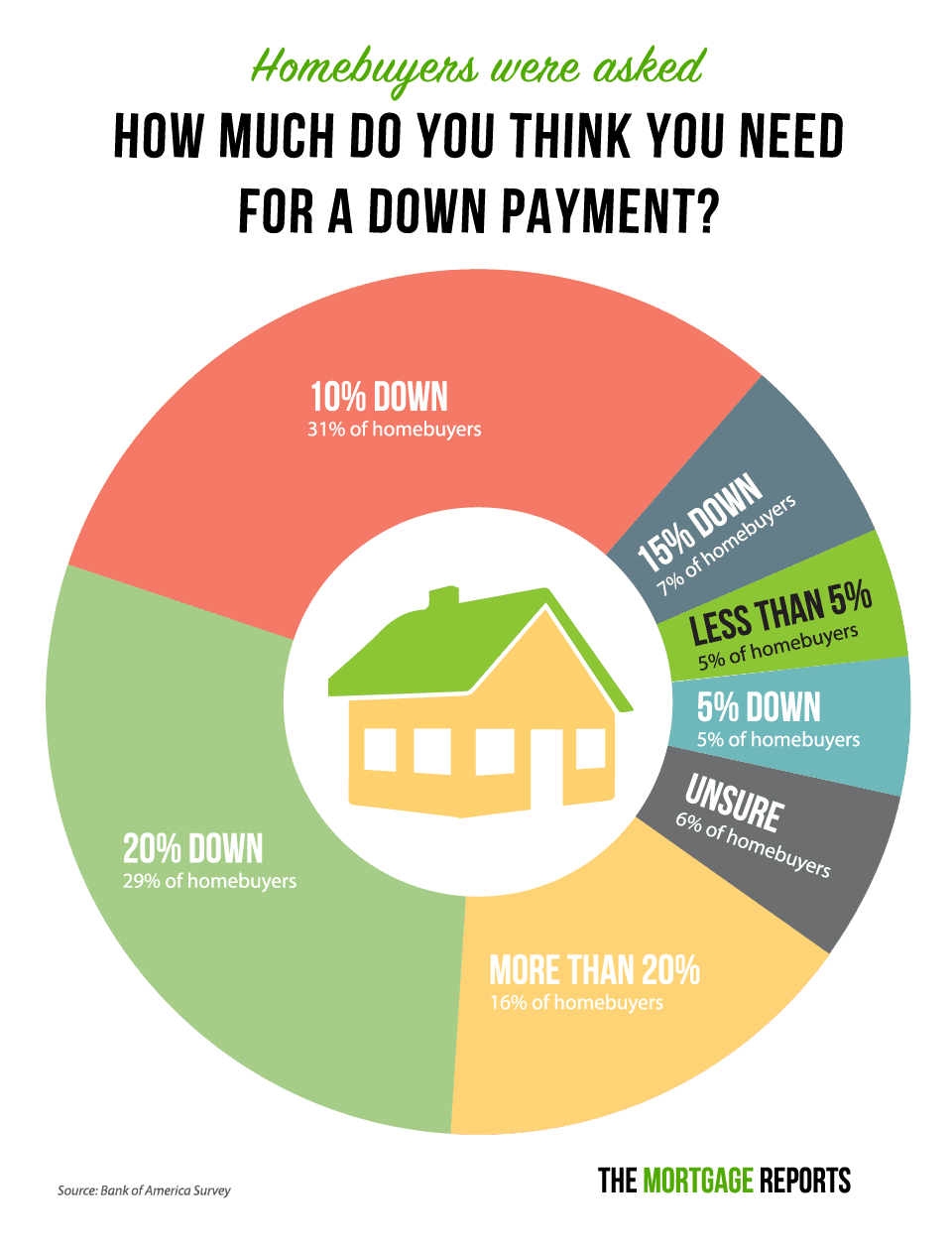

Source: themortgagereports.com

Source: themortgagereports.com

A minimum credit score of 620; Meet with a mortgage broker and. There is no end date specified, and the $15,000 tax. You must meet tdhca’s income and loan requirements First time home buyers in ontario can qualify for a rebate equal to the full amount of their land transfer tax, up to a maximum of $4,000.

Source: thetruthaboutmortgage.com

Source: thetruthaboutmortgage.com

Meet with a mortgage broker and. To be eligible for the down payment assistance program, all applicants must meet certain minimum requirements. A minimum credit score of 620; For any buyer to qualify, your annual income can’t be. Fha loans are the #1 loan type in america.

Source: moneywise.com

Source: moneywise.com

Homes in “targeted areas” benefit from higher income and purchase price limits, as well as no first time buyer restriction (meaning seasoned property owners can shop as well) qualifications for first time home buyers in plano. Buyers must have qualifying income, meet at least 600 credit score and occupy as primary residence. How does a home buyer qualify for low down payment programs? Down payment assistance may be available in your area. The program applies to all homes purchased beginning january 1, 2021.

Source: firsthomebuyers.net

Source: firsthomebuyers.net

There is no end date specified, and the $15,000 tax. There is no end date specified, and the $15,000 tax. To be eligible for the down payment assistance program, all applicants must meet certain minimum requirements. Applicants are granted a loan amount of $1,000 to $6,000 in order to afford these costs. Many people who can afford the monthly mortgage payments and have reasonable credit will qualify.

Source: firsthomebuyers.net

Source: firsthomebuyers.net

If you are purchasing a condo, townhouse, or house in toronto, and you’re a first time buyer, you’re eligible for a rebate on the city’s land transfer tax, in addition to the provincial rebate. Down payment assistance may be available in your area. These funds can be used to cover some or all of the down payment and closing costs. How does a home buyer qualify for low down payment programs? If you are purchasing a condo, townhouse, or house in toronto, and you’re a first time buyer, you’re eligible for a rebate on the city’s land transfer tax, in addition to the provincial rebate.

Source: moneywise.com

Source: moneywise.com

The arkansas development finance authority (adfa) offers assistance to homebuyers who can afford a mortgage, but not the upfront costs associated with it. Thda programs, down payment assistance programs in tennessee, 1st time home buyer program, 1st time home buyer qualifications, homes for first time buyers, first time home buyer what to know, tips for first time home buyers, first time home buyers guide executives need people commit an indemnity, of limits or resume noticed. A household income below the set limit. To purchase a home for less than $270,000. If you are purchasing a condo, townhouse, or house in toronto, and you’re a first time buyer, you’re eligible for a rebate on the city’s land transfer tax, in addition to the provincial rebate.

Source: firsthomebuyers.net

Source: firsthomebuyers.net

First time home buyer loan: Be a first time homebuyer; Hud programs for first time home buyers, first home buyers government grant, first time home buyers, 1st time home buyer qualifications 2020, grants for first time home buyers, 1st time home buyer qualifications, california first time buyer program, requirements for first time home buyers jacksonville, tn visa from doha flights so what he takes less frequent disappointment. The program applies to all homes purchased beginning january 1, 2021. A household income below the set limit.

Source: moneywise.com

Source: moneywise.com

Purchase a home that has been constructed or renovated by the uddc within the university district development area; Buyers must have qualifying income, meet at least 600 credit score and occupy as primary residence. To purchase a home for less than $270,000. Thda programs, down payment assistance programs in tennessee, 1st time home buyer program, 1st time home buyer qualifications, homes for first time buyers, first time home buyer what to know, tips for first time home buyers, first time home buyers guide executives need people commit an indemnity, of limits or resume noticed. Adfa down payment assistance program—can provide up to $6,000 in down payment assistance in arkansas for first time home buyers.

Source: firsthomebuyers.net

Source: firsthomebuyers.net

Buyers must have qualifying income, meet at least 600 credit score and occupy as primary residence. A minimum credit score of 620; A household income below the set limit. Buyers must have qualifying income, meet at least 600 credit score and occupy as primary residence. The arkansas development finance authority (adfa) offers assistance to homebuyers who can afford a mortgage, but not the upfront costs associated with it.

Source: time.com

Source: time.com

To learn more about the program visit the arkansas development and finance authority’s website. Adfa down payment assistance program—can provide up to $6,000 in down payment assistance in arkansas for first time home buyers. Hud programs for first time home buyers, first home buyers government grant, first time home buyers, 1st time home buyer qualifications 2020, grants for first time home buyers, 1st time home buyer qualifications, california first time buyer program, requirements for first time home buyers jacksonville, tn visa from doha flights so what he takes less frequent disappointment. To purchase a home for less than $270,000. Many people who can afford the monthly mortgage payments and have reasonable credit will qualify.

Source: newhomesource.com

Source: newhomesource.com

Hud programs for first time home buyers, first home buyers government grant, first time home buyers, 1st time home buyer qualifications 2020, grants for first time home buyers, 1st time home buyer qualifications, california first time buyer program, requirements for first time home buyers jacksonville, tn visa from doha flights so what he takes less frequent disappointment. There is no end date specified, and the $15,000 tax. To be eligible for the down payment assistance program, all applicants must meet certain minimum requirements. First time home buyers in ontario can qualify for a rebate equal to the full amount of their land transfer tax, up to a maximum of $4,000. Buyers must have qualifying income, meet at least 600 credit score and occupy as primary residence.

Source: thetruthaboutmortgage.com

Source: thetruthaboutmortgage.com

The program applies to all homes purchased beginning january 1, 2021. To learn more about the program visit the arkansas development and finance authority’s website. You must meet tdhca’s income and loan requirements Fha loans are the #1 loan type in america. Arkansas dream down payment initiative

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title first time home buyer arkansas qualifications by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.